Bank of the West 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT | FINANCIAL STATEMENTS

BANK OF

THE WEST

AND SUBSIDIARIES

Table of contents

-

Page 1

2014 ANNUAL REPORT | FINANCIAL STATEMENTS BANK OF THE WEST AND SUBSIDIARIES -

Page 2

-

Page 3

... AUDITORS' REPORT To the Board of Directors and Stockholder of Bank of the West and its Subsidiaries San Francisco, California We have audited the accompanying consolidated financial statements of Bank of the West and its subsidiaries (the "Bank"), which comprise the consolidated balance sheets as... -

Page 4

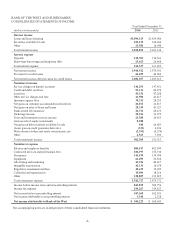

... income Service charges on deposit accounts Credit and debit card fees Loan fees Other service charges and fees Insurance agency fees Net gains on customer accommodation derivatives Net gains on sales of loans and leases Bank-owned life insurance Brokerage income Trust and investment services income... -

Page 5

...net of tax Comprehensive income attributable to Bank of the West Comprehensive income attributable to noncontrolling interest Total comprehensive income The accompanying notes are an integral part of these consolidated financial statements. Year Ended December 31, 2014 2013 $544,222 (97,961) 169,562... -

Page 6

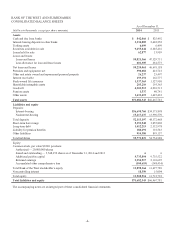

... for loan and lease losses Net loans and leases Premises and equipment, net Other real estate owned and repossessed personal property Interest receivable Bank-owned life insurance Identifiable intangible assets Goodwill Pension assets Other assets Total assets Liabilities and equity Deposits... -

Page 7

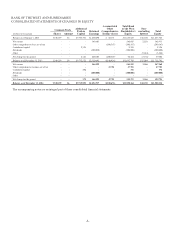

BANK OF THE WEST AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Common Stock Shares Amount 5,548,359 5,548,359 5,548,359 $6 $6 $6 (dollars in thousands) Balance as of January 1, 2013 Net income Other comprehensive loss, net of tax Contributed capital Dividends Other Net change for ... -

Page 8

... and collections Purchases of loans and leases Proceeds from sales (including participations) of loans originated for investment Proceeds from sales of foreclosed assets Purchase of premises, equipment and software Net change in low income housing tax credit investments Net change in FHLB stock... -

Page 9

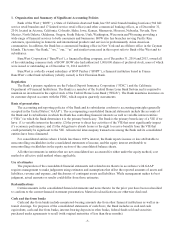

...located in Arizona, California, Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin and Wyoming providing a wide range of financial services to both consumers and businesses. BOW also has branches... -

Page 10

... reported in noninterest income. Direct loan origination fees and costs on loans held for sale are deferred until the related loan is sold and recognized in noninterest income upon sale. For consumer mortgage loans originated for sale, the Bank enters into short-term loan commitments to fund loans... -

Page 11

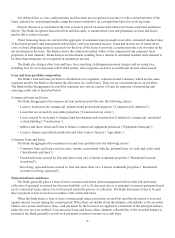

... terms. When the Bank places a loan or lease on nonaccrual status, previously accrued but uncollected interest is reversed against interest income during the current period. When there are doubts about the ultimate collectability of the recorded balance on a nonaccrual loan or lease, cash payments... -

Page 12

... on current information and events, it is probable that it will be unable to collect all amounts due according to the contractual terms of the loan. The Bank measures impairment by comparing the present value of the expected future cash flows discounted at the loan's effective original interest rate... -

Page 13

... delinquency status that ranges from 120 to 180 days depending on the type of consumer installment loans and leases. Recoveries of amounts on nonaccrual loans that have previously been charged off are credited to the Allowance and are generally recorded only to the extent that cash or other assets... -

Page 14

benefits and risks of ownership and do not meet the accounting requirements for capital lease classification. Operating lease payments are charged as rental expense on a straight-line basis over the lease term. Lease incentives received as part of the lease agreement are recognized as a reduction of... -

Page 15

Transfers and servicing of financial assets The Bank enters into loan participations and loan sales, including originations to sell residential mortgage loans to the Federal National Mortgage Association ("FNMA"). The Bank records these transactions as sales and derecognizes the financial assets in ... -

Page 16

... which approximates the tax to be paid or refunded for the current period. The Bank recognizes deferred income tax liabilities and assets for the expected future tax consequences of events that the Bank includes in the consolidated financial statements or tax returns based on the difference between... -

Page 17

...legal agreement. The guidance also requires new disclosures relating to foreclosed and repossessed assets held by the Bank as well as loans in process of foreclosure according to local requirements of the applicable jurisdiction. This guidance is effective for the Bank's 2015 annual reporting period... -

Page 18

... all transfers of financial assets accounted for as sales and new disclosures for repurchase agreements, securities lending transactions and repurchase-to-maturity transactions that are accounted for as secured borrowings. The guidance is effective for the Bank's 2015 annual reporting period and is... -

Page 19

... sponsored agencies Collateralized debt and loan obligations Other asset-backed securities Collateralized mortgage obligations: Government agencies Government sponsored agencies States and political subdivisions Corporate debt securities Equity securities Total securities available for sale Fair... -

Page 20

... sponsored agencies States and political subdivisions Corporate debt securities Equity securities Total securities available for sale $ (2,979) (2,084) (971) (3,002) (167) (542) (350) $(10,095) $1,378,186 535,510 297,103 417,641 101,856 81,136 97,656 $2,909,088 As of December 31, 2014 12 Months or... -

Page 21

... agencies States and political subdivisions Corporate debt securities Equity securities Total securities available for sale $ (20,045) (48,771) (17,589) (17,950) (8,476) (4,844) (297) $(117,972) $2,041,188 2,211,284 229,055 980,165 296,442 90,916 42,787 $5,891,837 As of December 31, 2013 12 Months... -

Page 22

... to held for sale. Net gains on sales of consumer loans include forward loan sale commitments and related interest rate lock commitments. Our consumer loan servicing activities include collecting principal, interest, tax and insurance payments from borrowers while accounting for and remitting... -

Page 23

... servicing income is recorded in noninterest income as a part of other service charges and fees and is reported net of the amortization of the servicing assets. The unpaid principal amount of consumer loans serviced for others was $4.0 billion and $3.8 billion for the years ended December 31, 2014... -

Page 24

...As of December 31, (dollars in thousands) Commercial: Commercial and industrial Commercial real estate Construction Equipment financing Agriculture Consumer: Installments and lines Residential secured-closed-end Residential secured-revolving, open-end Total loans and leases 2014 $ 8,554,842 11,981... -

Page 25

...or in the case of certain residential real estate loans, on terms that were widely available to employees of the Bank who were not directors or executive officers. Credit quality We monitor credit quality by evaluating various attributes and utilize such information in our evaluation of the adequacy... -

Page 26

The following tables present the credit quality of each class of commercial loans and leases based on our internal risk grading system: (dollars in thousands) Commercial and industrial Commercial real estate Construction Equipment financing Agriculture Total commercial Pass $ 8,317,786 11,364,971 1,... -

Page 27

... 31, (dollars in thousands) Balance as of January 1, Provision for credit losses Charge-offs: Commercial: Commercial and industrial Commercial real estate Construction Equipment financing Agriculture Total commercial(1) Consumer: Installments and lines Residential secured-closed-end Residential... -

Page 28

... in thousands) Collectively evaluated Individually evaluated Total (dollars in thousands) Collectively evaluated Individually evaluated Total As of December 31, 2013 Allocated Allowance for Loan and Lease Losses Recorded Investment in Loans Commercial Consumer Total Commercial Consumer Total $264... -

Page 29

... loans and leases The following tables present information related to impaired loans and leases that are individually evaluated: As of December 31, 2014 Commercial Product Commercial & Industrial Commercial Real Estate Equipment Financing Consumer Product Residential Secured- Closed-End (dollars... -

Page 30

... to past due payments. 2013 Financial Effects PrePostBalance as of Modification Modification December 31, Loan Balance Loan Balance 2013 (dollars in thousands) Commercial TDRs: Commercial and industrial Commercial real estate Construction Equipment financing Agriculture Consumer TDRs: Installments... -

Page 31

... 8,001 10,145 $34,716 (dollars in thousands) Commercial: Commercial and industrial Commercial real estate Construction Equipment financing Agriculture Consumer: Installments and lines Residential secured-closed-end Residential secured-revolving, open-end Total (1) Current(1) $ 7,546,904 11,282,173... -

Page 32

...(dollars in thousands) 2015 2016 2017 2018 2019 2020 and thereafter Total minimum payments Less: Interest on capital leases Present value of net minimum lease payments on capital leases(1) (1) Capital Leases $ 1,997 1,920 1,940 1,957 2,054 13,764 $23,632 9,625 $14,007 Excludes purchase accounting... -

Page 33

... to direct those activities and our obligation to absorb losses or the right to receive benefits significant to the VIE. Limited liability companies The Bank has formed CLAAS Financial Services, LLC with the purpose of providing lease and loan financing to commercial entities acquiring agricultural... -

Page 34

... is limited to providing financial support, as stated within the contractual agreements and, therefore, we are not the primary beneficiary. The business purpose of these entities is to provide affordable housing within the Bank's service area in return for tax credits and tax loss deductions... -

Page 35

...line items in our consolidated balance sheets: As of December 31, 2014 2013 (dollars in thousands) Assets Cash and due from banks Loans and leases: Loans and leases Less: Allowance for loan and lease losses Net loans and leases Other assets Total assets Liabilities Long-term debt Other liabilities... -

Page 36

... capital ratios and establishes new "well-capitalized" ratios. The U.S. Basel III final rule is effective on January 1, 2015 for the Bank. 10. Deposits As of December 31, 2014, the following table presents the maturity distribution of time certificates of deposit: (dollars in thousands) 2015 2016... -

Page 37

... (dollars in thousands) Interest Payment Interest Rate Maturities 2014 2013 Advances from FHLB: Fixed-rate Fixed-rate(1) Floating-rate Fixed-rate unsecured lines of credit with BNP Paribas Fixed-rate other debt Capital leases Total long-term debt (1) quarterly monthly monthly monthly monthly 1.65... -

Page 38

...the consolidated financial statements. The following table presents the Bank's commitments: (dollars in thousands) Commitments to extend credit(1) Commercial Consumer Standby and commercial letters of credit (1) $ 730,995 188,361 120,780 320,501 1,385 50,191 $1,412,213 As of December 31, 2014 2013... -

Page 39

...Bank uses interest rate swap contracts to hedge changes in fair value from interest rate changes of underlying fixed-rate debt instruments, including fixed-rate certificates of deposit and certain fixed-rate FHLB advances. As of December 31, 2014, the weighted-average remaining life of the currently... -

Page 40

... rate floors, marketlinked swaps and purchased options, written market-linked options and forward commitments to fund and sell residential mortgage loans. The Bank acts as a seller and buyer of interest rate derivatives and foreign exchange contracts to accommodate customers. To mitigate the market... -

Page 41

... fair value measurements reported in our consolidated financial statements. The fair value of assets and liabilities is determined using several methods including third-party pricing services, purchased valuation software or internally-developed models in accordance with the Bank's policy. The fair... -

Page 42

... for the asset, either directly or indirectly, for substantially the full term of the financial instrument. Examples of such instruments include agency mortgage-backed securities, collateralized loan obligations, municipal securities and corporate debt securities. If relevant market prices are... -

Page 43

... mortgage obligations: Government agencies Government sponsored agencies States and political subdivisions Corporate debt securities Equity securities Total securities available for sale Derivative assets(1): Interest rate contracts Foreign exchange contracts Market-linked swaps and purchased... -

Page 44

... mortgage obligations: Government agencies Government sponsored agencies States and political subdivisions Corporate debt securities Equity securities Total securities available for sale Derivative Interest rate contracts Foreign exchange contracts Market-linked swaps and purchased options Credit... -

Page 45

... 3 2014 (dollars in thousands) Sales Securities available for sale: Other asset-backed securities States and political subdivisions Total securities available for sale Market-linked swaps and purchased options Credit guarantee derivative Deferred compensation plan and other assets Total assets... -

Page 46

... loans are primarily based on real estate appraisal reports prepared by third-party appraisers. The Bank has a real estate valuation services group that manages the real estate appraisal solicitation and evaluation process for commercial real estate. The Bank reviews the third-party appraisals... -

Page 47

...noninterest-bearing checking, regular savings and certain types of money market savings accounts) is equal to the amount payable on demand at the reporting date. Accordingly, these are classified as Level 1. Fair values of fixed-rate certificates of deposit are estimated using a discounted cash flow... -

Page 48

... discounted cash flow analyses based on our current incremental borrowing rates for similar types of borrowing arrangements and are inclusive of our current credit spread levels. As the significant inputs are market observable, long-term debt is classified as Level 2. Off-balance sheet financial... -

Page 49

... prior service (credit) Subtotal reclassifications to net periodic benefit costs Net change in pension and other benefits adjustment Securities available for sale: Unrealized net gains (losses) arising during the year Reclassifications to net income: Net (gains) on debt securities available for sale... -

Page 50

... defined benefit plans. The Bank's other retirement plans consist of nonqualified, supplemental retirement plans and a qualified defined contribution plan. The Bank recognizes the overfunded and unfunded status of its pension plans as an asset and liability in the consolidated balance sheets... -

Page 51

...expected long-term rate of return on plan assets and (4) discount rate. Pension expense is directly affected by the number of employees eligible for pension benefits, their estimated compensation increases for active plans and economic conditions, which include the actual return on plan assets. With... -

Page 52

..."), fair value of plan assets and the funded status for all plans of the Bank: Pension Benefits Qualified Plans Non-Qualified Plans Other Benefits (dollars in thousands) PBO at January 1, Service cost Interest cost Actuarial (gain) loss Change in plan provisions Benefit payments PBO as of December... -

Page 53

... components of the net periodic benefit cost: Pension Benefits Qualified Plans Non-Qualified Plans 2014 2013 2014 2013 Other Benefits 2014 2013 (dollars in thousands) Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Recognized net actuarial loss... -

Page 54

... ERP Plan and UCB pension plans ("the Plans") are managed in accordance with the Employee Retirement Income Security Act of 1974 ("ERISA"). The Plans' assets consist mainly of fixed income and equity securities of U.S. and foreign issuers and may include alternative investments; such as, real estate... -

Page 55

... agency securities and corporate securities Mutual funds Municipal bonds Exchange-traded funds Contracts/annuities Equities: Mutual funds Exchange-traded funds Common stock Multi-strategy mutual funds Total plan investments Net pending settlements Total plan assets As of December 31, 2013 (dollars... -

Page 56

... funds include SEC registered mutual funds investing in alternative asset classes. The fair values are based on a review of quoted prices for identical assets in active markets and are classified as Level 1. Contributions Bank of the West did not contribute to the qualified pension plans during 2014... -

Page 57

...other assets in the consolidated balance sheets. Deferred taxes related to net unrealized gains (losses) on securities available for sale, net unrealized gains (losses) on derivatives and employee benefit plan adjustments are recorded in AOCI. See Note 17 for additional information. The deferred tax... -

Page 58

... (dollars in thousands) Federal statutory income tax expense and rate Foreign, state and local taxes expense, net of federal effect Bank-owned life insurance Non-taxable income, net Tax credits Other Effective income tax expense and rate The Bank and its subsidiaries file income tax returns with... -

Page 59

... from affiliates and off-balance sheet transactions: (dollars in thousands) Cash and due from banks Loans Noninterest-bearing demand deposits Money market deposits(1) Time certificates of deposit Other assets Other liabilities Fixed-rate unsecured lines of credit Noncontrolling interest Derivatives... -

Page 60

... after December 31, 2014 through March 25, 2015, the date of our financial statement issuance, and there have been no material events that would require recognition in the consolidated financial statements or disclosures in the notes for the consolidated financial statements of the Bank. -58- -

Page 61

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 62

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 63

-

Page 64

Bank of the West 180 Montgomery Street San Francisco, CA 94104 Phone: 415.765.4800 www.bankofthewest.com