Bank of the West 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

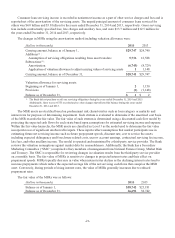

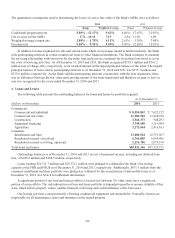

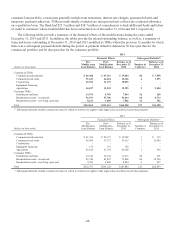

Consumer loan servicing income is recorded in noninterest income as a part of other service charges and fees and is

reported net of the amortization of the servicing assets. The unpaid principal amount of consumer loans serviced for

others was $4.0 billion and $3.8 billion for the years ended December 31, 2014 and 2013, respectively. Gross servicing

fees include contractually specified fees, late charges and ancillary fees, and were $13.7 million and $12.5 million for

the years ended December 31, 2014 and 2013, respectively.

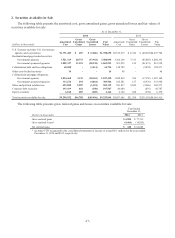

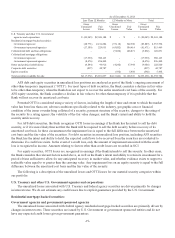

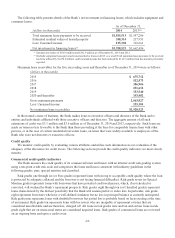

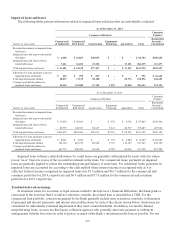

The changes in MSRs using the amortization method including valuation allowance were:

(dollars in thousands) 2014 2013

Carrying amount, balance as of January 1, $29,747 $24,740

Additions(1) :

Assumption of servicing obligations resulting from asset transfers 5,736 12,588

Subtractions(1) :

Amortization (6,743) (8,729)

Application of valuation allowance to adjust carrying values of servicing assets 11,148

Carrying amount, balance as of December 31, $28,741 $29,747

Valuation allowance for servicing assets:

Beginning as of January 1, 21,150

Provisions (1) (1,148)

Balance as of December 31, $1$2

(1) The Bank did not purchase or sell any servicing obligations during the years ended December 31, 2014 and 2013.

Additionally, there was no OTTI recorded and no other changes that affected the balance during the years ended

December 31, 2014 and 2013.

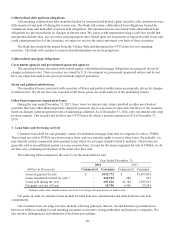

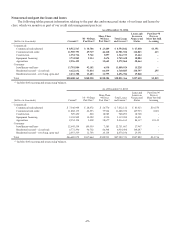

The MSR assets are stratified based on predominant risk characteristics such as loan category or maturity and

interest rate for purposes of determining impairment. Each stratum is evaluated to determine if the amortized cost basis

of the MSR exceeds the fair value. The fair value of each stratum is determined using a discounted cash flow model by

projecting the expected cash flows for each strata based upon assumptions for estimated servicing income and expense.

Within the fair value hierarchy, the MSR assets are classified as Level 3 as the model used to determine the fair value

incorporates use of significant unobservable inputs. These inputs reflect assumptions that market participants use in

estimating future net servicing income such as future prepayment speeds, discount rate, cost to service the assets

including expected delinquency and foreclosure related costs, escrow account earnings, contractual servicing fee income,

late fees, and other ancillary income. The model is operated and maintained by a third-party service provider. The Bank

reviews the valuation assumptions against market data for reasonableness. Additionally, the Bank has a Secondary

Marketing Committee (“SMC”) comprised of key members of management from National Finance Group, Market Risk

and Treasury. The SMC is responsible for reviewing changes in valuation results from the third-party service provider

on a monthly basis. The fair value of MSRs is sensitive to changes in projected interest rates and their effect on

prepayment speeds. MSRs typically decrease in value when interest rates decline as the declining interest rates tend to

increase prepayments which reduce the expected average life of the net servicing cash flows that comprise the MSR

asset. Conversely, during periods of rising interest rates, the value of MSRs generally increases due to reduced

prepayment rates.

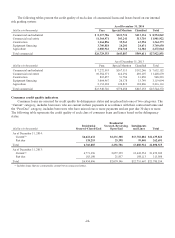

The fair value of the MSRs was as follows:

(dollars in thousands) 2014 2013

Balance as of January 1, $38,742 $25,181

Balance as of December 31, 36,694 38,742

-21-