Albertsons 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.thirty trading days of any fiscal quarter exceeds certain levels, at $38.13 per share for the quarter ending June 18,

2005, and rising to $113.29 per share at September 6, 2031. In the event of conversion, 9.6434 shares of the

company’s common stock will be issued per $1,000 debenture or approximately 7.8 million shares should all

debentures be converted. The debentures have an initial yield to maturity of 4.5 percent, which is being accreted

over the life of the debentures using the effective interest method. The company will pay contingent cash interest

for the six-month period commencing November 3, 2006, and for any six-month period thereafter if the average

market price of the debentures for a five trading day measurement period preceding the applicable six-month

period equals 120 percent or more of the sum of the issue price and accrued original issue discount for the

debentures. The debentures are classified as long-term debt based on the company’s ability and intent to

refinance the obligation with long-term debt if the company is required to repurchase the debentures.

The debt agreements contain various financial covenants including ratios for fixed charge interest coverage,

asset coverage and debt leverage, in addition to a minimum net worth covenant as defined in the company’s debt

agreements. The company has met the financial covenants under the debt agreements as of February 26, 2005.

The company is party to a synthetic leasing program for one of its major warehouses. The lease expires

April 2008, may be renewed with the lessor’s consent through April 2013 and has a purchase option of

approximately $60 million.

The company repurchases shares of the company’s common stock under programs authorized by the Board

of Directors, for re-issuance upon the exercise of employee stock options and for other compensation programs

utilizing the company’s stock. The company repurchased 2.0 million, 0.6 million and 1.5 million shares of

common stock at an average cost per share of $28.30, $23.80, and $27.94 during fiscal 2005, 2004, and 2003,

respectively. As of February 26, 2005, approximately 4.6 million shares remained available for purchase under

the 5.0 million share repurchase program authorized by the Board of Directors in May 2004.

SFAS No. 87, “Employers’ Accounting for Pension,” requires that a prepaid pension asset or minimum

pension liability, based on the current market value of plan assets and the accumulated benefit obligation of the

plan, be reflected. Based on both performance of the pension plan assets and plan assumption changes, the

company’s accumulated other comprehensive loss for minimum pension liability is $104.6 million after-tax as of

February 26, 2005. This accumulated other comprehensive loss for minimum pension liability will be revised in

future years depending upon market performance and interest rate levels.

The company’s capital budget for fiscal 2006, which includes capitalized leases, is projected at

approximately $500.0 million to $550.0 million, compared with actual spending of $325.7 million in fiscal 2005

including $62.9 million of capital leases. The capital budget for 2006 anticipates cash spending of $410.0 million

to $460.0 million, in addition to approximately $90 million for capital leases. Approximately $315.0 million of

the fiscal 2006 budget has been identified for use in the company’s retail food business and includes

approximately 10 to 12 new regional banner stores, approximately 90 to 110 new extreme value combination

stores, including licensed sites, and approximately 20 regional banner major store remodels. The 2006 capital

budget also includes capital for distribution projects, distribution maintenance capital and information technology

related items. In addition, the company will continue to support store development and financing for the

company’s independent retailers. Certain retailer financing activities may not require cash outlays because they

involve leases or guarantees. The capital budget does include amounts for projects which are subject to change

and for which firm commitments have not been made.

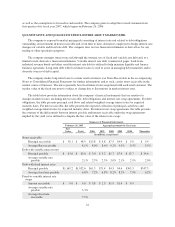

Annual cash dividends declared for fiscal 2005, 2004 and 2003, were $.6025, $0.5775 and $0.5675 per

common share, respectively. The company’s dividend policy will continue to emphasize a high level of earnings

retention for growth.

COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

The company has guaranteed certain leases, fixture financing loans and other debt obligations of various

retailers at February 26, 2005. These guarantees were generally made to support the business growth of affiliated

18