XM Radio 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Covenants and Restrictions

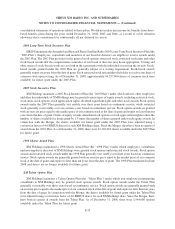

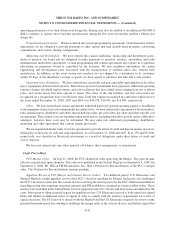

The 95⁄8% Notes, Loral Credit Agreement, SIRIUS Term Loan, XM Term Loan, 13% Notes and XM Revolving

Credit Facility require compliance with certain covenants that restrict our ability to, among other things, (i) incur

additional indebtedness, (ii) incur liens, (iii) pay dividends or make certain other restricted payments, investments

or acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or consolidate with another person,

(vi) sell, assign, lease or otherwise dispose of all or substantially all of our assets, and (vii) make voluntary

prepayments of certain debt, in each case subject to exceptions as provided in the applicable indenture or credit

agreement. SIRIUS operates XM Holdings as an unrestricted subsidiary for purposes of compliance with the

covenants contained in its debt instruments. The XM Term Loan and the XM Revolving Credit Facility also require

XM to maintain a level of cash and cash equivalents of at least $75,000. If we fail to comply with these covenants,

the 95⁄8% Notes, SIRIUS Term Loan, XM Term Loan, 13% Notes, the Revolving Credit Facility and any loans

outstanding under the Loral Credit Agreement, the SIRIUS Term Loan and the XM Term Loan could become

immediately payable and the Loral Credit Agreement could be terminated.

At December 31, 2008, we were in compliance with all such covenants.

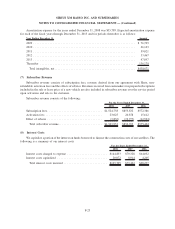

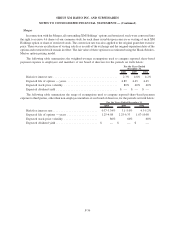

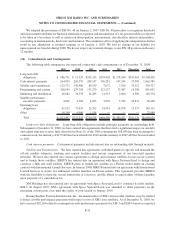

(13) Stockholders’ Equity

Common Stock, par value $0.001 per share

At our annual meeting of stockholders held in December 2008, we received approval from our stockholders to

increase the amount of shares of common stock authorized under our certificate of incorporation from

4,500,000,000 to 8,000,000,000. We are authorized to issue up to 8,000,000,000 and 2,500,000,000 shares of

common stock as of December 31, 2008 and December 31, 2007, respectively. There were 3,651,765,837 and

1,471,143,570 shares of common stock issued and outstanding as of December 31, 2008 and 2007, respectively.

As of December 31, 2008, approximately 858,934,000 shares of common stock were reserved for issuance in

connection with outstanding convertible debt, preferred stock, warrants, incentive stock plans and common stock to

be granted to third parties upon satisfaction of performance targets. During the year ended December 31, 2008,

employees exercised 117,442 stock options at exercise prices ranging from $1.45 to $3.36 per share, resulting in

proceeds to us of $208.

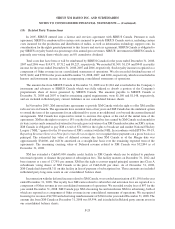

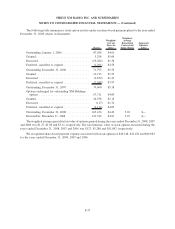

In January 2007, Howard Stern and his agent were granted an aggregate of 22,059,000 shares of our common

stock as a result of certain performance targets that were satisfied on December 31, 2006. We recognized expense

associated with these shares of $82,941 during the year ended December 31, 2006.

In January 2006, Howard Stern and his agent were granted an aggregate of 34,375,000 shares of our common

stock as a result of certain performance targets that were satisfied in January 2006. We recognized expense

associated with these shares of $224,813 during the year ended December 31, 2006.

In January 2004, SIRIUS signed a seven-year agreement with the National Football League»(“NFL”). Upon

execution of this agreement, SIRIUS delivered to the NFL 15,173,070 shares of common stock valued at $40,967.

These shares of common stock are subject to transfer restrictions which lapse over time. We recognized expense

associated with these shares of $5,852 during each of the years ended December 31, 2008, 2007 and 2006. Of the

remaining $13,272 in common stock value, $5,852 and $7,420 are included in Other current assets and Other long-

term assets, respectively, in the consolidated balance sheet as of December 31, 2008.

Convertible Preferred Stock, par value $0.001 per share

We are authorized to issue up to 50,000,000 shares of undesignated preferred stock as of December 31, 2008.

There were 24,808,959 and zero shares of Series A convertible preferred stock issued and outstanding as of

December 31, 2008 and 2007, respectively. The liquidation preference on the preferred stock issued and outstanding

as of December 31, 2008 was $51,370.

F-32

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)