Albertsons 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

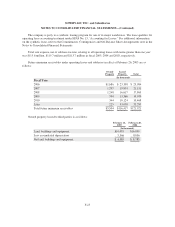

TREASURY STOCK PURCHASE PROGRAM

In October 2001, the Board of Directors authorized a treasury stock purchase program under which the

company was authorized to purchase up to 5.0 million shares of the company’s common stock for re-issuance

upon the exercise of employee stock options and for other compensation programs utilizing the company’s stock.

In fiscal 2002, the company purchased 1.3 million shares under the program at an average cost of $22.16 per

share. In fiscal 2003, the company purchased 1.5 million shares under the program at an average cost of $27.94

per share. In fiscal 2004, the company purchased 0.6 million shares under the program at an average cost of

$23.80 per share. In fiscal 2005, the company completed the program by purchasing the remaining 1.6 million

shares under the program at an average cost of $28.45 per share.

In May 2004, the Board of Directors authorized a treasury stock purchase program under which the

company is authorized to purchase up to 5.0 million shares of the company’s common stock for reissuance upon

the exercise of employee stock options and for other compensation programs utilizing the company’s stock. In

fiscal 2005, the company purchased approximately 0.4 million shares under the program at an average cost of

$27.73 per share. As of February 26, 2005, approximately 4.6 million shares remained available for purchase

under this program.

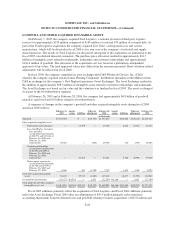

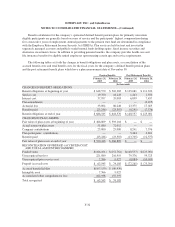

EARNINGS PER SHARE

The following table reflects the calculation of basic and diluted earnings per share:

2005 2004 2003

(In thousands, except per share amounts)

Earnings per share—basic:

Net earnings $385,823 $280,138 $257,042

Weighted average shares outstanding—basic 135,003 133,975 133,730

Earnings per share—basic $ 2.86 $ 2.09 $ 1.92

Earnings per share—diluted:

Net earnings $385,823 $280,138 $257,042

Interest and amortization related to dilutive contingently

convertible debentures, net of tax 6,786 7,678 7,971

Net earnings used for diluted earnings per share calculation $392,609 $287,816 $265,013

Weighted average shares outstanding 135,003 133,975 133,730

Dilutive impact of options outstanding 2,103 1,443 1,147

Dilutive impact of contingently convertible debentures 7,818 7,818 7,818

Weighted average shares—diluted 144,924 143,236 142,695

Earnings per share—diluted $ 2.71 $ 2.01 $ 1.86

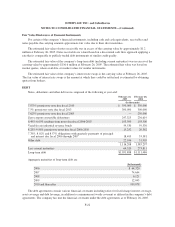

In November 2004, the FASB ratified the effective date of the Emerging Issues Task Force (EITF)

consensus on Issue No. 04-8, “The Effect of Contingently Convertible Instruments on Diluted Earnings per

Share” to be applied to reporting periods ending after December 15, 2004. Under EITF Issue No. 04-8, net

earnings and diluted shares outstanding, used for earnings per share calculations, are restated using the

if-converted method of accounting to reflect the contingent issuance of 7.8 million shares under the company’s

outstanding contingently convertible zero-coupon debentures which were issued in November 2001. The

company adopted the provisions of EITF 04-8 in the fourth quarter of fiscal 2005 and restated prior years’ diluted

earnings per share amounts. The impact of the EITF 04-8 restatement reduced diluted earnings per share by

approximately $0.11, $0.06 and $0.05 in fiscal 2005, fiscal 2004 and fiscal 2003, respectively.

F-30