Albertsons 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

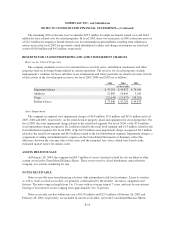

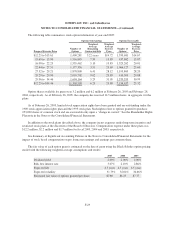

Temporary differences which give rise to significant portions of the net deferred tax asset (liability) as of

February 26, 2005 and February 28, 2004 are as follows:

2005 2004

(In thousands)

Deferred tax assets:

Restructure $ 25,845 $ 38,561

Net operating loss from acquired subsidiaries 16,191 28,919

Pension liability 41,580 39,506

Other health and benefit plans 92,054 96,075

Other 13,117 10,012

Total deferred tax assets 188,787 213,073

Deferred tax liabilities:

Accelerated deductions primarily depreciation and

amortization (218,442) (176,734)

Acquired assets basis differences (52,220) (86,010)

Other (36,062) (60,318)

Total deferred tax liabilities (306,724) (323,062)

Net deferred tax liability $(117,937) $(109,989)

The company currently has net operating loss (NOL) carryforwards from acquired companies of $44 million

for tax purposes, which expire beginning in 2007 and continuing through 2018.

Based on management’s assessment, it is more likely than not that all of the deferred tax assets will be

realized; therefore, no valuation allowance is considered necessary.

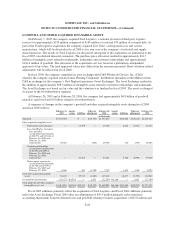

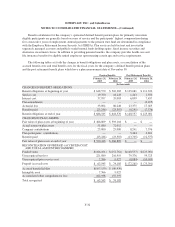

ACCUMULATED OTHER COMPREHENSIVE LOSSES

The accumulated balances, net of income taxes, for each classification of accumulated other comprehensive

losses are as follows:

Derivative Financial

Instrument-

Unrealized Loss

Minimum Pension

Liability Adjustment

Accumulated Other

Comprehensive Losses

(In thousands)

Balances at February 23, 2002 $(7,075) $ — $ (7,075)

Minimum pension liability — (72,328) (72,328)

Amortization of loss on derivative

financial instrument (including

impact of debt redemption) 340 — 340

Balances at February 22, 2003 (6,735) (72,328) (79,063)

Minimum pension liability — (26,404) (26,404)

Amortization of loss on derivative

financial instrument (including

impact of debt redemption) 6,735 — 6,735

Balances at February 28, 2004 — (98,732) (98,732)

Minimum pension liability — (5,849) (5,849)

Balances at February 26, 2005 $ — $(104,581) $(104,581)

F-27