Albertsons 2005 Annual Report Download - page 27

Download and view the complete annual report

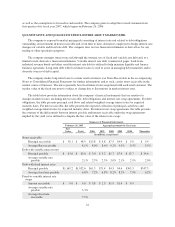

Please find page 27 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NEW ACCOUNTING STANDARDS

In January 2003, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. (FIN)

No. 46, “Consolidation of Variable Interest Entities” (FIN 46), and revised it in December 2003. FIN 46

addresses how a business should evaluate whether it has a controlling financial interest in an entity through

means other than voting rights and accordingly should consolidate the entity. FIN 46 applied immediately to

entities created after January 31, 2003, and no later than the end of the first reporting period that ended after

December 15, 2003 to entities considered to be special-purpose entities (SPEs). FIN 46 was effective for all other

entities no later than the end of the first interim or annual reporting period ending after March 15, 2004. The

adoption of the provisions of FIN 46 relative to SPEs and for entities created after January 31, 2003 did not have

an impact on the company’s consolidated financial statements. The other provisions of FIN 46 did not have an

impact on the company’s consolidated financial statements.

In December 2003, the FASB issued SFAS No. 132 (Revised 2003), “Employers’ Disclosures about

Pensions and Other Post Retirement Benefits—An Amendment of FASB Statements No. 87, 88 and 106.” This

statement increases the existing disclosure’s requirements by requiring more details about pension plan assets,

benefit obligations, cash flows, benefit costs and related information. The effect of the revisions to SFAS No. 132

are included in the Benefit Plans note in the Notes to Consolidated Financial Statements.

In May 2004, the FASB issued Financial Staff Position (FSP) No. 106-2, “Accounting and Disclosure

Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003.” FSP

No. 106-2 supersedes FSP No. 106-1, “Accounting and Disclosure Requirements Related to the Medicare

Prescription Drug, Improvement and Modernization Act of 2003,” and provides guidance on the accounting and

disclosures related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the

Medicare Act) which was signed into law in December 2003. Except for certain nonpublic entities, FSP 106-2 is

effective for the first interim or annual period beginning after June 15, 2004. The company adopted FSP 106-2 in

the second quarter of fiscal 2005 using the retroactive application method and the fiscal 2005 impact was

immaterial to the consolidated financial statements. Based upon current guidance around the definition of

actuarially equivalent, equivalence was only determined with respect to a portion of the plan participants

depending on plan benefits provided. If additional clarifying regulations related to the Medicare Act or the

definition of actuarially equivalent becomes available, remeasurement of the plan obligations may be required,

and related impacts on net periodic benefit costs would be reflected prospectively in the consolidated financial

statements.

In November 2004, the FASB ratified the effective date of the Emerging Issues Task Force (EITF)

consensus on Issue No. 04-8, “The Effect of Contingently Convertible Instruments on Diluted Earnings per

Share” to be applied to reporting periods ending after December 15, 2004. Under EITF Issue No. 04-8, net

earnings and diluted shares outstanding, used for earnings per share calculations, would be restated using the if-

converted method of accounting to reflect the contingent issuance of 7.8 million shares under the company’s

outstanding contingently convertible zero-coupon debentures which were issued in November 2001. The

company adopted the provisions of EITF 04-8 in the fourth quarter of fiscal 2005 and restated prior years’ diluted

earnings per share amounts. The impact of EITF No. 04-8 reduced diluted earnings per share by $0.11 ($0.08

excluding the gain on the sale of WinCo) in fiscal 2005. The impact of the EITF 04-8 restatement reduced diluted

earnings per share by approximately $0.06 and $0.05 in fiscal 2004 and 2003, respectively.

In December 2004, the FASB issued FASB Statement 123 (Revised 2004), “Share-Based Payment.” This

revised statement, which is effective for fiscal years beginning after June 15, 2005, requires all share-based

payments to employees to be recognized in the financial statements based on their fair values. The company

currently accounts for its share-based payments to employees under the intrinsic value method of accounting set

forth in Accounting Principles Board Opinion No. 25, “Accounting for Stock Issues to Employees.”

Additionally, the company complies with the stock-based employer compensation disclosure requirements of

SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure, an amendment of

FASB Statement No. 123.” The company is in the process of evaluating the use of certain option-pricing models

21