XM Radio 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

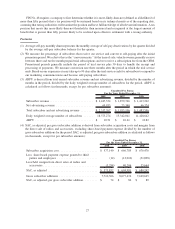

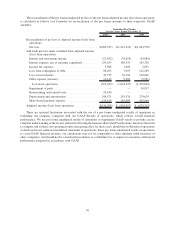

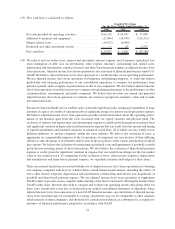

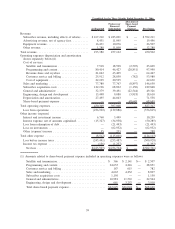

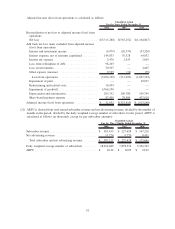

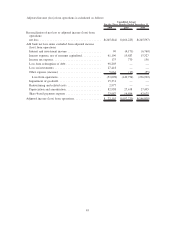

The reconciliation of the pro forma unadjusted net loss to the pro forma adjusted income (loss) from

operations is calculated as follows (See footnotes for reconciliation of the pro forma amounts to their

respective GAAP amounts):

2008 2007 2006

Unaudited Pro Forma

For the Three Months Ended December 31,

Reconciliation of net loss to adjusted income (loss) from

operations:

Net loss ...................................... $(248,468) $(405,041) $(502,321)

Add back net loss items excluded from adjusted income

(loss) from operations:

Interest and investment expense (income) ............. 90 (6,978) (10,259)

Interest expense, net of amounts capitalized ............ 71,274 48,703 50,285

Income tax expense.............................. 175 901 1,393

Loss from redemption of debt ...................... 98,203 728 21,443

Loss on investments ............................. 27,418 3,768 62,932

Other expense (income) .......................... 5,664 5,834 (288)

Loss from operations ........................... (45,644) (352,085) (376,815)

Restructuring and related costs ..................... 2,977 — —

Depreciation and amortization ...................... 49,519 75,045 71,538

Share-based payment expense ...................... 24,945 52,897 68,649

Adjusted income (loss) from operations................. $ 31,797 $(224,143) $(236,628)

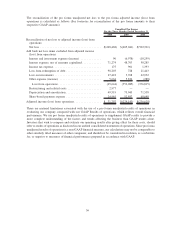

There are material limitations associated with the use of a pro forma unadjusted results of operations in

evaluating our company compared with our GAAP Results of operations, which reflects overall financial

performance. We use pro forma unadjusted results of operations to supplement GAAP results to provide a

more complete understanding of the factors and trends affecting the business than GAAP results alone.

Investors that wish to compare and evaluate our operating results after giving effect for these costs, should

refer to results of operations as disclosed in our audited consolidated statements of operations. Since pro forma

unadjusted results of operations is a non-GAAP financial measure, our calculations may not be comparable to

other similarly titled measures of other companies; and should not be considered in isolation, as a substitute

for, or superior to measures of financial performance prepared in accordance with GAAP.

36