Bank of the West 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

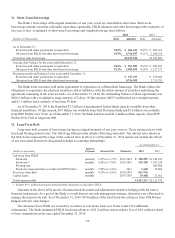

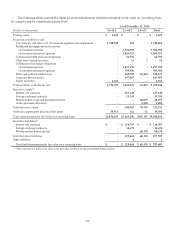

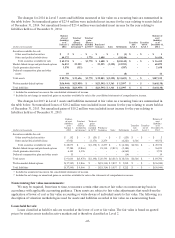

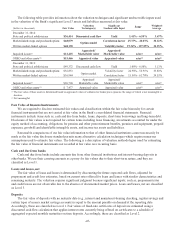

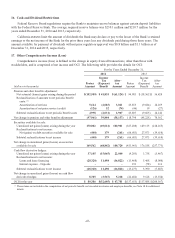

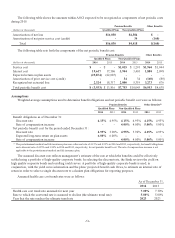

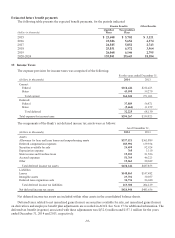

The following table provides information about the valuation techniques and significant unobservable inputs used

in the valuation of the Bank’s significant Level 3 assets and liabilities measured at fair value.

(dollars in thousands) Fair Value

Valuation

Technique(s)

Significant

Unobservable Input Range Weighted-

Average

December 31, 2014:

State and political subdivisions $36,414 Discounted cash flow Yield 1.41% - 6.50% 3.67%

Market-linked swaps and purchased options $68,079 Option model Correlation factor 25.37% - 40.03% 30.22%

Written market-linked options $68,138 Volatility factor 19.34% - 127.85% 32.25%

Impaired Loans(1) $12,425

Appraised/

Marketable value

Appraised/

Marketable value n/m(2) n/m(2)

OREO and other assets(1) $15,466 Appraised value Appraised value n/m(2) n/m(2)

December 31, 2013:

State and political subdivisions $49,372 Discounted cash flow Yield 1.00% - 6.50% 3.13%

Market-linked swaps and purchased options $36,833

Option model

Volatility factor 24.98% - 56.91% 33.83%

Written market-linked options $36,944 Correlation factor 15.56% - 61.70% 39.53%

Impaired Loans(1) $96,768

Appraised/

Marketable value

Appraised/

Marketable value n/m(2) n/m(2)

OREO and other assets(1) $ 7,477 Appraised value Appraised value n/m(2) n/m(2)

(1) The fair value of these assets is determined based on appraised values of collateral or broker price opinions, the range of which is not meaningful to

disclose.

(2) Not meaningful.

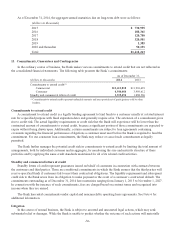

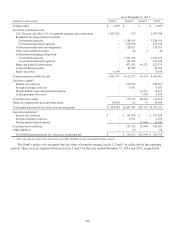

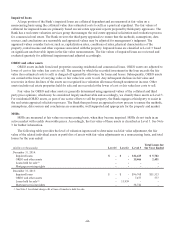

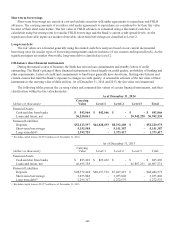

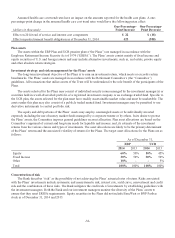

Fair Value of financial instruments

We are required to disclose estimated fair values and classification within the fair value hierarchy for certain

financial instruments that are not carried at fair value in the Bank’s consolidated financial statements. Financial

instruments include items such as, cash and due from banks, loans, deposits, short-term borrowings and long-term debt.

Disclosure of fair values is not required for certain items including lease financing, investments accounted for under the

equity method of accounting, obligations for pension and other postretirement benefits, premises and equipment, prepaid

expenses, goodwill and identifiable intangible assets, and income tax assets and liabilities.

Reasonable comparisons of our fair value information to that of other financial institutions cannot necessarily be

made as the fair value disclosure standard permits many alternative calculation techniques which require numerous

assumptions used to estimate fair values. The following is a description of valuation methodologies used for estimating

the fair value of financial instruments not recorded at fair value on a recurring basis:

Cash and due from banks

Cash and due from banks include amounts due from other financial institutions and interest-bearing deposits in

other banks. We use their carrying amounts as a proxy for fair values due to their short-term nature, and they are

classified as Level 1.

Loans and leases, net

The fair value of loans and leases is determined by discounting the future expected cash flows, adjusted for

prepayment and credit loss estimates, based on current rates offered for loans and leases with similar characteristics and

remaining maturity. The valuation requires significant judgment because significant inputs; such as, prepayment rates

and credit losses are not observable due to the absence of documented market prices. Loans and leases, net are classified

as Level 3.

Deposits

The fair value of deposits with no maturity date (e.g., interest and noninterest-bearing checking, regular savings and

certain types of money market savings accounts) is equal to the amount payable on demand at the reporting date.

Accordingly, these are classified as Level 1. Fair values of fixed-rate certificates of deposit are estimated using a

discounted cash flow calculation that applies interest rates currently being offered on certificates to a schedule of

aggregated expected monthly maturities on time deposits. Accordingly, these are classified as Level 2.

-45-