Albertsons 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to the high level of benefits generally provided, has led to the underfunding. As a result, contributions

to these plans will continue to increase and the benefit levels and related issues will continue to create

collective bargaining challenges.

‰Expansion and Acquisitions. While we intend to continue to expand our retail and distribution

businesses through new store openings, new affiliations and acquisitions, expansion is subject to a

number of risks, including the adequacy of our capital resources, the location of suitable store or

distribution center sites and the negotiation of acceptable purchase or lease terms; and the ability to hire

and train employees. Acquisitions may involve a number of special risks, including: making

acquisitions at acceptable rates of return, the diversion of management’s attention to the assimilation of

the operations and integration of personnel of the acquired business, costs and other risks associated

with integrating or adapting operating systems, and potential adverse effects on our operating results.

‰Liquidity. We expect to continue to replenish operating assets with internally generated funds.

However, if our capital spending significantly exceeds anticipated capital needs, additional funding

could be required from other sources including borrowing under our bank credit lines or through debt

issuances. In addition, acquisitions could affect our borrowing costs and future financial flexibility.

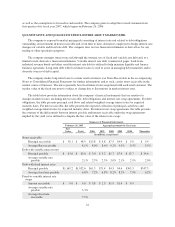

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information called for by Item 7A is found under the heading of “Quantitative and Qualitative

Disclosure About Market Risk” under Part II, Item 7 of this report.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information called for by Item 8 is found in a separate section of this report on pages F-1 through F-37.

See “Index of Selected Financial Data and Financial Statements and Schedules” on page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

Not applicable.

ITEM 9A. CONTROLS AND PROCEDURES

The company carried out an evaluation, under the supervision and with the participation of the company’s

management, including the company’s chief executive officer and its chief financial officer, of the effectiveness

of the design and operation of the company’s disclosure controls and procedures (as defined in Rule 13a-15(e)

under the Securities and Exchange Act of 1934 (the “Exchange Act”)) as of February 26, 2005 the end of the

period covered by this report. Based upon that evaluation, the chief executive officer and chief financial officer

concluded that as of the Evaluation Date, the company’s disclosure controls and procedures are effective to

ensure that information required to be disclosed by the company in reports that it files or submits under the

Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities

and Exchange commission rules and forms.

Management’s Annual Report on Internal Control Over Financial Reporting

The financial statements, financial analyses and all other information included in this Annual Report on

Form 10-K were prepared by the company’s management, which is responsible for establishing and maintaining

adequate internal control over financial reporting.

The company’s internal control over financial reporting is designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in

24