XM Radio 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.James E. Meyer

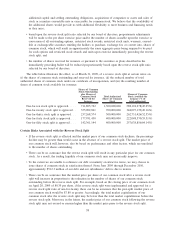

Mr. Meyer has agreed to serve as our President, Operations and Sales, until April 2010. We pay Mr. Meyer

an annual salary of $950,000, and annual bonuses in an amount determined each year by the Compensation

Committee of our board of directors.

In the event Mr. Meyer’s employment is terminated without cause or he terminates his employment for

good reason after July 28, 2009, we will pay him a lump sum payment equal to (1) his annual base salary in

effect on the termination date plus, (2) the greater of (x) a bonus equal to 60% of his annual base salary or

(y) the prior year’s annual bonus actually paid to him (the “Designated Amount”). Pursuant to his employment

agreement, Mr. Meyer may elect to retire in April 2010. In the event he elects to retire, we have agreed to pay

him a lump sum payment equal to the Designated Amount. In the event Mr. Meyer’s employment is

terminated without cause or he terminates his employment for good reason, we are also obligated to continue

his medical and dental insurance benefits for 18 months following his termination and to continue his life

insurance benefits for twelve months following his termination. If Mr. Meyer’s employment is terminated due

to a scheduled retirement, we are obligated to continue his medical, dental and life insurance benefits for

12 months following his termination.

If Mr. Meyer is terminated without cause or he terminates his employment for good reason prior to

July 28, 2009, we will pay him a lump sum payment equal to two times the Designated Amount. In such

event, we are also obligated to continue his medical, dental and life insurance benefits for 24 months following

his termination.

Upon the expiration of Mr. Meyer’s employment agreement in April 2010 or following his retirement, we

have agreed to offer Mr. Meyer a one-year consulting agreement. We expect to reimburse Mr. Meyer for all of

his reasonable out-of-pocket expenses associated with the performance of his obligations under this consulting

agreement, but do not expect to pay him any cash compensation. Mr. Meyer’s stock options will continue to

vest and will be exercisable during the term of this consulting agreement.

In the event that any payment we make, or benefit we provide, to Mr. Meyer would require him to pay an

excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Mr. Meyer the amount of

such tax and such additional amount as may be necessary to place him in the exact same financial position

that he would have been in if the excise tax were not imposed.

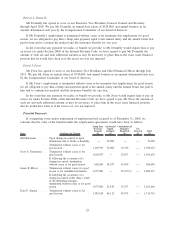

Dara F. Altman

On September 26, 2008, we entered into a three year employment agreement with Dara F. Altman to

serve as our Executive Vice President and Chief Administrative Officer. We pay Ms. Altman an annual salary

of $446,332, and annual bonuses in an amount determined each year by the Compensation Committee of our

board of directors.

If Ms. Altman’s employment is terminated without cause or she terminates her employment for good

reason, she is entitled to receive (1) a lump sum severance payment in cash equal to two times the sum of

(a) her base salary as in effect immediately prior to the termination date or, if higher, in effect immediately

prior to the first occurrence of an event or circumstance constituting good reason, and (b) the higher of (x) the

last annual bonus actually paid to her and (y) 55% of her base salary as in effect immediately prior to the

termination date or, if higher, in effect immediately prior to the first occurrence of an event or circumstance

constituting good reason, (2) a pro rata portion of her contingent cash incentive compensation awards,

(3) outplacement services for two years following her termination of employment, and (4) continued medical,

dental and disability insurance benefits for two years following her termination of employment. In addition, in

such event, all of Ms. Altman’s stock options and restricted stock units will vest and become exercisable.

In the event that any payment we make, or benefit we provide, to Ms. Altman would require her to pay

an excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Ms. Altman the

amount of such tax and any additional amount as may be necessary to place her in the exact same financial

position that she would have been in if the excise tax was not imposed.

28