Albertsons 2005 Annual Report Download - page 22

Download and view the complete annual report

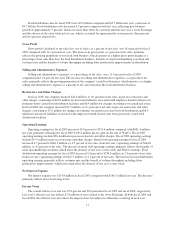

Please find page 22 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management believes the current estimates on closed properties are adequate, it is possible that market conditions

could cause changes in the company’s assumptions and may require additional reserves and asset impairment

charges to be recorded.

Reserves for Self Insurance

The company is primarily self-insured for workers’ compensation, health care for certain employees and

general and automobile liability costs. It is the company’s policy to record its self-insurance liabilities based on

claims filed and an estimate of claims incurred but not yet reported, discounted at a risk free interest rate. Any

projection of losses concerning workers’ compensation, health care and general and automobile liability is

subject to a considerable degree of variability. Among the causes of this variability are unpredictable external

factors affecting future inflation rates, discount rates, litigation trends, legal interpretations, benefit level changes

and claim settlement patterns. A 100 basis point change in discount rates, based on changes in market rates

would increase the company’s liability by approximately $1 million.

Benefit Plans

The company sponsors pension and other post retirement plans in various forms covering substantially all

employees who meet eligibility requirements. The determination of the company’s obligation and related

expense for company sponsored pension and other post retirement benefits is dependent, in part, on

management’s selection of certain assumptions used by its actuaries in calculating these amounts. These

assumptions include, among other things, the discount rate, the expected long-term rate of return on plan assets

and the rates of increase in compensation and health care costs. In accordance with generally accepted accounting

principles, actual results that differ from the company’s assumptions are accumulated and amortized over future

periods and, therefore, affect its recognized expense and obligation in future periods. While the company

believes that its assumptions are appropriate, significant differences in actual experience or significant changes in

assumptions may materially impact non-union pension and other post retirement obligations and future expenses.

For fiscal 2006, when not considering other changes in assumptions, the impact to pension expense of each

25 basis point reduction in the discount rate is to increase pension expense by approximately $3 million and the

impact of each 25 basis point reduction in expected return on plan assets is to increase pension expense by

approximately $1 million. For post retirement, a one percent increase in the health care cost trend rate would

increase the accumulated post retirement benefit obligation by approximately $11 million and the service and

interest cost by $1 million in fiscal 2005. In contrast, a one percent decrease in the health care cost trend rate

would decrease the accumulated post retirement benefit obligation by approximately $10 million and the service

and interest cost by approximately $1 million in fiscal 2005. The actuarial assumptions used by the company may

differ materially from actual results due to changing market and economic conditions, higher or lower

withdrawal rates, and longer or shorter life spans of participants.

Goodwill

Management assesses the valuation of goodwill for each of the company’s reporting units on an annual basis

through the comparison of the fair value of the respective reporting unit with its carrying value. Fair value is

determined primarily based on valuation studies performed by the company, which utilize a discounted cash flow

methodology. Valuation analysis requires significant judgments and estimates to be made by management. The

company’s estimates could be materially impacted by factors such as competitive forces, customer behaviors,

changes in growth trends and specific industry conditions.

LIQUIDITY AND CAPITAL RESOURCES

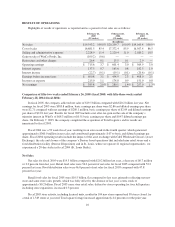

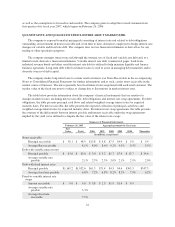

Net cash provided by operating activities was $791.6 million, $846.8 million and $583.5 million in fiscal

2005, 2004 and 2003, respectively. The decrease in cash from operating activities in fiscal 2005 from fiscal 2004

is primarily related to changes in working capital.

16