XM Radio 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

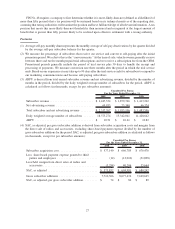

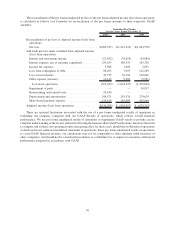

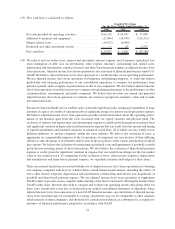

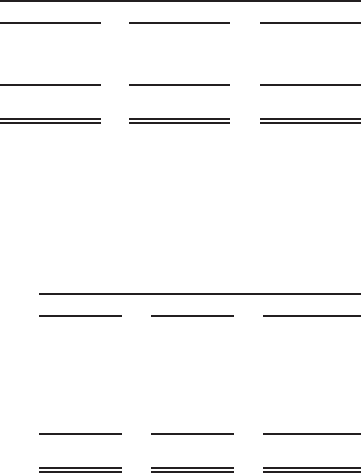

(5) Customer service and billing expenses, as adjusted, per average subscriber is derived from total customer

service and billing expenses, excluding share-based payment expense, divided by the number of months in the

period, divided by the daily weighted average number of subscribers for the period. Customer service and

billing expenses, as adjusted, per average subscriber is calculated as follows (in thousands, except for per

subscriber amounts):

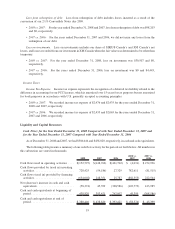

2008 2007 2006

Unaudited Pro Forma

For the Years Ended December 31,

Customer service and billing expenses ............ $ 248,176 $ 220,593 $ 181,333

Less: share-based payment expense ............... (3,981) (3,191) (2,150)

Customer service and billing expenses, as adjusted . . . $ 244,195 $ 217,402 $ 179,183

Daily weighted average number of subscribers ...... 18,373,274 15,342,041 11,428,642

Customer service and billing expenses, as adjusted,

per average subscriber....................... $ 1.11 $ 1.18 $ 1.31

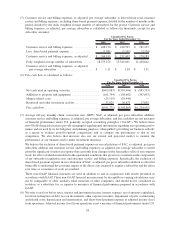

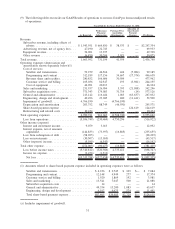

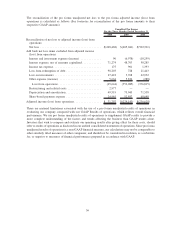

(6) Free cash flow is calculated as follows:

2008 2007 2006

Unaudited Pro Forma

For the Years Ended December 31,

Net cash used in operating activities .................. $(403,883) $(303,496) $ (883,793)

Additions to property and equipment ................. (161,394) (198,602) (367,693)

Merger related costs.............................. (23,519) (29,444) —

Restricted and other investment activity ............... 37,025 26,673 17,051

Free cash flow .................................. $(551,771) $(504,869) $(1,234,435)

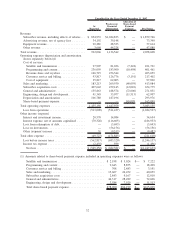

(7) Average self-pay monthly churn; conversion rate; ARPU; SAC, as adjusted, per gross subscriber addition;

customer service and billing expenses, as adjusted, per average subscriber; and free cash flow are not measures

of financial performance under U.S. generally accepted accounting principles (“GAAP”). We believe these

non-GAAP financial measures provide meaningful supplemental information regarding our operating perfor-

mance and are used by us for budgetary and planning purposes; when publicly providing our business outlook;

as a means to evaluate period-to-period comparisons; and to compare our performance to that of our

competitors. We also believe that investors also use our current and projected metrics to monitor the

performance of our business and to make investment decisions.

We believe the exclusion of share-based payment expense in our calculations of SAC, as adjusted, per gross

subscriber addition and customer service and billing expenses, as adjusted, per average subscriber is useful

given the significant variation in expense that can result from changes in the fair market value of our common

stock, the effect of which is unrelated to the operational conditions that give rise to variations in the components

of our subscriber acquisition costs and customer service and billing expenses. Specifically, the exclusion of

share-based payment expense in our calculation of SAC, as adjusted, per gross subscriber addition is critical in

being able to understand the economic impact of the direct costs incurred to acquire a subscriber and the effect

over time as economies of scale are reached.

These non-GAAP financial measures are used in addition to and in conjunction with results presented in

accordance with GAAP. These non-GAAP financial measures may be susceptible to varying calculations; may

not be comparable to other similarly titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with

GAAP.

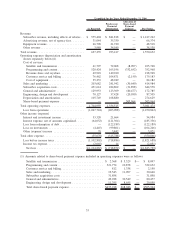

(8) We refer to net loss before taxes, interest and investment income, interest expense, net of amounts capitalized,

loss from redemption of debt, loss on investments, other expense (income), impairment of parts, restructuring

and related costs; depreciation and amortization, and share-based payment expense as adjusted income (loss)

from operations. Adjusted income (loss) from operations is not a measure of financial performance under U.S.

28