Albertsons 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

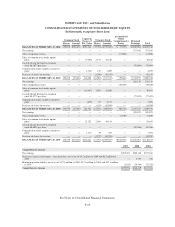

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

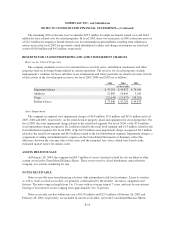

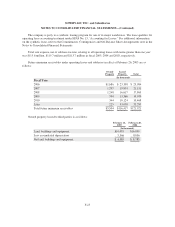

The remaining 2001 restructure reserves includes $25.9 million for employee benefit related costs and $16.4

million for lease related costs for exited properties. In fiscal 2005, there was an increase in 2001 restructure reserves

of $22.3 million for employee benefit related costs for multiemployer plan liabilities resulting from withdrawal

notices received in fiscal 2005 for previously exited distribution facilities and changes in estimates on exited real

estate of $18.0 million and $4.3 million, respectively.

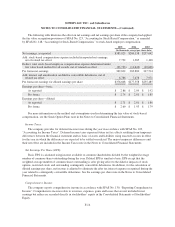

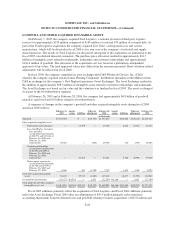

RESERVES FOR CLOSED PROPERTIES AND ASSET IMPAIRMENT CHARGES

Reserves for Closed Properties:

The company maintains reserves for estimated losses on retail stores, distribution warehouses and other

properties that are no longer being utilized in current operations. The reserves for closed properties include

management’s estimates for lease subsidies, lease terminations and future payments on exited real estate. Details

of the activity in the closed property reserves for fiscal 2005, 2004 and 2003 are as follows:

2005 2004 2003

(in thousands)

Beginning balance $ 47,205 $ 49,873 $ 74,996

Additions 12,889 10,809 3,169

Usage (22,648) (13,477) (28,292)

Ending balance $ 37,446 $ 47,205 $ 49,873

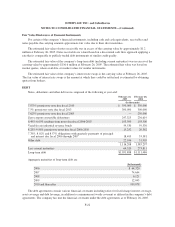

Asset Impairment:

The company recognized asset impairment charges of $4.8 million, $7.6 million and $15.6 million in fiscal

2005, 2004 and 2003, respectively, on the write-down of property, plant and equipment for closed properties. For

fiscal 2005, the asset impairment charge related to the retail food segment. For fiscal 2004, of the $7.6 million

asset impairment charge recognized, $6.2 million related to the retail food segment and $1.4 million related to the

food distribution segment. For fiscal 2003, of the $15.6 million asset impairment charge recognized, $8.7 million

related to the retail food segment and $6.9 million related to the food distribution segment. Impairment charges, a

component of selling and administrative expenses in the Consolidated Statements of Earnings, reflect the

difference between the carrying value of the assets and the estimated fair values, which were based on the

estimated market values for similar assets.

ASSETS HELD FOR SALE

At February 28, 2004, the company had $9.7 million of assets classified as held for sale included in other

current assets in the Consolidated Balance Sheets. These assets were for closed distribution centers that the

company was actively marketing for sale.

NOTES RECEIVABLE

Notes receivable arise from financing activities with independent retail food customers. Loans to retailers,

as well as trade accounts receivable, are primarily collateralized by the retailers’ inventory, equipment and

fixtures. The notes range in length from 1 to 15 years with an average term of 7 years, and may be non-interest

bearing or bear interest at rates ranging from approximately 4 to 12 percent.

Notes receivable, net due within one year of $13.8 million and $25.5 million at February 26, 2005 and

February 28, 2004, respectively, are included in current receivables, net in the Consolidated Balance Sheets.

F-19