Albertsons 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

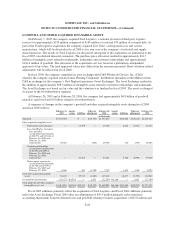

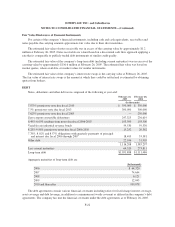

Fair Value Disclosures of Financial Instruments

For certain of the company’s financial instruments, including cash and cash equivalents, receivables and

notes payable, the carrying amounts approximate fair value due to their short maturities.

The estimated fair value of notes receivable was in excess of the carrying value by approximately $1.2

million at February 26, 2005. Notes receivable are valued based on a discounted cash flow approach applying a

rate that is comparable to publicly traded debt instruments of similar credit quality.

The estimated fair value of the company’s long-term debt (including current maturities) was in excess of the

carrying value by approximately $116.6 million at February 26, 2005. The estimated fair value was based on

market quotes, where available, or market values for similar instruments.

The estimated fair value of the company’s interest rate swaps is the carrying value at February 26, 2005.

The fair value of interest rate swaps is the amount at which they could be settled and is estimated by obtaining

quotes from brokers.

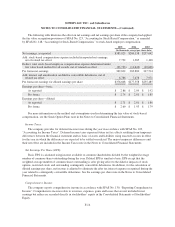

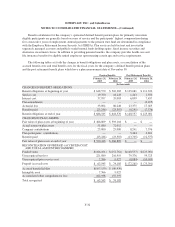

DEBT

Notes, debentures and other debt were composed of the following at year-end:

February 26,

2005

February 28,

2004

(In thousands)

7.875% promissory note due fiscal 2010 $ 350,000 $ 350,000

7.5% promissory note due fiscal 2013 300,000 300,000

7.625% promissory note due fiscal 2005 — 250,000

Zero-coupon convertible debentures 247,325 236,619

6.49%-6.69% medium-term notes due fiscal 2006-2007 103,500 103,500

Variable rate industrial revenue bonds 59,530 59,530

8.28%-9.96% promissory notes due fiscal 2006-2010 15,252 20,362

7.78%, 8.02% and 8.57% obligations with quarterly payments of principal

and interest due fiscal 2006 through 2007 18,495 33,381

Other debt 22,106 31,905

1,116,208 1,385,297

Less current maturities 64,320 273,811

Long-term debt $1,051,888 $1,111,486

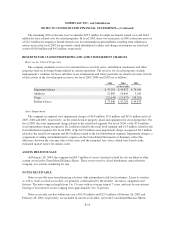

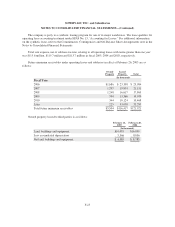

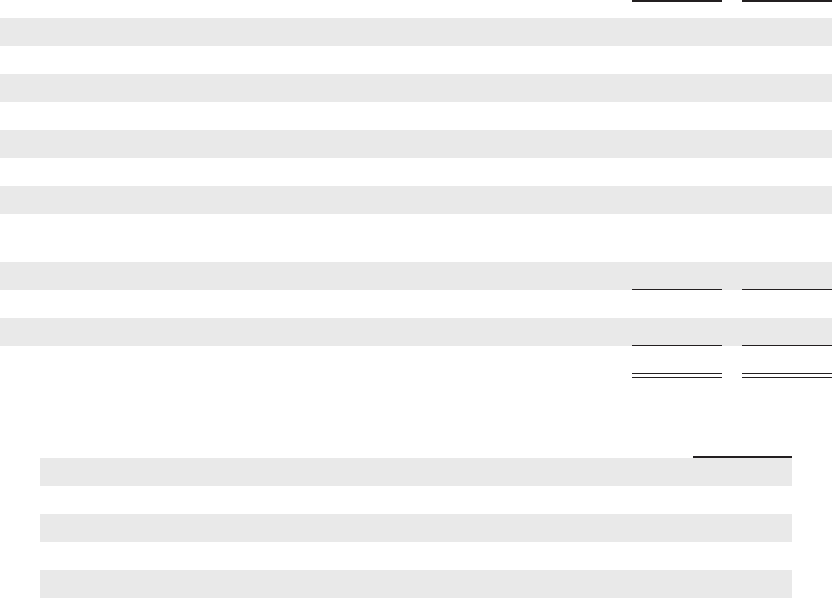

Aggregate maturities of long-term debt are:

(In thousands)

2006 $ 64,320

2007 74,644

2008 6,121

2009 12,045

2010 and thereafter 959,078

The debt agreements contain various financial covenants including ratios for fixed charge interest coverage,

asset coverage and debt leverage, in addition to a minimum net worth covenant as defined in the company’s debt

agreements. The company has met the financial covenants under the debt agreements as of February 26, 2005.

F-22