Bank of the West 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

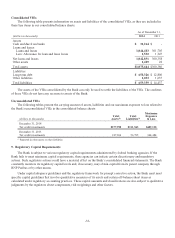

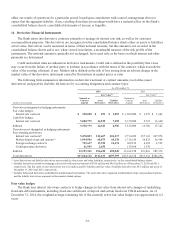

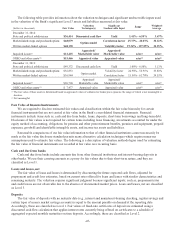

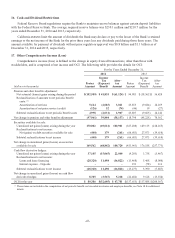

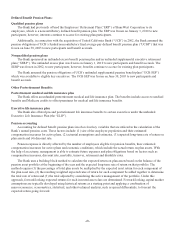

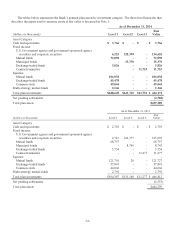

The changes for 2014 in Level 3 assets and liabilities measured at fair value on a recurring basis are summarized in

the table below. Net unrealized gains of $23.4 million were included in net income for the year relating to assets held as

of December 31, 2014. Net unrealized losses of $23.4 million were included in net income for the year relating to

liabilities held as of December 31, 2014.

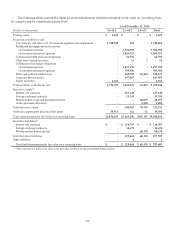

(dollars in thousands)

Balance

of asset

(liability)

as of

January 1,

2014

Total net

gains

(losses)

included in

net income(1)

Total net

gains

(losses)

included

in OCI(2)

Purchases/

Issuances Sales Settlements

Transfers

into

Level 3

Transfers

out of

Level 3

Balance of

asset

(liability)

as of

December 31,

2014

Securities available for sale:

Other asset-backed securities $2$-$-$-$-$(1)$-$-$1

States and political subdivisions 49,372 - 3,778 1,408 - (18,144) - - 36,414

Total securities available for sale $ 49,374 $ - $3,778 $ 1,408 $ - $(18,145) $ - $ - $ 36,415

Market-linked swaps and purchased options 36,833 23,959 - 23,595 (3,355) (12,953) - - 68,079

Credit guarantee derivative 3,570 (333) - - - (587) - - 2,650

Deferred compensation plan and other

assets 19 - - - - (8) - - 11

Total assets $ 89,796 $ 23,626 $3,778 $ 25,003 $(3,355) $(31,693) $ - $ - $107,155

Written market-linked options $(36,944) $(23,959) $ - $(23,595) $ 3,363 $ 12,997 $ - $ - $ (68,138)

Total liabilities $(36,944) $(23,959) $ - $(23,595) $ 3,363 $ 12,997 $ - $ - $ (68,138)

(1) Included in noninterest income in the consolidated statements of income.

(2) Included in net change in unrealized gains on securities available for sale in the consolidated statements of comprehensive income.

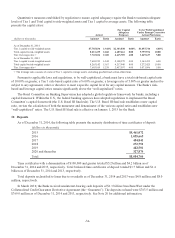

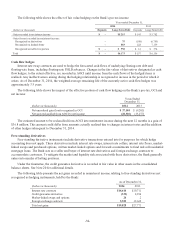

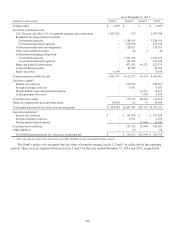

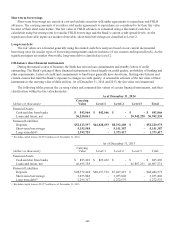

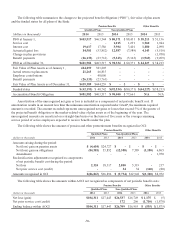

The changes for 2013 in Level 3 assets and liabilities measured at fair value on a recurring basis are summarized in

the table below. Net unrealized losses of $10.2 million were included in net income for the year relating to assets held as

of December 31, 2013. Net unrealized gains of $10.2 million were included in net income for the year relating to

liabilities held as of December 31, 2013.

(dollars in thousands)

Balance

of asset

(liability)

as of

January 1,

2013

Total net

gains

(losses)

included in

net income(1)

Total net

gains

(losses)

included

in OCI(2)

Purchases/

Issuances Sales Settlements

Transfers

into

Level 3

Transfers

out of

Level 3

Balance of

asset

(liability)

as of

December 31,

2013

Securities available for sale:

Other asset-backed securities $ 152 $ - $ (25) $ - $ - $ (125) $ - $ - $ 2

States and political subdivisions 47,921 - (1,173) 2,279 - (6,221) 6,566 - 49,372

Total securities available for sale $ 48,073 $ - $(1,198) $ 2,279 $ - $ (6,346) $6,566 $ - $ 49,374

Market-linked swaps and purchased options 37,384 (9,866) - 18,314 (3,815) (5,184) - - 36,833

Credit guarantee derivative 6,143 4,396 - - - (6,969) - - 3,570

Deferred compensation plan and other assets 33 - - - - (14) - - 19

Total assets $ 91,633 $(5,470) $(1,198) $ 20,593 $(3,815) $(18,513) $6,566 $ - $ 89,796

Written market-linked options $(37,545) $ 9,866 $ - $(18,314) $ 3,837 $ 5,212 $ - $ - $(36,944)

Total liabilities $(37,545) $ 9,866 $ - $(18,314) $ 3,837 $ 5,212 $ - $ - $(36,944)

(1) Included in noninterest income in the consolidated statements of income.

(2) Included in net change in unrealized gains on securities available for sale in the statements of comprehensive income.

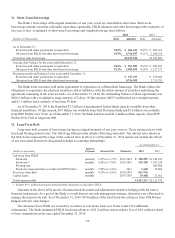

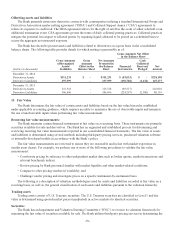

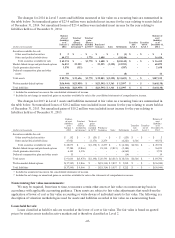

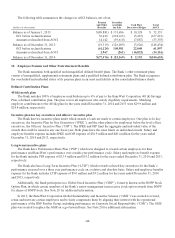

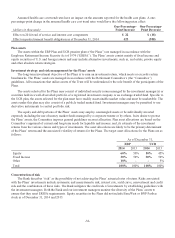

Nonrecurring fair value measurements:

We may be required, from time to time, to measure certain other assets at fair value on a nonrecurring basis in

accordance with applicable accounting guidance. These assets are subject to fair value adjustments that result from the

application of lower of cost or fair value accounting or write-downs of individual assets to fair value. The following is a

description of valuation methodologies used for assets and liabilities recorded at fair value on a nonrecurring basis.

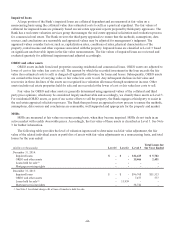

Loans held for sale

Loans classified as held for sale are recorded at the lower of cost or fair value. The fair value is based on quoted

prices for similar assets traded in active markets and is therefore classified as Level 2.

-43-