Albertsons 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

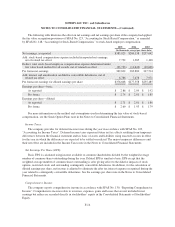

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

February 26,

2005

(52 weeks)

February 28,

2004

(53 weeks)

February 22,

2003

(52 weeks)

Cash flows from operating activities

Net earnings $ 385,823 $ 280,138 $ 257,042

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation and amortization 303,039 301,589 297,056

LIFO expense 6,112 4,734 4,741

Provision for losses on receivables 10,338 10,479 15,719

Loss (gain) on sale of property, plant and equipment 7,445 (1,802) (5,564)

Gain on sale of WinCo Foods, Inc. (109,238) — —

Restructure and other charges 26,416 15,523 2,918

Deferred income taxes 48,962 38,761 14,184

Equity in earnings of unconsolidated subsidiaries (14,325) (39,215) (39,724)

Other adjustments, net 3,154 4,339 3,675

Changes in assets and liabilities, net of effects from acquisition of business:

Receivables 18,049 23,407 (46,890)

Inventories 34,943 (19,331) (15,974)

Long-term notes receivable, net 24,880 14,620 (4,094)

Accounts payable 26,990 1,361 111,811

Income taxes currently payable (67,449) 82,781 22,707

Other assets and liabilities 86,427 129,442 (34,097)

Net cash provided by operating activities 791,566 846,826 583,510

Cash flows from investing activities

Proceeds from sale of assets 34,896 56,552 65,986

Proceeds from sale of WinCo Foods, Inc. 229,846 — —

Purchases of property, plant and equipment (262,790) (328,156) (396,609)

Purchase of Total Logistics, Inc. (163,766) — —

Net cash used in investing activities (161,814) (271,604) (330,623)

Cash flows from financing activities

Net (reduction) issuance of notes payable — (80,000) 56,000

Proceeds from issuance of long-term debt 3,813 — 296,535

Repayment of long-term debt (331,798) (131,063) (472,448)

Reduction of obligations under capital leases (33,004) (32,884) (29,767)

Dividends paid (80,220) (77,035) (75,648)

Net proceeds from the sale of common stock under option plans 39,375 23,127 31,617

Payment for purchase of treasury shares (55,959) (14,599) (42,159)

Net cash used in financing activities (457,793) (312,454) (235,870)

Net increase in cash and cash equivalents 171,959 262,768 17,017

Cash and cash equivalents at beginning of year 291,956 29,188 12,171

Cash and cash equivalents at end of year $ 463,915 $ 291,956 $ 29,188

SUPPLEMENTAL CASH FLOW INFORMATION

The company’s non-cash activities were as follows:

Leased asset additions and related obligations $ 62,898 $ 43,308 $ 42,829

Minimum pension liability, net of deferred taxes $ 5,849 $ 26,404 $ 72,328

Interest and income taxes paid:

Interest paid (net of amount capitalized) $122,131 $143,088 $171,089

Income taxes paid (net of refunds) $216,572 $ 29,081 $ 48,787

See Notes to Consolidated Financial Statements.

F-11