XM Radio 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9.75% Senior Notes due 2014

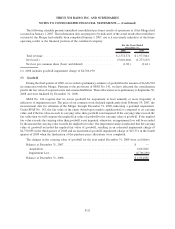

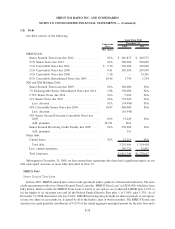

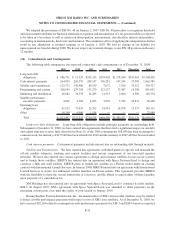

XM has outstanding $5,260 aggregate principal amount of 9.75% Senior Notes due 2014 (the “9.75% Notes”).

Interest on the 9.75% Notes is payable semi-annually on May 1 and November 1 at a rate of 9.75% per annum. The

9.75% Notes are unsecured and mature on May 1, 2014. XM, at its option, may redeem the 9.75% Notes at declining

redemption prices at any time on or after May 1, 2010, subject to certain restrictions. Prior to May 1, 2010, XM may

redeem the 9.75% Notes, in whole or in part, at a price equal to 100% of the principal amount thereof, plus a make-

whole premium and accrued and unpaid interest to the date of redemption.

13% Senior Notes due 2013

In July 2008, XM Escrow LLC (“Escrow LLC”), a Delaware limited liability company and wholly-owned

subsidiary of XM Holdings, issued $778,500 aggregate principal amount of 13% Senior Notes due 2013 (the

“13% Notes”). Interest is payable semi-annually in arrears on February 1 and August 1 of each year at a rate of 13%

per annum. The 13% Notes were issued for $700,105, resulting in an original issuance discount of $78,395. The

13% Notes are unsecured and mature in 2013. Escrow LLC merged with and into XM. Upon this merger, the

13% Notes became obligations of XM and became guaranteed by XM Holdings, XM Equipment Leasing LLC and

XM Radio Inc. The 13% Notes are not guaranteed by SIRIUS.

10% Convertible Senior Notes due 2009

XM Holdings has issued $400,000 aggregate principal amount of 10% Convertible Senior Notes due 2009 (the

“10% Convertible Notes”). Interest is payable semi-annually at a rate of 10% per annum. The 10% Convertible

Notes mature on December 1, 2009. The 10% Convertible Notes may be converted by the holder, at its option, into

shares of our common stock at a conversion rate of 92.0 shares of our common stock per $1,000 principal amount,

which is equivalent to a conversion price of $10.87 per share of common stock (subject to adjustment in certain

events). As a result of the fair valuation at acquisition date, we recognized an initial discount of $23,700.

10% Senior Secured Discount Convertible Notes due 2009

XM Holdings and XM, as co-obligors, have outstanding $33,249 aggregate principal amount of 10% Senior

Secured Discount Convertible Notes due 2009 (the “10% Discount Convertible Notes”). Interest is payable semi-

annually at a rate of 10% per annum. The 10% Discount Convertible Notes mature on December 31, 2009. At any

time, a holder of the notes may convert all or part of the accreted value of the notes at a conversion price of $0.69 per

share. The 10% Discount Convertible Notes rank equally in right of payment with all of XM Holdings’ and XM’s

other existing and future senior indebtedness, and are senior in right of payment to all of XM Holdings’ and XM’s

existing and future subordinated indebtedness. As a result of the fair valuation at the acquisition date, we recognized

an initial premium of $57,550.

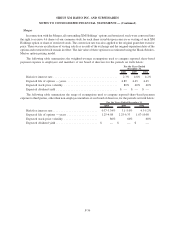

Senior Secured Revolving Credit Facility

XM is party to a $250,000 Senior Secured Revolving Credit Facility (the “XM Revolving Credit Facility”),

which has been fully drawn. The XM Revolving Credit Facility matures on May 5, 2009. Borrowings under the XM

Revolving Credit Facility bear interest at a rate of LIBOR plus 150 to 225 basis points or an alternate base rate, to be

the higher of the JPMorgan Chase prime rate and the Federal Funds rate plus 50 basis points, in each case plus 50 to

125 basis points. For $187,500 of the drawn amount, the interest rate at December 31, 2008 was 3.1875%; and for

$62,500 of the drawn amount, the interest rate at December 31, 2008 was 3.9375%. The XM Revolving Credit

Facility is secured by substantially all the assets of XM, other than certain specified property.

F-31

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)