Bank of the West 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

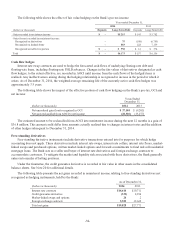

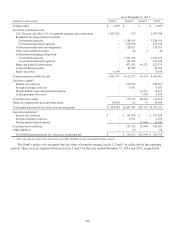

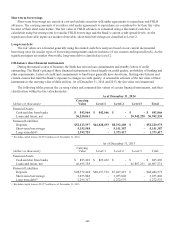

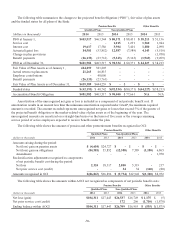

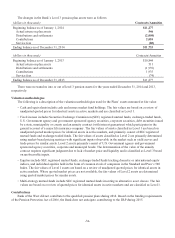

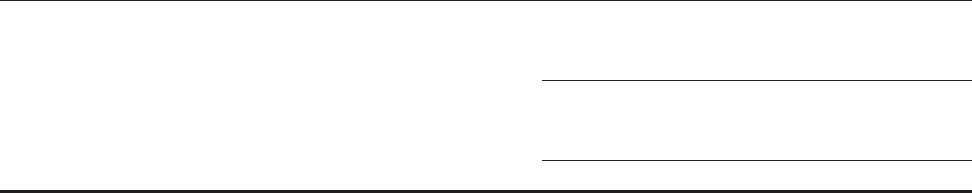

The following table summarizes the changes in AOCI balances, net of tax:

(dollars in thousands)

Pension

and Other

Benefits

Securities

Available

for Sale

Cash Flow

Derivative Hedges

Total

AOCI

Balance as of January 1, 2013: $(89,881) $ 131,686 $ 10,328 $ 52,133

OCI before reclassifications 56,420 (218,165) (5,467) (167,212)

Amounts reclassified from AOCI 14,142 (39,610) (7,887) (33,355)

Balance as of December 31, 2013: (19,319) (126,089) (3,026) (148,434)

OCI before reclassifications (61,124) 100,981 22,040 61,897

Amounts reclassified from AOCI 2,967 (261) (16,822) (14,116)

Balance as of December 31, 2014 $(77,476) $ (25,369) $ 2,192 $(100,653)

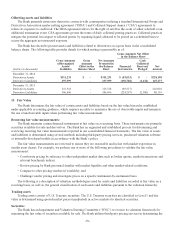

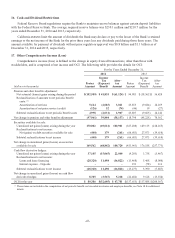

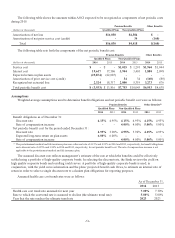

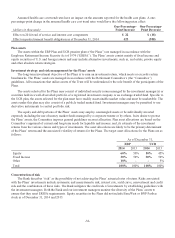

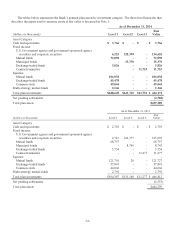

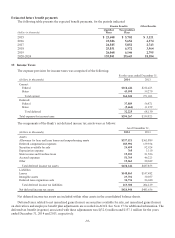

18. Employee Pension and Other Postretirement Benefits

The Bank maintains both qualified and nonqualified defined benefit plans. The Bank’s other retirement plans

consist of nonqualified, supplemental retirement plans and a qualified defined contribution plan. The Bank recognizes

the overfunded and unfunded status of its pension plans as an asset and liability in the consolidated balance sheets.

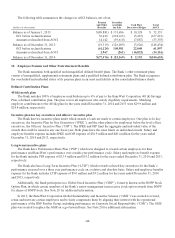

Defined Contribution Plans:

401(k) match plan

The Bank matches 100% of employee contributions up to 6% of pay to the BancWest Corporation 401(k) Savings

Plan, a defined contribution plan. The plan covers all employees who satisfy eligibility requirements. Matching

employer contributions to the 401(k) plan for the years ended December 31, 2014 and 2013 were $29.9 million and

$28.4 million, respectively.

Incentive plan for key executives and officers’ incentive plan

The Bank has two incentive plans under which awards of cash are made to certain employees. One plan is for key

executives; the Incentive Plan for Key Executives (“IPKE”), and the other plan is for employees below the level of key

executives; the Officers’ Incentive Plan (“OIP”). The IPKE and OIP limit the aggregate and individual value of the

awards that could be issued in any one fiscal year. Both plans have the same limits on individual awards. Salary and

employee benefits expense includes IPKE and OIP expense of $56.9 million and $40.4 million for the years ended

December 31, 2014 and 2013, respectively.

Long-term incentive plans

The Bank has a Performance Share Plan (“PSP”) which was designed to reward certain employees for their

performance and BancWest’s performance over a multi-year performance cycle. Salary and employee benefit expense

for the Bank includes PSP expense of $13.9 million and $19.2 million for the years ended December 31, 2014 and 2013,

respectively.

The Bank also has a Long-Term Incentive Plan (“LTIP”) which rewards selected key executives for the Bank’s

performance assessed over a three year performance cycle on a relative and absolute basis. Salary and employee benefits

expense for the Bank includes LTIP expense of $9.0 million and $9.2 million for the years ended December 31, 2014

and 2013, respectively.

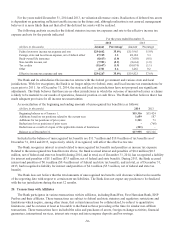

Additionally, the Bank participates in a Global Stock Incentive Plan (“GSIP”), formerly known as the BNPP Stock

Option Plan, in which certain members of the Bank’s senior management team receive stock option awards from BNPP

for shares of BNPP stock. See Note 20 for additional information.

In 2013, the BancWest Corporation Global Sustainability and Incentive Scheme (“GSIS”) was created to reward,

retain and motivate certain employees and to fairly compensate them by aligning their interest with the operational

performance of the BNP Paribas Group, including performance on Corporate Social Responsibility (“CSR”). The GSIS

plan was created to replace the GSIP on a go-forward basis. See Note 20 for additional information.

-48-