Bank of the West 2014 Annual Report Download - page 42

Download and view the complete annual report

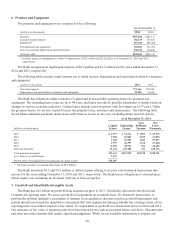

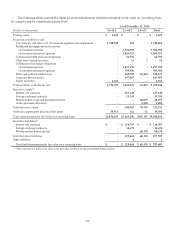

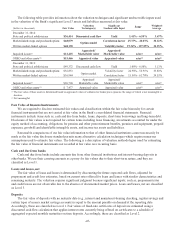

Please find page 42 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fair value of substantially all securities. IVSC consists of senior executive management and other relevant employees

who meet on a quarterly basis and monitor the use of pricing sources and other valuation processes. In addition, a cross-

functional team comprised of representatives from our Treasury and Risk groups, reviews and approves the fair value

measurements on a monthly basis. This management team also analyzes changes in fair value from period to period.

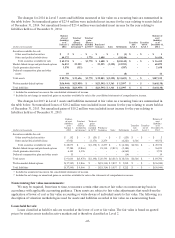

Securities classified as Level 1 are priced using quoted market prices (unadjusted) in active markets for identical

securities, and consist of U.S. Treasury securities, money market funds and equity securities. When quoted market prices

are not available, fair values are classified as Level 2 using quoted prices for similar assets in markets that are either

active or not active and through model-based techniques in which all significant inputs are observable for the asset,

either directly or indirectly, for substantially the full term of the financial instrument. Examples of such instruments

include agency mortgage-backed securities, collateralized loan obligations, municipal securities and corporate debt

securities.

If relevant market prices are limited or unavailable, fair value measurements may require use of significant

unobservable inputs, in which case the fair values are classified as Level 3. Level 3 securities primarily consist of

Community Reinvestment Act (“CRA”) bonds, which are categorized within states and political subdivisions, and are

valued using proprietary discounted cash flow models from a third-party service provider. The significant input to the

valuation model is a bond yield, which consists of interest rate yield curves, credit spreads and liquidity spreads. This

requires judgment due to the absence of available market prices and lack of liquidity. An increase or decrease in any of

the factors that comprise the bond yields would result in lower or higher fair values for CRA bonds, respectively.

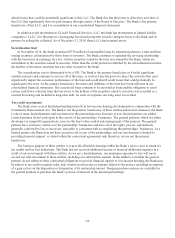

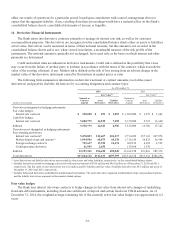

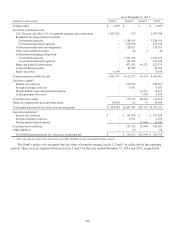

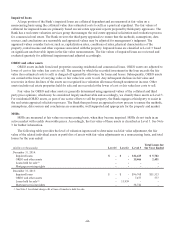

Derivatives

All of our derivatives are private transactions where quoted market prices are not readily available. Therefore, the

Bank values these derivatives using internal valuation techniques, primarily discounted cash flows. Valuation techniques

and inputs to internally developed models depend on the type of derivative and nature of the underlying rate, price or

index used to value the derivative. Key inputs can include yield curves, credit curves, foreign-exchange rates, volatility

measurements and other market parameters. Where model inputs can be observed in a liquid market and the model does

not require significant judgment, such derivatives are typically classified as Level 2. Level 2 derivatives include interest

rate swaps, foreign currency and forward contracts and certain options.

We also measure the fair value of certain derivatives using an option-pricing model with significant unobservable

inputs, which are classified as Level 3. The derivatives are embedded written options linking the returns on host

certificates of deposit to the performance of baskets of equity securities, equity indices or commodity indices. We

purchase offsetting options to minimize the related market risk. The fair value of the derivative instruments would

increase or decrease based on the performance of the underlying equity securities, equity indices or commodity indices.

The primary unobservable inputs to the values of these options are the volatility of option prices for the underlying

securities in the basket or market indices and correlation of underlying individual securities in the basket or market

indices.

An increase in the volatility or correlation factor would generally increase the fair value of the option. A decrease in

the volatility or correlation factor would generally decrease the fair value of the option. The correlation factor is

considered independent from movements in other significant unobservable inputs for the derivative instruments.

The credit guarantee derivative is also classified as a Level 3 asset since the Bank estimates its fair value using an

internally developed discounted cash flow valuation model. The key assumptions in the model and the drivers of

changes in fair value are credit loss forecasts to project the future potential payoffs from the Guarantee and the rate to

discount the estimated claims under the Guarantee. The credit loss forecast is an internally developed estimate that

cannot be directly corroborated by observable market data. A significant increase or decrease in the credit loss forecast

would result in a significantly higher or lower fair value measurement. See Note 20 for additional information.

In addition, the fair value for derivatives may include an adjustment for estimated counterparty and Bank credit

risk.

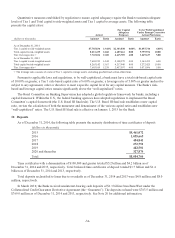

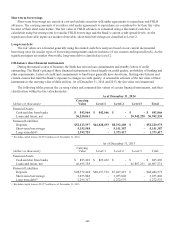

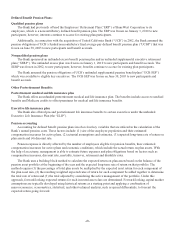

Deferred compensation plan and other assets

Assets for deferred compensation plans are based on quoted market prices and are classified as Level 1 assets

consisting of money market funds held within a nonqualified deferred compensation trust.

-40-