XM Radio 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

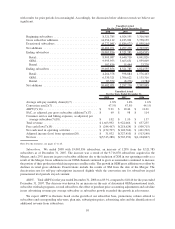

with results for prior periods less meaningful. Accordingly, the discussion below addresses trends we believe are

significant.

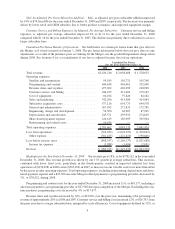

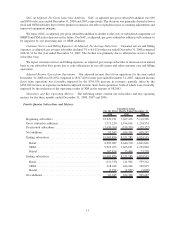

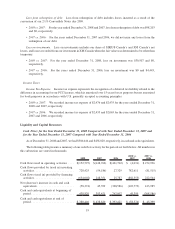

2008 2007 2006

Unaudited Actual

For the Years Ended December 31,

Beginning subscribers ............................ 8,321,785 6,024,555 3,316,560

Gross subscriber additions ......................... 14,954,112 4,183,901 3,758,159

Deactivated subscribers ........................... (4,272,041) (1,886,671) (1,050,164)

Net additions .................................. 10,682,071 2,297,230 2,707,995

Ending subscribers .............................. 19,003,856 8,321,785 6,024,555

Retail ...................................... 8,905,087 4,640,710 4,041,826

OEM....................................... 9,995,953 3,665,631 1,959,009

Rental ...................................... 102,816 15,444 23,720

Ending subscribers .............................. 19,003,856 8,321,785 6,024,555

Retail ...................................... 4,264,378 598,884 1,576,463

OEM....................................... 6,330,321 1,706,622 1,135,316

Rental ...................................... 87,372 (8,276) (3,784)

Net additions .................................. 10,682,071 2,297,230 2,707,995

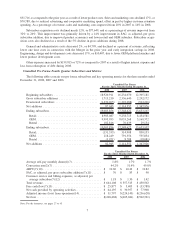

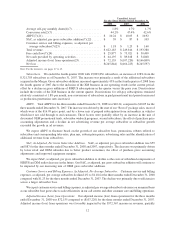

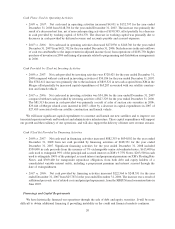

2008 2007 2006

Unaudited Actual

For the Years Ended December 31,

Average self-pay monthly churn(1)(7) ............... 1.8% 1.6% 1.6%

Conversion rate(2)(7) ........................... 47.5% 47.5% 44.1%

ARPU(7)(16) ................................. $ 9.91 $ 10.46 $ 11.01

SAC, as adjusted, per gross subscriber addition(7)(17) . . . $ 69 $ 98 $ 114

Customer service and billing expenses, as adjusted, per

average subscriber(7)(18) ....................... $ 1.02 $ 1.10 $ 1.37

Total revenue ................................. $1,663,992 $ 922,066 $ 637,235

Free cash flow(7)(19) ........................... $ (244,467) $(218,624) $ (500,715)

Net cash used in operating activities ................ $ (152,797) $(148,766) $ (421,702)

Adjusted income (loss) from operations(20) . . ......... $ 31,032 $(327,410) $ (513,140)

Net loss ..................................... $(5,313,288) $(565,252) $(1,104,867)

Note: For the footnotes, see pages 27 to 45.

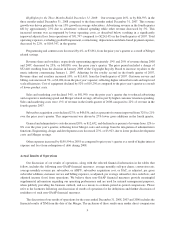

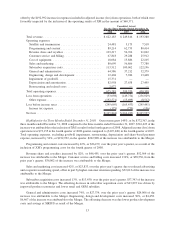

Subscribers. We ended 2008 with 19,003,856 subscribers, an increase of 128% from the 8,321,785

subscribers as of December 31, 2007. The increase was a result of the 9,716,070 subscribers acquired in the

Merger, and a 25% increase in gross subscriber additions due to the inclusion of XM in our operating results as a

result of the Merger. Gross additions in our OEM channel continued to grow as automakers continued to increase

the portion of their production which incorporates satellite radio. The growth in OEM gross additions was offset by

declines in retail gross additions. Deactivations include the results of XM from the date of the Merger. The

deactivation rate for self-pay subscriptions increased slightly while the conversion rate for subscribers in paid

promotional trial periods stayed constant.

ARPU. Total ARPU for the year ended December 31, 2008 was $9.91, compared to $10.46 for the year ended

December 31, 2007. The decrease was driven by an increase in the mix of discounted OEM promotional trials,

subscriber winback programs, second subscribers, the effect of purchase price accounting adjustments and a decline

in net advertising revenue per average subscriber as subscriber growth exceeded the growth in ad revenues.

We expect ARPU to fluctuate based on the growth of our subscriber base, promotions, rebates offered to

subscribers and corresponding take-rates, plan mix, subscription prices, advertising sales and the identification of

additional revenue from subscribers.

10