XM Radio 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

trademarks, copyrights or other intellectual property. None of these actions are, in our opinion, likely to have a

material adverse effect on our cash flows, financial position or results of operations.

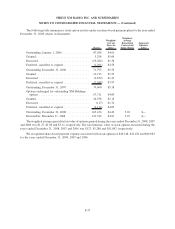

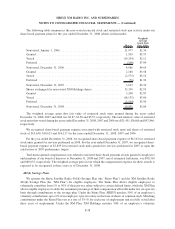

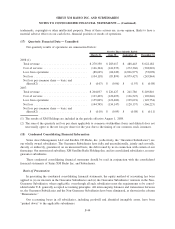

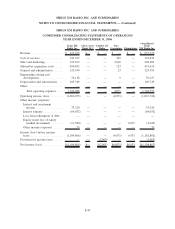

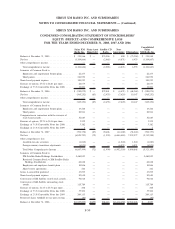

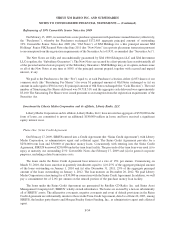

(17) Quarterly Financial Data — Unaudited

Our quarterly results of operations are summarized below:

March 31 June 30 September 30 December 31

For the Three Months Ended

2008:(1)

Total revenue ............................. $270,350 $ 283,017 $ 488,443 $ 622,182

Cost of services ........................... (146,344) (141,933) (272,360) (302,810)

Loss from operations . . ..................... (88,625) (68,049) (4,826,977) (53,098)

Net loss ................................. (104,118) (83,899) (4,879,427) (245,844)

Net loss per common share — basic and

diluted(2) .............................. $ (0.07) $ (0.06) $ (1.93) $ (0.08)

2007:

Total revenue ............................. $204,037 $ 226,427 $ 241,786 $ 249,816

Cost of services ........................... (123,429) (120,493) (126,547) (169,846)

Loss from operations . . ..................... (135,045) (122,600) (105,691) (149,754)

Net loss ................................. (144,745) (134,147) (120,137) (166,223)

Net loss per common share — basic and

diluted(2) .............................. $ (0.10) $ (0.09) $ (0.08) $ (0.11)

(1) The results of XM Holdings are included in the periods effective August 1, 2008.

(2) The sum of the quarterly net loss per share applicable to common stockholders (basic and diluted) does not

necessarily agree to the net loss per share for the year due to the timing of our common stock issuances.

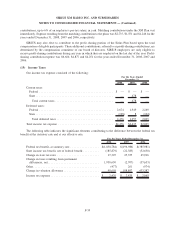

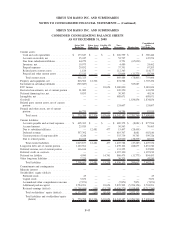

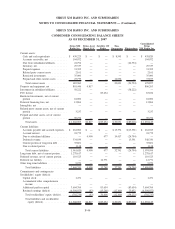

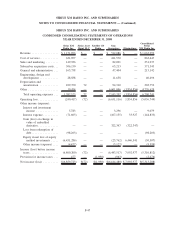

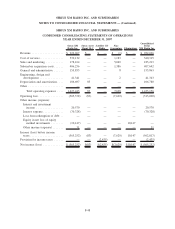

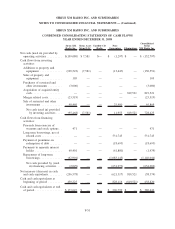

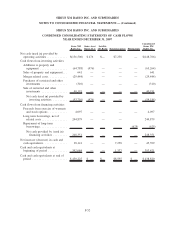

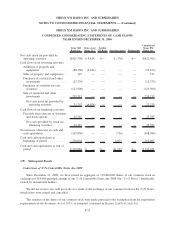

(18) Condensed Consolidating Financial Information

Sirius Asset Management, LLC and Satellite CD Radio, Inc. (collectively, the “Guarantor Subsidiaries”) are

our wholly owned subsidiaries. The Guarantor Subsidiaries have fully and unconditionally, jointly and severally,

directly or indirectly, guaranteed, on an unsecured basis, the debt issued by us in connection with certain of our

financings. Our unrestricted subsidiary, XM Satellite Radio Holdings Inc. and its consolidated subsidiaries, are non-

guarantor subsidiaries.

These condensed consolidating financial statements should be read in conjunction with the consolidated

financial statements of Sirius XM Radio Inc. and Subsidiaries.

Basis of Presentation

In presenting the condensed consolidating financial statements, the equity method of accounting has been

applied to (i) our interests in the Guarantor Subsidiaries and (ii) the Guarantor Subsidiaries’ interests in the Non-

Guarantor Subsidiaries, where applicable, even though all such subsidiaries meet the requirements to be consol-

idated under U.S. generally accepted accounting principles. All intercompany balances and transactions between

us, the Guarantor Subsidiaries and the Non-Guarantor Subsidiaries have been eliminated, as shown in the column

“Eliminations.”

Our accounting bases in all subsidiaries, including goodwill and identified intangible assets, have been

“pushed down” to the applicable subsidiaries.

F-44

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)