XM Radio 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Space Systems/Loral Credit Agreement

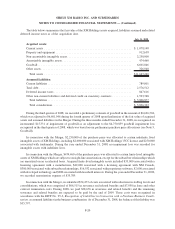

In July 2007, SIRIUS amended and restated its existing Credit Agreement with Space Systems/Loral (the

“Loral Credit Agreement”). Under the Loral Credit Agreement, Space Systems/Loral agreed to make loans to

SIRIUS in an aggregate principal amount of up to $100,000 to finance the purchase of its fifth and sixth satellites.

After April 6, 2009, Loral’s commitment will be limited to 80% of amounts due with respect to the construction of

our sixth satellite. Loans made under the Loral Credit Agreement are secured by SIRIUS’ rights under the Satellite

Purchase Agreement with Space Systems/Loral, including its rights to these satellites. The loans are also entitled to

the benefits of a subsidiary guarantee from Satellite CD Radio, Inc., the subsidiary that holds SIRIUS’ FCC license,

and any future material subsidiary that may be formed by SIRIUS. The maturity date of the loans is the earliest to

occur of (i) June 10, 2010, (ii) 90 days after the sixth satellite becomes available for shipment and (iii) 30 days prior

to the scheduled launch of the sixth satellite. The Loral Credit Agreement contains certain drawing conditions,

including the requirement that SIRIUS have a market capitalization of at least $1 billion. As a result of these

borrowing conditions, we currently cannot borrow under this facility and in the future we may be limited in our

ability to borrow under this facility. Any loans made under the Loral Credit Agreement generally will bear interest

at a variable rate equal to 3-month LIBOR plus 4.75%. The daily unused balance bears interest at a rate per annum

equal to 0.50%, payable quarterly on the last day of each March, June, September and December. The Loral Credit

Agreement permits SIRIUS to prepay all or a portion of the loans outstanding without penalty. SIRIUS has not

borrowed under the Loral Credit Agreement.

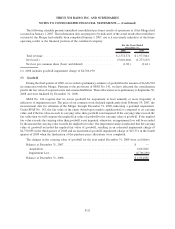

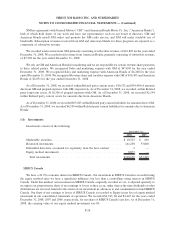

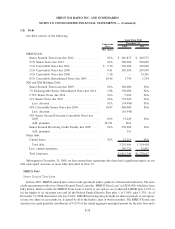

XM and XM Holdings Debt

On the date of the Merger, XM and XM Holdings had debt in the aggregate amount of $2,600,000. Following

the Merger, XM repurchased notes with aggregate principal amounts outstanding of $795,000 in accordance with

“change of control put” terms of such indebtedness. In addition, XM satisfied its $309,400 transponder repurchase

obligation associated with one of its satellites in accordance with the terms of a sale-leaseback transaction. In order

to effect these repurchases, XM issued approximately $1,328,500 in aggregate principal amount of new debt

securities.

Senior Secured Term Loan

XM is party to a credit agreement dated May 2008 relating to a $100,000 Senior Secured Term Loan (the “XM

Term Loan”) with UBS AG. The XM Term Loan matures on May 5, 2009. Interest is payable quarterly. At

December 31, 2008, the interest rate was 5.5625%. The interest rate is 225 basis points over the 9-month LIBOR.

The XM Term Loan is secured on a pari passu basis with the XM Revolving Credit Facility (as defined below) by

substantially all of XM’s assets.

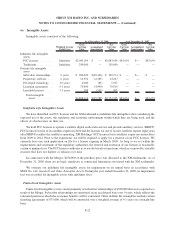

7% Exchangeable Senior Subordinated Notes due 2014

In August 2008, XM issued $550,000 aggregate principal amount of 7% Exchangeable Senior Subordinated

Notes due 2014 (the “Exchangeable Notes”). The Exchangeable Notes are senior subordinated obligations of XM

and rank junior in right of payment to its existing and future senior debt and equally in right of payment with its

existing and future senior subordinated debt. XM Holdings, XM Equipment Leasing LLC and XM Radio Inc. have

guaranteed the Exchangeable Notes on a senior subordinated basis. The Exchangeable Notes are not guaranteed by

SIRIUS or Satellite CD Radio, Inc. Interest is payable semi-annually in arrears on June 1 and December 1 of each

year at a rate of 7% per annum. The Exchangeable Notes mature on December 1, 2014. The Exchangeable Notes are

exchangeable at any time at the option of the holder into shares of our common stock at an initial exchange rate of

533.3333 shares of common stock per $1,000 principal amount of Exchangeable Notes, which is equivalent to an

approximate exchange price of $1.875 per share of common stock.

F-30

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)