XM Radio 2008 Annual Report Download - page 67

Download and view the complete annual report

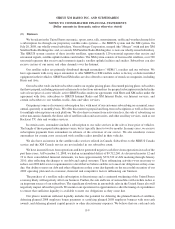

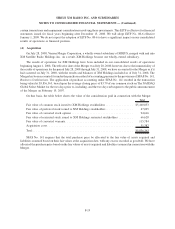

Please find page 67 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other intangible assets with indefinite lives are tested for impairment at least annually or more frequently if

indicators of impairment exist under the provisions of SFAS No. 142.

Other intangible assets with finite lives are amortized over their respective estimated useful lives to their

estimated residual values, and reviewed for impairment under the provisions of SFAS No. 144, Accounting for

Impairment or Disposal of Long-Lived Assets.

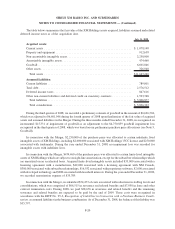

Fair Value of Financial Instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in an orderly

transaction between market participants to sell the asset or transfer the liability. As of December 31, 2008 and 2007,

we have determined that the carrying amounts of cash and cash equivalents, accounts and other receivables, and

accounts payable approximate fair value due to the short-term nature of these instruments.

The fair value of our long-term debt is determined by either (i) estimation of the discounted future cash flows

of each instrument at rates currently offered to us for similar debt instruments of comparable maturities by our

bankers, or quoted market prices at the reporting date for the traded debt securities. As of December 31, 2008 and

2007, the carrying value of long-term debt was $3,251,466 and $1,314,418, respectively; while the fair value

approximated $1,211,613 and $1,309,017, respectively.

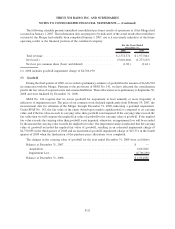

Reclassifications

Certain amounts in the prior period consolidated financial statements have been reclassified to conform to the

current period presentation.

Recent Accounting Pronouncements

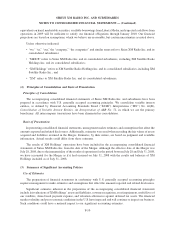

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This Statement defines fair

value, establishes a framework for measuring fair value and enhances disclosures about fair value measurements. In

February 2008, the FASB issued FASB Staff Position (“FSP”) 157-1, Application of FASB Statement No. 157 to

FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for

Purposes of Lease Classification or Measurement under Statement 13 and FSP 157-2, Effective Date of FASB

Statement No. 157. FSP 157-1 amends SFAS No. 157 to remove certain leasing transactions from its scope.

FSP 157-2, delays the effective date of SFAS No. 157 for all nonfinancial assets and liabilities, except those that are

recognized or disclosed at fair value in the financial statements on at least an annual basis, until January 1, 2009 for

calendar year end entities. In October 2008, the FASB issued FSP 157-3, Determining the Fair Value of a Financial

Asset When the Market for That Asset Is Not Active, which provides a detailed example to illustrate key

considerations in determining the fair value of a financial asset in an inactive market, and emphasizes the

requirements to disclose significant unobservable inputs used as a basis for estimating fair value. We adopted the

provisions of SFAS No. 157 on January 1, 2008, except as it applies to nonfinancial assets and liabilities as noted in

FSP 157-2. Neither the partial adoption nor the issuance of FSP 157-3 had any significant impact on our

consolidated results of operations or financial position. We will adopt the provisions of SFAS No. 157, as

amended, on January 1, 2009 as it relates to nonfinancial assets and liabilities, and do not expect a significant impact

on our consolidated results of operations or financial position as a result.

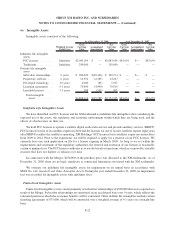

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities — Including an Amendment of FASB Statement No. 115, which permits entities to choose to measure

many financial instruments and certain other items at fair value. The objective is to improve financial reporting by

providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets

and liabilities differently without having to apply complex hedge accounting provisions. This Statement is expected

to expand the use of fair value measurement, which is consistent with the FASB’s long-term measurement

objectives for accounting for financial instruments. We adopted the provisions of SFAS No. 159 on January 1, 2008

F-17

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)