XM Radio 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.XM Canada

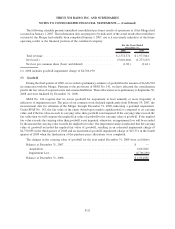

We have a 23.33% economic interest in XM Canada. The amount of the Merger purchase price allocated to the

fair value of our investment in XM Canada was $41,188. Our investment in XM Canada is recorded using the equity

method (on a one-month lag) since we have significant influence, but less than a controlling voting interest in XM

Canada. Under this method, our investment in XM Canada is adjusted quarterly to recognize our share of net

earnings or losses as they occur, rather than at the time dividends or other distributions are received, limited to the

extent of our investment in, advances to, and commitments to fund XM Canada. Our share of net earnings or losses

of XM Canada is recorded to Loss on investments in our consolidated statements of operations. We recorded $9,309

for the year ended December 31, 2008 for our share of XM Canada’s net loss. In the fourth quarter of 2008, we

reduced the carrying value of our investment in XM Canada due to decreases in fair value that were considered to be

other- than- temporary and recorded an impairment charge of $16,453. Under SFAS No. 157, we used a Level 1

input, consisting of the quoted market price of shares of XM Canada, to value our investment in XM Canada. In

addition, XM Holdings holds an investment in Cdn$4,000 face value of 8% convertible unsecured subordinated

debentures issued by XM Canada for which the embedded conversion feature is required under SFAS No. 133 to be

bifurcated from the host contract. The host contract is accounted for as an available-for-sale security at fair value

with changes in fair value recorded to Accumulated other comprehensive loss, net of tax. The embedded conversion

feature is accounted for as a derivative at fair value with changes in fair value recorded in earnings as Interest and

investment income. As of December 31, 2008, the carrying value of our equity method investment was $8,873,

while the carrying value of the host contract and embedded derivative related to our investment in the debentures

was $2,540 and $2, respectively.

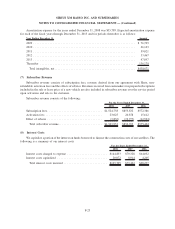

Auction Rate Certificates

Auction rate certificates are long-term securities structured to reset their coupon rates by means of an auction.

We account for our investment in auction rate certificates as available-for-sale securities. As of December 31, 2008,

the carrying value of these securities was $7,985.

Restricted Investments

Restricted investments relate to deposits placed into escrow for the benefit of third parties pursuant to

programming agreements and reimbursement obligations under letters of credit issued for the benefit of lessors of

office space. As of December 31, 2008 and 2007, the carrying value of our short-term restricted investments was $0

and $35,000, respectively, and primarily included certificates of deposit placed in escrow for the benefit of a third

party pursuant to a programming agreement. As of December 31, 2008 and 2007, the carrying value of our long-

term restricted investments was $141,250 and $18,000, respectively, and primarily included certificates of deposit

and money market funds deposited in escrow for the benefit of third parties pursuant to programming agreements

and certificates of deposit placed in escrow to secure reimbursement obligations under letters of credit issued for the

benefit of lessors of office space. Included in the December 31, 2008 balances are restricted investments in the form

of a $120,000 escrow deposit for the benefit of Major League Baseball, which we acquired in connection with the

Merger.

F-27

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)