Albertsons 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

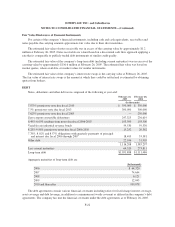

Deferred Rent:

The company recognizes rent holidays, including the time period during which the company has access to

the property prior to the opening of the site, as well as construction allowances and escalating rent provisions, on

a straight-line basis over the term of the lease. The deferred rents are included in other current liabilities and

other long-term liabilities on the Consolidated Balance Sheets.

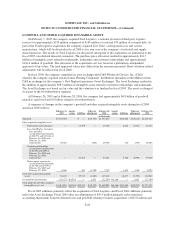

Benefit Plans:

The company sponsors pension and other retirement plans in various forms covering primarily non-union

employees who meet eligibility requirements. The determination of the company’s obligation and expense for

company sponsored pension and other post retirement benefits is dependent, in part, on management’s selection

of certain assumptions used by actuaries in calculating such amounts. These assumptions are described in the

Benefit Plans note in the Notes to Consolidated Financial Statements and include, among other things, the

discount rate, the expected long-term rate of return on plan assets, and the rates of increases in compensation and

healthcare costs.

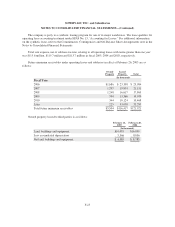

Derivatives:

The company accounts for derivatives pursuant to SFAS No. 133, “Accounting for Derivatives and Hedging

Activities”, and SFAS No. 138, “Accounting for Certain Derivative Instruments and Certain Hedging Activity,

an Amendment of SFAS No. 133”. SFAS No. 133 and No. 138 require that all derivative financial instruments

are recorded on the balance sheet at their respective fair value.

The company has limited involvement with derivatives and uses them only to manage well-defined interest

rate risks. The derivatives used have included interest rate caps, collars and swap agreements. The company does

not use financial instruments or derivatives for any trading or other speculative purposes.

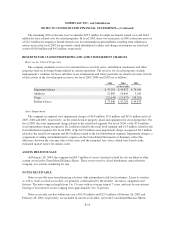

Stock-based Compensation:

The company has stock based employee compensation plans, which are described more fully in the Stock

Option Plans note in the Notes to Consolidated Financial Statements. The company utilizes the intrinsic value-

based method, per Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to

Employees,” for measuring the cost of compensation paid in company common stock. This method defines the

company’s cost as the excess of the stock’s market value at the time of the grant over the amount that the

employee is required to pay. In accordance with APB Opinion No. 25, no compensation expense was recognized

for options issued under the stock option plans in fiscal 2005, 2004 or 2003 as the exercise price of all options

granted was not less than 100 percent of fair market value of the common stock on the date of grant.

F-15