Albertsons 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

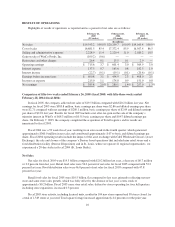

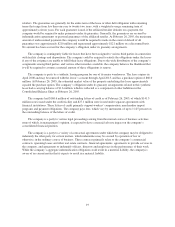

The following table represents the company’s significant contractual obligations and off-balance sheet

arrangements at February 26, 2005.

Amount of Commitment Expiration Per Period

Total

Amount

Committed

Fiscal

2006

Fiscal

2007-2008

Fiscal

2009-2010 Thereafter

(In thousands)

Contractual Obligations & off-balance

sheet arrangements:

Debt $1,116,208 $ 64,320 $ 80,765 $388,997 $582,126

Operating Leases 1,019,835 155,429 267,639 238,163 358,604

Interest on long-term debt (1) 870,155 60,398 106,066 87,565 616,126

Capital and Direct Financing Leases 562,122 35,143 94,001 86,843 346,135

Benefit Obligations (2) 528,486 43,494 89,684 94,896 300,412

Construction Loan Commitments 212,924 212,924 — — —

Retailer Loan and Lease Guarantees 210,174 29,206 46,072 35,894 99,002

Deferred Taxes 117,937 3,937 28,578 51,299 34,123

Purchase Option on Synthetic Lease 60,000 — — 60,000 —

Purchase Obligations (3) 50,615 26,168 23,644 803 —

(1) The interest on long-term debt for fiscal 2032 reflects the company’s zero-coupon debentures accreted

interest for fiscal 2006 through fiscal 2032, should the debentures remain outstanding to maturity.

(2) The company’s benefit obligations include obligations related to sponsored defined benefit pension and post

retirement benefit plans and deferred compensation plans. The defined benefit pension plan has plan assets

of approximately $520 million at the end of fiscal 2005.

(3) The company’s purchase obligations include various obligations that have annual purchase commitments of

$1 million or greater. At the end of fiscal 2005, future purchase obligations of $50.6 million existed that

primarily related to technology and advertising. In the ordinary course of business, the company enters into

supply contracts to purchase products for resale. These supply contracts typically include either a volume

commitment or a fixed expiration date, termination provisions and other standard contractual considerations.

These supply contracts are cancelable and therefore no amounts have been included above.

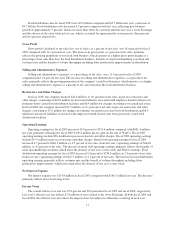

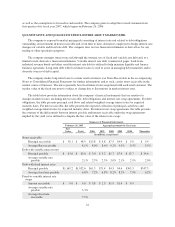

COMMON STOCK PRICE

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal

2005 year end, there were 6,483 shareholders of record compared with 6,839 at the end of fiscal 2004.

Common Stock Price Range Dividends Per Share

2005 2004 2005 2004

Fiscal High Low High Low

First Quarter $32.49 $27.25 $22.74 $12.60 $0.1450 $0.1425

Second Quarter 31.99 25.70 24.99 20.80 0.1525 0.1450

Third Quarter 32.59 26.59 26.29 23.39 0.1525 0.1450

Fourth Quarter 35.15 31.30 29.95 25.20 0.1525 0.1450

Year 35.15 25.70 29.95 12.60 0.6025 0.5775

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to

the Board of Directors approval.

20