Albertsons 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

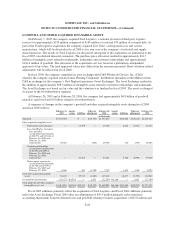

GOODWILL AND OTHER ACQUIRED INTANGIBLE ASSETS

On February 7, 2005, the company acquired Total Logistics, a national provider of third party logistics

services for approximately $234 million comprised of $164 million of cash and $70 million of assumed debt. As

part of the Total Logistics acquisition, the company acquired Zero Zone, a refrigeration case and system

manufacturer, which will be divested in fiscal 2006 as it is non-core to the company’s food retail and supply

chain businesses. The results of Total Logistics for the period subsequent to the acquisition are immaterial to the

fiscal 2005 consolidated financial statements. The purchase price allocation resulted in approximately $14.7

million of intangible assets related to trademarks, tradenames and customer relationships and approximately

$116.6 million of goodwill. The allocation of the acquisition cost was based on a preliminary independent

appraisal of fair values. The final appraised values may differ from the amounts presented. Final valuation related

adjustments will be reflected in fiscal 2006.

In fiscal 2004, the company completed an asset exchange with C&S Wholesale Grocers, Inc. (C&S)

whereby the company acquired certain former Fleming Companies’ distribution operations in the Midwest from

C&S in exchange for the company’s New England operations (Asset Exchange). The Asset Exchange resulted in

the addition of approximately $58.6 million of intangible assets related to customer relationships and trademarks.

The Asset Exchange was based on fair value and the valuation was finalized in fiscal 2005. The assets exchanged

were part of the food distribution segment.

At February 26, 2005 and at February 28, 2004, the company had approximately $0.8 billion of goodwill

related to retail food and 0.8 billion related to food distribution.

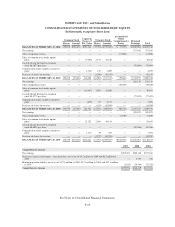

A summary of changes in the company’s goodwill and other acquired intangible assets during fiscal 2004

and fiscal 2005 follows:

February 22,

2003

Amorti-

zation Additions

Other net

adjustments

February 28,

2004

Amorti-

zation Additions

Other net

adjustments

February 26,

2005

(in thousands)

Goodwill $1,576,584 $ — $(19,527) $1,557,057 $116,606 $(45,816) $1,627,847

Other acquired intangible assets:

Trademarks and tradenames — 15,269 — 15,269 8,042 (1,057) 22,254

Leasehold Rights, Customer

lists and other

(accumulated amortization

of $20,573 and $17,836, at

February 26, 2005 and

February 28, 2004,

respectively) 49,663 — (294) 49,369 510 (594) 49,285

Customer relationships

(accumulated amortization

of $2,492 and $495 at

February 26, 2005 and

February 28, 2004,

respectively) — 43,361 — 43,361 6,700 (2,992) 47,069

Non-compete agreements

(accumulated amortization

of $4,329 and $3,959 at

February 26, 2005 and

February 28, 2004) 8,506 502 (1,789) 7,219 1,625 (550) 8,294

Total other acquired intangible

assets 58,169 59,132 (2,083) 115,218 16,877 (5,193) 126,902

Accumulated amortization (19,772) $(4,541) — 2,023 (22,290) $(6,166) — 1,062 (27,394)

Total goodwill and other acquired

intangible assets, net $1,614,981 $(4,541) $59,132 $(19,587) $1,649,985 $(6,166) $133,483 $(49,947) $1,727,355

Fiscal 2005 additions primarily reflect the acquisition of Total Logistics and Fiscal 2004 additions primarily

reflect the Asset Exchange. Fiscal 2005 other net adjustments of $49.9 million primarily reflect purchase

accounting adjustments between deferred taxes and goodwill relating to former acquisitions of $45.8 million and

F-20