XM Radio 2008 Annual Report Download - page 152

Download and view the complete annual report

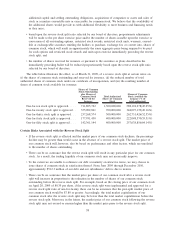

Please find page 152 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fractional Shares

Stockholders will not receive fractional post-reverse stock split shares in connection with the reverse

stock split. Instead, our transfer agent for the registered stockholders will aggregate all fractional shares and

arrange for them to be sold as soon as practicable after the Effective Time at the then prevailing prices on the

open market on behalf of those stockholders who would otherwise be entitled to receive a fractional share. We

expect that the transfer agent will cause the sale to be conducted in an orderly fashion at a reasonable pace

and that it may take several days to sell all of the aggregated fractional shares of common stock. After

completing the sale, stockholders will receive a cash payment from the transfer agent in an amount equal to

the stockholder’s pro rata share of the total net proceeds of these sales. No transaction costs will be assessed

on the sale. However, the proceeds will be subject to certain taxes as discussed below. In addition, stockholders

will not be entitled to receive interest for the period of time between the Effective Time and the date a

stockholder receives payment for the cashed-out shares. The payment amount will be paid to the stockholder

in the form of a check in accordance with the procedures outlined below.

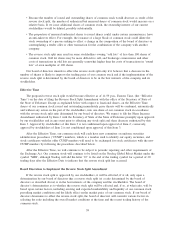

After the reverse stock split, a stockholder will have no further interest in the company with respect to

their cashed-out fractional shares. A person otherwise entitled to a fractional interest will not have any voting,

dividend or other rights except to receive payment as described above.

Effect on Beneficial Holders of Common Stock (i.e., stockholders who hold in “street name”)

Upon the reverse stock split, we intend to treat shares held by stockholders in “street name,” through a

bank, broker or other nominee, in the same manner as registered stockholders whose shares are registered in

their names. Banks, brokers or other nominees will be instructed to effect the reverse stock split for their

beneficial holders holding our common stock in “street name”. However, these banks, brokers or other

nominees may have different procedures than registered stockholders for processing the reverse stock split and

making payment for fractional shares. If a stockholder holds shares of our common stock with a bank, broker

or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank,

broker or other nominee.

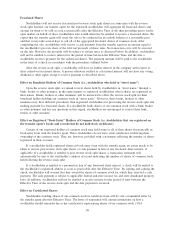

Effect on Registered “Book-Entry” Holders of Common Stock (i.e. stockholders that are registered on

the transfer agent’s books and records but do not hold stock certificates)

Certain of our registered holders of common stock may hold some or all of their shares electronically in

book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their

ownership of the common stock. They are, however, provided with a statement reflecting the number of shares

registered in their accounts.

If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be

taken to receive post-reverse stock split shares or cash payment in lieu of any fractional share interest, if

applicable. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will

automatically be sent to the stockholder’s address of record indicating the number of shares of common stock

held following the reverse stock split.

If a stockholder is entitled to a payment in lieu of any fractional share interest, a check will be mailed to

the stockholder’s registered address as soon as practicable after the Effective Time. By signing and cashing the

check, stockholders will warrant that they owned the shares of common stock for which they received a cash

payment. The cash payment is subject to applicable federal and state income tax and state abandoned property

laws. In addition, stockholders will not be entitled to receive interest for the period of time between the

Effective Time of the reverse stock split and the date payment is received.

Effect on Certificated Shares

Stockholders holding shares of our common stock in certificate form will be sent a transmittal letter by

the transfer agent after the Effective Time. The letter of transmittal will contain instructions on how a

stockholder should surrender his or her certificate(s) representing shares of our common stock (“Old

40