XM Radio 2008 Annual Report Download - page 62

Download and view the complete annual report

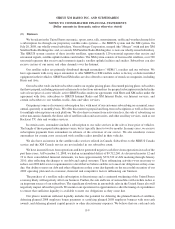

Please find page 62 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.specified number of events are amortized on an event-by-event basis; programming costs which are for a specified

season are amortized over the season on a straight-line basis. We allocate a portion of certain programming costs

which are related to sponsorship and marketing activities to sales and marketing expenses on a straight-line basis

over the term of the agreement.

Advertising Costs

We record the costs associated with advertising in accordance with Statement of Position (“SOP”) No. 93-7,

Reporting on Advertising Costs. Media is expensed when aired and advertising production costs are expensed as

incurred. Market development funds are fixed and variable payments to reimburse retailers for the cost of

advertising and other product awareness activities. Fixed market development funds are expensed over the periods

specified in the applicable agreement; variable costs are expensed at the time a subscriber is activated. During the

years ended December 31, 2008, 2007 and 2006, we recorded advertising costs of $109,253, $107,485 and

$123,553, respectively. These costs are reflected in Sales and marketing expense in our consolidated statements of

operations.

Stock-Based Compensation

We account for equity instruments granted to employees in accordance with SFAS No. 123 (revised 2004),

Share-Based Payment (“SFAS No. 123R”). SFAS No. 123R requires all share-based compensation payments to be

recognized in the financial statements based on fair value using an option pricing model. SFAS No. 123R requires

forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures

differ from initial estimates. We use the Black-Scholes-Merton option-pricing model to value stock option awards

and have elected to treat awards with graded vesting as a single award.

Fair value is determined using Black-Scholes-Merton model varies based on assumptions used for the

expected life, expected stock price volatility and risk-free interest rates. We estimate the fair value of awards granted

using the implied volatility of actively traded options on our common stock. The expected life assumption

represents the weighted-average period stock-based awards are expected to remain outstanding. These expected life

assumptions are established through a review of historical exercise behavior of stock-based award grants with

similar vesting periods. Where historical patterns do not exist, contractual terms are used. The risk-free interest rate

represents the daily treasury yield curve rate at the grant date based on the closing market bid yields on actively

traded U.S. treasury securities in the over-the-counter market for the expected term. Our assumptions may change in

future periods.

Equity instruments granted to non-employees are accounted for in accordance with SFAS No. 123R, as

interpreted by EITF No. 96-18, Accounting for Equity Instruments That are Issued to Other Than Employees for

Acquiring, or in Conjunction with Selling, Goods or Services. The final measurement date for the fair value of

equity instruments with performance criteria is the date that each performance commitment for such equity

instrument is satisfied or there is a significant disincentive for non-performance.

Stock-based awards granted to employees, non-employees and members of our board of directors generally

include warrants, stock options, restricted stock and restricted stock units. The share-based payment expense

recognized includes compensation cost for all stock-based awards granted to employees and members of our board

of directors (i) prior to, but not vested as of January 1, 2006, based on the grant date fair value originally estimated in

accordance with the provisions of SFAS No. 123, Accounting for Stock-Based Compensation, and (ii) subsequent to

December 31, 2005, based on the grant date fair value estimated in accordance with the provisions of

SFAS No. 123R.

F-12

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)