Albertsons 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

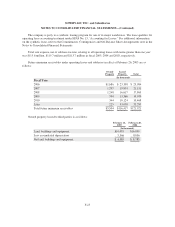

outstanding contingently convertible debentures which were issued in November 2001. The company adopted the

provisions of EITF 04-8 in the fourth quarter of fiscal 2005 and restated prior years’ diluted earnings per share

amounts. The impact of the EITF 04-8 restatement reduced diluted earnings per share by approximately $0.11,

$0.06 and $0.05 in fiscal 2005, fiscal 2004 and fiscal 2003, respectively.

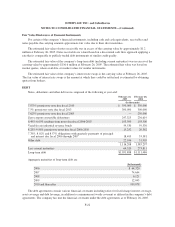

In December 2004, the FASB issued FASB Statement 123 (Revised 2004), “Share-Based Payment.” This

revised statement, which is effective for fiscal years beginning after June 15, 2005, requires all share-based

payments to employees to be recognized in the financial statements based on their fair values. The company

currently accounts for its share-based payments to employees under the intrinsic value method of accounting set

forth in Accounting Principles Board Opinion No. 25, “Accounting for Stock Issues to Employees.”

Additionally, the company complies with the stock-based employer compensation disclosure requirements of

SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure, an amendment of

FASB Statement No. 123.” The company is in the process of evaluating the use of certain option-pricing models

as well as the assumptions to be used in such models. The company plans to adopt the revised statement in its

first quarter of its fiscal year 2007, which begins on February 26, 2006.

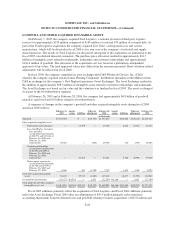

RESTRUCTURE AND OTHER CHARGES

In fiscal 2000, 2001, and 2002, the company commenced restructuring programs designed to reduce costs

and enhance efficiencies and included facility consolidation and disposal of non-core assets and assets not

meeting return objectives or providing long-term strategic opportunities. The restructuring plans resulted in the

company recording pre-tax restructure and other charges in fiscal 2000, 2001 and 2002.

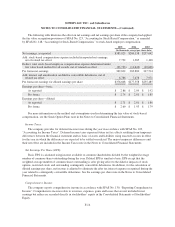

In fiscal 2003, all activity for the fiscal 2002, 2001 and 2000 restructure plans was completed. The table

below shows the remaining restructure reserves for the 2002, 2001, and 2000 plans as of February 26, 2005, as

well as reserve related activity for the three fiscal years then ended.

Restructure

Plan

Fiscal 2002

Reserve

Balance

Fiscal 2003

Activity Fiscal 2003

Reserve

Balance

Fiscal 2004

Activity Fiscal 2004

Reserve

Balance

Fiscal 2005

Activity Fiscal 2005

Reserve

BalanceUsage Adjustment Usage Adjustment Usage Adjustment

(In millions)

2002 $16.3 $ (9.3) $ (3.6) $ 3.4 $ (3.8) $ 0.6 $ 0.2 $(0.2) $ — $ 0.0

2001 $56.0 $(35.5) $11.7 $32.2 $(17.3) $11.7 $26.6 $(6.6) $22.3 $42.3

2000 $18.0 $ (9.8) $ 2.9 $11.1 $ (9.1) $ 0.5 $ 2.5 $(1.4) $ — $ 1.1

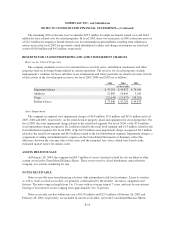

The company recognized pre-tax restructure and other charges of $26.4 million, $15.5 million and $2.9

million for fiscal years 2005, 2004, and 2003 respectively. These charges reflect changes in liabilities associated

with employee benefit related costs from previously exited distribution facilities as well as changes in estimates

on exited real estate, including asset impairment. Fiscal 2005 charges related primarily to restructure 2001 and

consisted of reserve adjustments of $22.3 million, asset impairment charges of $0.5 million, and property holding

costs of $3.6 million. Fiscal 2004 charges reflect the net adjustments to the restructure reserves of $12.8 million,

as well as asset impairment adjustments of $2.7 million for restructure 2001. Fiscal 2003 charges reflect the net

adjustments to the restructure reserves of $11.0 million, as well as asset impairment adjustments of $(3.6) million

and $(4.5) million for restructure 2001 and 2000, respectively.

F-18