Albertsons 2005 Annual Report Download - page 49

Download and view the complete annual report

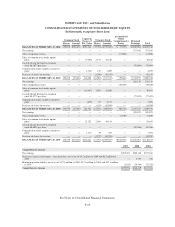

Please find page 49 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.change the previously reported fiscal 2001 diluted earnings per share as the convertible debentures were

issued in fiscal 2002. The impact of the EITF 04-8 restatement reduced diluted earnings per share by

approximately $0.11, $0.06, $0.05 and $0.01 in fiscal 2005, fiscal 2004, fiscal 2003, and fiscal 2002,

respectively.

(c) Inventories (FIFO), working capital and current ratio are calculated after adding back the LIFO reserve. The

LIFO reserve for each year is as follows: $148.6 million for fiscal 2005, $135.8 million for fiscal 2004,

$145.5 million for fiscal 2003, $140.8 million for fiscal 2002, and $140.6 million for fiscal 2001.

(d) Long-term debt includes long-term debt and long-term obligations under capital leases.

(e) The debt to capital ratio is calculated as debt, which includes notes payable, current debt, current obligations

under capital leases, long-term debt and long-term obligations under capital leases, divided by the sum of

debt and stockholders’ equity.

(f) As of February 24, 2002, pursuant to Statement of Financial Accounting Standards (SFAS) No. 142,

goodwill and intangible assets acquired in a purchase business combination and determined to have an

indefinite useful life are not amortized.

(g) Capital expenditures include cash expenditures and capital lease asset additions.

F-3