Albertsons 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.network spans 48 states and we serve as primary grocery supplier to approximately 2,300 stores, in addition to

our own regional banner store network, as well as serving as secondary grocery supplier to approximately 700

stores. Based on revenues today, we would be ranked as the largest extreme value food retailer, eighth largest

grocery retailer, and largest public company food wholesaler in the United States.

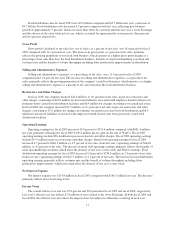

The grocery food industry can be characterized as one of consolidation and rationalization. The grocery

industry also continues to experience store saturation driven primarily by increases in square footage devoted to

food in supercenters, club stores, mass merchandisers, dollar stores, drug stores and other alternate formats as

well as organic growth by traditional supermarket operators. As a result, same-store sales growth for the industry

has been soft, pressuring profitability levels in the industry as operating costs rise at a rate faster than sales

growth. We expect this industry environment to continue for the foreseeable future. In fiscal 2006, we anticipate

same store sales growth of approximately one percent.

The grocery industry is also affected by the general economic environment and its impact on consumer

spending behavior. We would characterize fiscal 2005 as a year with modest economic growth with relatively

normal levels of consumer spending and product cost inflation. For fiscal 2006, we expect consumer spending to

be pressured by higher fuel prices and modest food inflation.

In fiscal 2005, most businesses, including the labor intensive grocery industry, were again impacted by

another year of rising health care and pension costs. Although the rate of increase moderated in fiscal 2005, these

rising costs impacted the overall profitability levels of the food industry and have become a pivotal issue in labor

negotiations for unionized employees who bargain for health and retirement benefits in addition to wages.

Approximately 41 percent of SUPERVALU’s employees are unionized. We did not experience any strikes

during fiscal 2005. Approximately 33 percent of our unionized workforce are represented by contracts that are up

for renewal in fiscal 2006.

All of these industry factors impact our food distribution customer base. As a result, we continue to

experience customer attrition in our food distribution operations. The attrition rate in fiscal 2005 was

approximately seven percent, which is above the historical range of approximately two percent to four percent,

due primarily to three large customer transitions to other suppliers during the year. For fiscal 2006, we anticipate

the attrition rate in this business will be in the upper end of that historical range.

All the above factors will continue to impact our industry and our company in fiscal 2006.

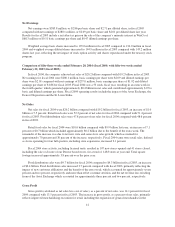

We believe we can be successful against this industry backdrop with our regional retail formats that focus

on local execution, merchandising, and consumer knowledge. In addition, our operations will benefit from our

efficient and low-cost supply chain and economies of scale as we leverage our retail and distribution operations.

Save-A-Lot, our extreme value format, has nationwide potential, and currently operates in 39 states. In fiscal

2005 and in the future, the majority of our new extreme value food stores will be a type of combination store

offering both food and general merchandise. We plan to expand regional retail banner square footage through

selective new store growth in key markets where we have significant market share. In addition, we will

supplement regional retail store growth with continued focus on remodel activities. Given the life cycle maturity

of our distribution business with its inherent attrition rate, future growth in food distribution will be modest and

primarily achieved through serving new independent customers, net growth from existing customers and further

consolidation opportunities. Our recent acquisition of Total Logistics offers a new platform to participate in the

fast-growing logistics arena. We remain committed to streamlining our operations and improving our return on

invested capital through a variety of initiatives.

9