XM Radio 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

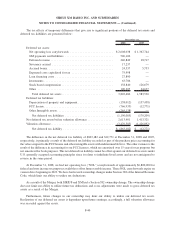

We adopted the provisions of FIN No. 48 on January 1, 2007. FIN No. 48 prescribes a recognition threshold

and measurement attributes for financial statement recognition and measurement of a tax position taken or expected

to be taken in a tax return, as well as criteria on derecognition, measurement, classification, interest and penalties,

accounting in interim periods, disclosure and transition. The cumulative effect of applying this interpretation did not

result in any adjustment to retained earnings as of January 1, 2007. We had no change in our liability for

unrecognized tax benefits during 2008. We do not expect any material changes to our FIN 48 positions in the next

12 months.

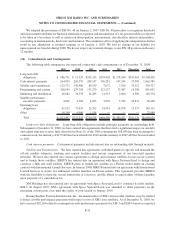

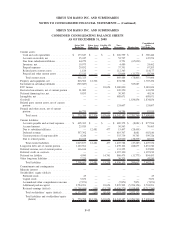

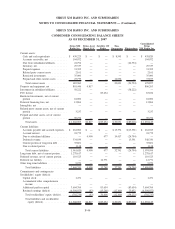

(16) Commitments and Contingencies

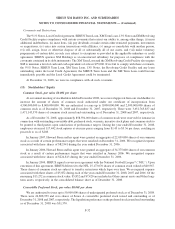

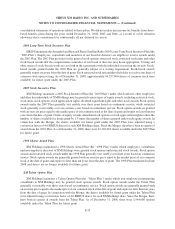

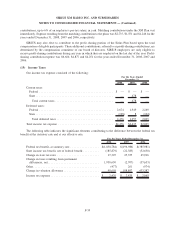

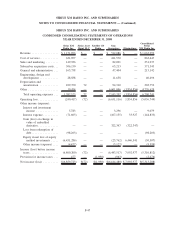

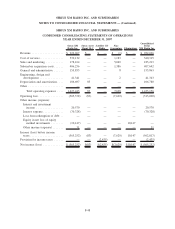

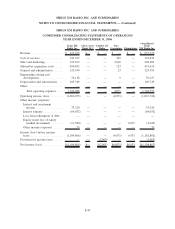

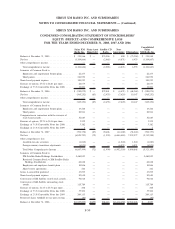

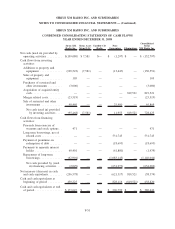

The following table summarizes our expected contractual cash commitments as of December 31, 2008:

2009 2010 2011 2012 2013 Thereafter Total

Long-term debt

obligations ........... $ 986,791 $ 13,129 $235,143 $239,402 $1,278,500 $555,463 $3,308,428

Cash interest payments .... 264,029 210,179 209,147 196,281 147,244 35,505 1,062,385

Satellite and transmission. . . 125,372 145,486 80,159 7,672 7,926 33,112 399,727

Programming and content . . 308,545 279,798 133,279 123,237 32,483 14,350 891,692

Marketing and distribution . . 66,882 36,578 24,285 14,533 3,000 4,500 149,778

Satellite performance

incentive payments . .... 4,096 4,384 4,695 5,030 5,392 42,831 66,428

Operating lease

obligations ........... 41,513 37,055 22,352 18,341 14,878 15,373 149,512

Other . . ............... 16,269 4,906 1,514 — — — 22,689

Total . ............... $1,813,497 $731,515 $710,574 $604,496 $1,489,423 $701,134 $6,050,639

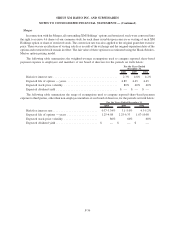

Long-term debt obligations. Long-term debt obligations include principal payments on outstanding debt.

Subsequent to December 31, 2008, we have entered into agreements that have had a significant impact on our debt

and capital structure as more fully described in Note 19, of the 2009 commitments $18,000 has been exchanged to

common stock, the maturity of $175,000 has been extended to 2010 and the maturity of $247,485 has been extended

to 2011.

Cash interest payments. Cash interest payments include interest due on outstanding debt through maturity.

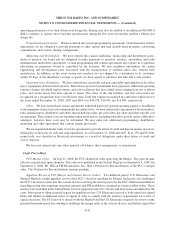

Satellite and Transmission. We have entered into agreements with third parties to operate and maintain the

off-site satellite telemetry, tracking and control facilities and certain components of our terrestrial repeater

networks. We have also entered into various agreements to design and construct satellites for use in our systems

and to launch those satellites. SIRIUS has entered into an agreement with Space Systems/Loral to design and

construct a fifth and sixth satellite. SIRIUS plans to launch one satellite on a Proton rocket under an existing

contract with International Launch Services. In January 2008, SIRIUS entered into an agreement with International

Launch Services to secure two additional satellite launches on Proton rockets. This agreement provides SIRIUS

with the flexibility to defer the second launch date if it chooses, and the ability to cancel either of these launches

upon payment of a cancellation fee.

XM Holdings has also entered into an agreement with Space Systems/Loral to construct its fifth satellite,

XM-5. In August 2007, XM’s agreement with Space Systems/Loral was amended to defer payments on the

remaining construction costs until the earlier of post-launch or January 2010.

Boeing Satellite Systems International, Inc., the manufacturer of XM’s four in-orbit satellites, may be entitled

to future in-orbit performance payments with respect to two of XM’s four satellites. As of December 31, 2008, we

have accrued $28,365 related to contingent in-orbit performance payments for XM-3 and XM-4 based on expected

F-41

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)