Albertsons 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

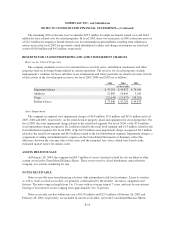

The expectations on timing of disposition or sublease and the estimated sales price or sublease income

associated with closed properties are impacted by variable factors such as inflation, the general health of the

economy, resultant demand for commercial property, the ability to secure subleases, the creditworthiness of

sublessees and the company’s success at negotiating early termination agreements with lessors. While

management believes the current estimates on closed properties are adequate, it is possible that market conditions

in the real estate market could cause changes in the company’s assumptions and may require additional reserves

and asset impairment charges to be recorded.

Reserves for Self Insurance:

The company is primarily self-insured for workers’ compensation, health care for certain employees and

general and automobile liability costs. It is the company’s policy to record its self-insurance liabilities based on

claims filed and an estimate of claims incurred but not yet reported, discounted at a risk free interest rate. Any

projection of losses concerning workers’ compensation, health care and general and automobile liability is

subject to a considerable degree of variability. Among the causes of this variability are unpredictable external

factors affecting future inflation rates, discount rates, litigation trends, legal interpretations, benefit level changes

and claim settlement patterns.

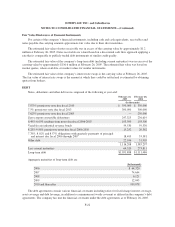

Property, Plant and Equipment:

Property, plant and equipment are carried at cost. Depreciation, as well as amortization of assets under capital

leases, is based on the estimated useful lives of the assets using the straight-line method. Estimated useful lives

generally are 10 to 40 years for buildings and major improvements, 3 to 10 years for equipment, and the shorter of

the term of the lease or expected life for leasehold improvements. Interest on property under construction of $0.2

million, $0.4 million and $5.9 million was capitalized in fiscal years 2005, 2004 and 2003, respectively.

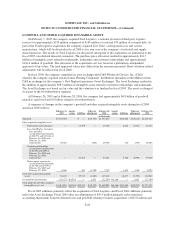

Goodwill and Other Intangible Assets:

Goodwill represents the excess of costs over fair value of assets of businesses acquired. The company

adopted the provisions of Statement of Financial Accounting Standards (SFAS) No. 142, “Goodwill and Other

Intangible Assets”, as of February 24, 2002. Pursuant to SFAS No. 142, goodwill and intangible assets acquired

in a purchase business combination and determined to have an indefinite useful life are not amortized, but instead

are tested for impairment at least annually in accordance with the provisions of SFAS No. 142. SFAS No. 142

also requires that intangible assets with estimable useful lives be amortized over their respective estimated useful

lives to their estimated residual values, and be reviewed for impairment in accordance with SFAS No. 144,

“Accounting for Impairment or Disposal of Long-Lived Assets”.

Impairment of Long-Lived Assets:

In accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets,” the

Company monitors the carrying value of long-lived assets for potential impairment each quarter based on

whether certain trigger events have occurred. These events include current period losses combined with a history

of losses or a projection of continuing losses or a significant decrease in the market value of an asset. When a

trigger event occurs, an impairment calculation is performed, comparing projected undiscounted future cash

flows rates, to the carrying value. If impairment is identified for long-lived assets to be held and used, discounted

future cash flows are compared to the asset’s current carrying value. Impairment is recorded when the carrying

value exceeds the discounted cash flows. Costs to reduce the carrying value of long-lived assets are a component

of selling and administrative expenses in the Consolidated Statement of Earnings.

F-14