XM Radio 2008 Annual Report Download - page 92

Download and view the complete annual report

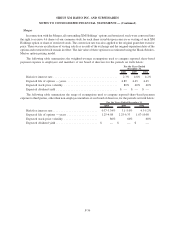

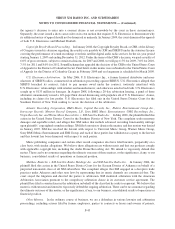

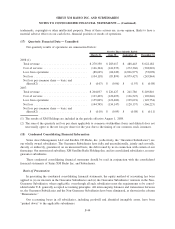

Please find page 92 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating performance over their fifteen year design life. Boeing may also be entitled to an additional $10,000 if

XM-4 continues to operate above baseline specifications during the five years beyond the satellite’s fifteen year

design life.

Programming and Content. We have entered into various programming agreements. Under the terms of these

agreements, we are obligated to provide payments to other entities that may include fixed payments, advertising

commitments and revenue sharing arrangements.

Marketing and Distribution. We have entered into various marketing, sponsorship and distribution agree-

ments to promote our brand and are obligated to make payments to sponsors, retailers, automakers and radio

manufacturers under these agreements. Certain programming and content agreements also require us to purchase

advertising on properties owned or controlled by the licensors. We also reimburse automakers for certain

engineering and development costs associated with the incorporation of satellite radios into vehicles they

manufacture. In addition, in the event certain new products are not shipped by a distributor to its customers

within 90 days of the distributor’s receipt of goods, we have agreed to purchase and take title to the product.

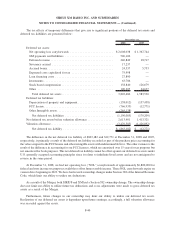

Operating lease obligations. We have entered into cancelable and non-cancelable operating leases for office

space, equipment and terrestrial repeaters. These leases provide for minimum lease payments, additional operating

expense charges, leasehold improvements, and rent escalations that have initial terms ranging from one to fifteen

years, and certain leases that have options to renew. The effect of the rent holidays and rent concessions are

recognized on a straight-line basis over the lease term. Total rent expense recognized in connection with leases for

the years ended December 31, 2008, 2007 and 2006 was $40,378, $16,941 and $15,984, respectively.

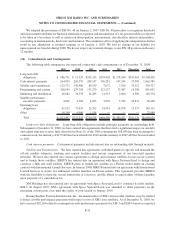

Other. We have entered into various agreements with third parties for general operating purposes. In addition

to the minimum contractual cash commitments described above, we have entered into agreements with automakers,

radio manufacturers, distributors and others that include per-radio, per-subscriber, per-show and other variable cost

arrangements. These future costs are dependent upon many factors, including subscriber growth, and are difficult to

anticipate; however, these costs may be substantial. We may enter into additional programming, distribution,

marketing and other agreements that contain similar provisions.

We are required under the terms of certain agreements to provide letters of credit and deposit monies in escrow,

which place restrictions on cash and cash equivalents. As of December 31, 2008 and 2007, $141,250 and $53,000,

respectively, was classified as Restricted investments as a result of obligations under these letters of credit and

escrow deposits.

We have not entered into any other material off-balance sheet arrangements or transactions.

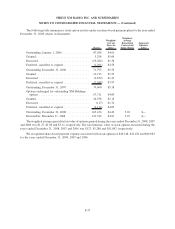

Legal Proceedings

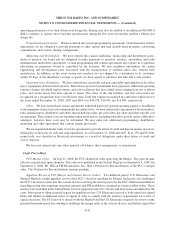

FCC Merger Order. On July 25, 2008, the FCC adopted an order approving the Merger. The order became

effective immediately upon adoption. This order was published in the Federal Register on September 8, 2008. On

September 4, 2008, Mt. Wilson FM Broadcasters, Inc. filed a Petition for Reconsideration of the FCC’s merger

order. This Petition for Reconsideration remains pending.

Appellate Review of FCC Merger and Consent Decree Orders. Two different parties, U.S. Electronics and

Michael Hartleib, sought appellate review of the FCC’s decision regarding the Merger. Each party also challenged

the FCC’s decision to enter into the consent decrees resolving the investigations by the FCC’s Enforcement Bureau

regarding certain non-compliant terrestrial repeaters and FM modulators contained in certain satellite radios. These

matters were both filed in the United States Court of Appeals for the D.C. Circuit, and have been consolidated by the

court. Subsequent to filing its initial request for appellate review, U.S. Electronics moved to both amend its original

filing and submit an additional notice of appeal in order to comply with the statutory requirements for review of

agency decisions. The FCC moved to dismiss both the Hartleib and the U.S. Electronics requests for review on the

grounds that neither party has standing to challenge the merger order or the consent decrees, and further argued that

F-42

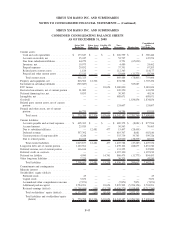

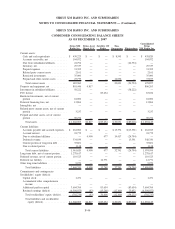

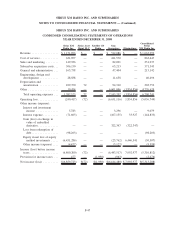

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)