Albertsons 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

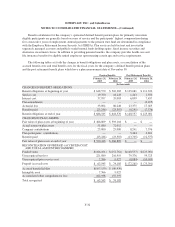

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

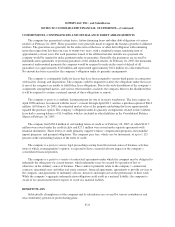

COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

The company has guaranteed certain leases, fixture financing loans and other debt obligations of various

retailers at February 26, 2005. These guarantees were generally made to support the business growth of affiliated

retailers. The guarantees are generally for the entire term of the lease or other debt obligation with remaining

terms that range from less than one year to twenty-two years, with a weighted average remaining term of

approximately eleven years. For each guarantee issued, if the affiliated retailer defaults on a payment, the

company would be required to make payments under its guarantee. Generally, the guarantees are secured by

indemnification agreements or personal guarantees of the affiliated retailer. At February 26, 2005, the maximum

amount of undiscounted payments the company would be required to make in the event of default of all

guarantees was approximately $210 million and represented approximately $121 million on a discounted basis.

No amount has been accrued for the company’s obligation under its guaranty arrangements.

The company is contingently liable for leases that have been assigned to various third parties in connection

with facility closings and dispositions. The company could be required to satisfy the obligations under the leases

if any of the assignees are unable to fulfill their lease obligations. Due to the wide distribution of the company’s

assignments among third parties, and various other remedies available, the company believes the likelihood that

it will be required to assume a material amount of these obligations is remote.

The company is party to a synthetic leasing program for one of its major warehouses. The lease expires in

April 2008 and may be renewed with the lessor’s consent through April 2013, and has a purchase option of $60.0

million. At February 26, 2005, the estimated market value of the property underlying this lease approximately

equaled the purchase option. The company’s obligation under its guaranty arrangements related to this synthetic

lease had a carrying balance of $1.6 million, which is included in other liabilities in the Consolidated Balance

Sheets at February 26, 2005.

The company had $168.6 million of outstanding letters of credit as of February 26, 2005, of which $141.5

million were issued under the credit facility and $27.1 million were issued under separate agreements with

financial institutions. These letters of credit primarily support workers’ compensation programs, merchandise

import programs, and payment obligations. The company pays fees, which vary by instrument, of up to 1.125

percent on the outstanding balance of the letter of credit.

The company is a party to various legal proceedings arising from the normal course of business activities,

none of which, in management’s opinion, is expected to have a material adverse impact on the company’s

consolidated financial position.

The company is a party to a variety of contractual agreements under which the company may be obligated to

indemnify the other party for certain matters, which indemnities may be secured by operation of law or

otherwise, in the ordinary course of business. These contracts primarily relate to the company’s commercial

contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services to

the company, and agreements to indemnify officers, directors and employees in the performance of their work.

While the company’s aggregate indemnification obligation could result in a material liability, the company is

aware of no current matter that it expects to result in a material liability.

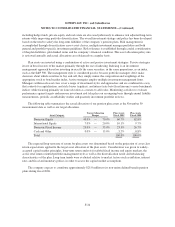

BENEFIT PLANS

Substantially all employees of the company and its subsidiaries are covered by various contributory and

non-contributory pension or profit sharing plans.

F-31