XM Radio 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

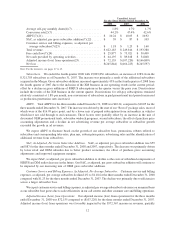

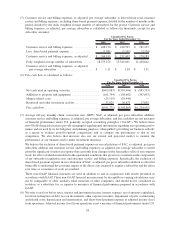

Loss from redemption of debt. Loss from redemption of debt includes losses incurred as a result of the

conversion of our 21⁄2% Convertible Notes due 2009.

•2008 vs. 2007: For the year ended December 31, 2008 and 2007, loss from redemption of debt was $98,203

and $0, respectively.

•2007 vs. 2006: For the years ended December 31, 2007 and 2006, we did not incur any losses from the

redemption of our debt.

Loss on investments. Loss on investments includes our share of SIRIUS Canada’s and XM Canada’s net

losses, and losses recorded from our investment in XM Canada when the fair value was determined to be other than

temporary.

•2008 vs. 2007: For the year ended December 31, 2008, loss on investment was $30,507 and $0,

respectively.

•2007 vs. 2006: For the years ended December 31, 2006, loss on investment was $0 and $4,445,

respectively.

Income Taxes

Income Tax Expense. Income tax expense represents the recognition of a deferred tax liability related to the

difference in accounting for our FCC licenses, which is amortized over 15 years for tax purposes but not amortized

for book purposes in accordance with U.S. generally accepted accounting principles.

•2008 vs. 2007: We recorded income tax expense of $2,476 and $2,435 for the years ended December 31,

2008 and 2007, respectively.

•2007 vs. 2006: We recorded income tax expense of $2,435 and $2,065 for the years ended December 31,

2007 and 2006, respectively.

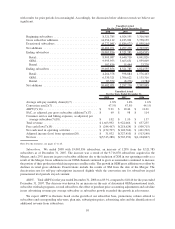

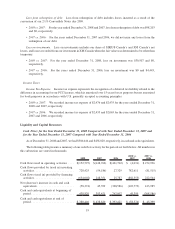

Liquidity and Capital Resources

Cash Flows for the Year Ended December 31, 2008 Compared with Year Ended December 31, 2007 and

for the Year Ended December 31, 2007 Compared with Year Ended December 31, 2006

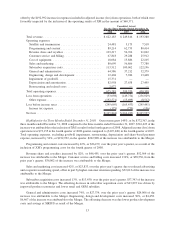

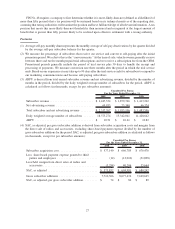

As of December 31, 2008 and 2007, we had $380,446 and $438,820, respectively, in cash and cash equivalents.

The following table presents a summary of our cash flow activity for the periods set forth below. All numbers in

this subsection are stated in thousands:

2008 2007 2006

2008 vs.

2007

2007 vs.

2006

Cash flows used in operating activities .... $(152,797) $(148,766) $(421,702) $ (4,031) $ 272,936

Cash flows provided by (used in) investing

activities ......................... 728,425 (54,186) 27,329 782,611 (81,515)

Cash flows (used in) provided by financing

activities ......................... (634,002) 248,351 25,787 (882,353) 222,564

Net (decrease) increase in cash and cash

equivalents ....................... (58,374) 45,399 (368,586) (103,773) 413,985

Cash and cash equivalents at beginning of

period........................... 438,820 393,421 762,007 45,399 (368,586)

Cash and cash equivalents at end of

period........................... $380,446 $ 438,820 $ 393,421 $ (58,374) $ 45,399

19