XM Radio 2008 Annual Report Download - page 28

Download and view the complete annual report

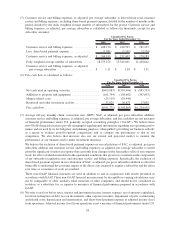

Please find page 28 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We determined that the sale of our service through our direct to consumer channel with accompanying

equipment constitutes a revenue arrangement with multiple deliverables. In these types of arrangements, amounts

received for equipment are recognized as equipment revenue; amounts received for service are recognized as

subscription revenue; and amounts received for the non-refundable, up-front activation fee that are not contingent

on the delivery of the service are allocated to equipment revenue. Activation fees are recorded to equipment revenue

only to the extent that the aggregate equipment and activation fee proceeds do not exceed the fair value of the

equipment. Any activation fees not allocated to the equipment are deferred upon activation and recognized as

subscriber revenue on a straight-line basis over the estimated term of a subscriber relationship.

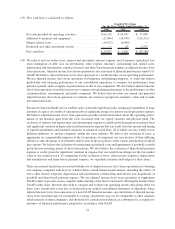

Share-based Payment. Effective January 1, 2006, we adopted the provisions of Statement of Financial

Accounting Standard (“SFAS”) No. 123 (revised 2004), Share-Based Payment, using the modified prospective

transition method. Our 2005 consolidated results of operations and financial position were not restated under this

transition method. The share-based payment expense recognized beginning January 1, 2006 includes compensation

cost for all stock-based awards granted to employees and members of our board of directors (i) prior to, but not

vested as of, January 1, 2006 based on the grant date fair value originally estimated in accordance with the

provisions of SFAS No. 123, Accounting for Stock-Based Compensation, and (ii) subsequent to December 31, 2005

based on the grant date fair value estimated in accordance with the provisions of SFAS No. 123R. Compensation

cost under SFAS No. 123R is recognized ratably using the straight-line attribution method over the expected vesting

period. SFAS No. 123R requires forfeitures to be estimated on the grant date and revised in subsequent periods if

actual forfeitures differ from those estimates.

Effective January 1, 2006, we account for such awards at fair value in accordance with SFAS No. 123R and

SEC guidance contained in Staff Accounting Bulletin (“SAB”) No. 107. The fair value of equity instruments

granted to non-employees is measured in accordance with EITF No. 96-18, Accounting for Equity Instruments That

are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services. The final

measurement date of equity instruments with performance criteria is the date that each performance commitment

for such equity instrument is satisfied or there is a significant disincentive for non-performance.

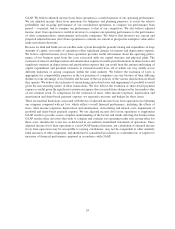

Upon adoption of SFAS No. 123R, we continued to estimate the fair value of stock-based awards using the

Black-Scholes-Merton option valuation model (“Black-Scholes-Merton”). Black-Scholes-Merton was developed

to estimate the fair market value of traded options, which have no vesting restrictions and are fully transferable.

Option valuation models require the input of highly subjective assumptions. Because our stock-based awards have

characteristics significantly different from those of traded options and because changes in the subjective assump-

tions can materially affect the fair market value estimate, the existing option valuation models do not necessarily

provide a reliable single measure of the fair value of our stock-based awards.

Fair value determined using Black-Scholes-Merton varies based on assumptions used for the expected life,

expected stock price volatility and risk-free interest rates. We estimated the fair value of awards granted during the

years ended December 31, 2008, 2007 and 2006 using the implied volatility of actively traded options on our stock.

We believe that implied volatility is more representative of future stock price trends than historical volatility. The

expected life assumption represents the weighted-average period stock-based awards are expected to remain

outstanding. These expected life assumptions are established through a review of historical exercise behavior of

stock-based award grants with similar vesting periods. Where historical patterns do not exist, contractual terms are

used. The risk-free interest rate represents the daily treasury yield curve rate at the reporting date based on the

closing market bid yields on actively traded U.S. treasury securities in the over-the-counter market for the expected

term. Our assumptions may change in future periods.

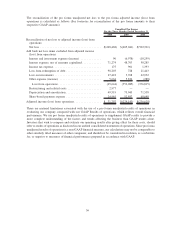

Income Taxes. We account for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes,

and FIN No. 48, Accounting for Uncertainty in Income Taxes. Deferred income taxes are recognized for the tax

consequences related to temporary differences between the carrying amount of assets and liabilities for financial

reporting purposes and the amounts used for tax purposes at each year-end, based on enacted tax laws and statutory

tax rates applicable to the periods in which the differences are expected to affect taxable income. A valuation

allowance is established when necessary based on the weight of available evidence, if it is considered more likely

than not that all or some portion of the deferred tax assets will not be realized. Income tax expense is the sum of

current income tax plus the change in deferred tax assets and liabilities.

26