Albertsons 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

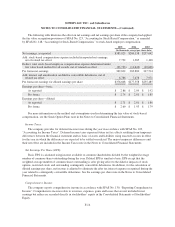

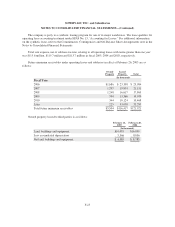

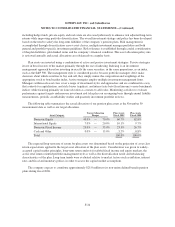

Direct financing leases:

Under direct financing capital leases, the company leases buildings on behalf of independent retailers with

terms ranging from 5 to 20 years. Future minimum rentals to be received under direct financing leases and

related future minimum obligations under capital leases in effect at February 26, 2005, are as follows:

Direct

Financing

Lease

Receivables

Direct

Financing

Capital Lease

Obligations

(In thousands)

Fiscal Year

2006 $11,840 $11,139

2007 11,141 10,551

2008 10,111 9,529

2009 9,349 8,823

2010 8,235 7,794

Later 36,701 35,061

Total minimum lease payments 87,377 82,897

Less unearned income 27,180 —

Less interest — 24,237

Present value of net minimum lease payments 60,197 58,660

Less current portion 6,761 6,933

Long-term portion $53,436 $51,727

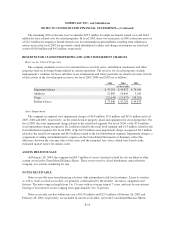

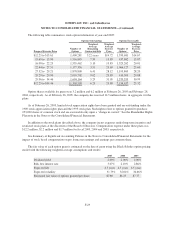

INCOME TAXES

The provision for income taxes consists of the following:

2005 2004 2003

(In thousands)

Current

Federal $151,003 $110,031 $ 78,704

State 19,227 14,495 12,050

Tax credits (1,644) (1,500) (1,000)

Total current 168,586 123,026 89,754

Deferred 46,455 51,716 61,208

Total provision $215,041 $174,742 $150,962

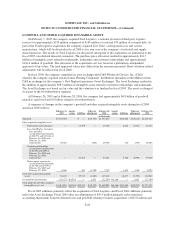

The difference between the actual tax provision and the tax provision computed by applying the statutory

federal income tax rate to earnings before taxes is attributable to the following:

2005 2004 2003

(In thousands)

Federal taxes based on statutory rate $210,302 $159,208 $142,801

State income taxes, net of federal benefit 15,800 13,394 12,153

Audit settlements (6,700) (2,214) —

Other (4,361) 4,354 (3,992)

Total provision $215,041 $174,742 $150,962

F-26