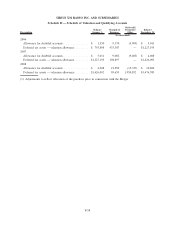

XM Radio 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Phase One: Investment Agreement

On February 17, 2009, SIRIUS entered into an Investment Agreement (the “Investment Agreement”) with

Liberty Radio, LLC (the “Purchaser”), an indirect wholly-owned subsidiary of Liberty Media Corporation.

Pursuant to the Investment Agreement, SIRIUS agreed to issue to the Purchaser 12,500,000 shares of convertible

preferred stock with a liquidation preference of $0.001 per share in partial consideration for the loan investments

described herein.

Upon expiration of the applicable waiting period under the Hart-Scott-Rodino Act, the preferred stock will be

convertible into 40% of our outstanding shares of common stock (after giving effect to such conversion). The

Purchaser has agreed not to acquire more than 49.9% of our outstanding common stock for three years. Certain of

the standstill restrictions will cease to apply after two years.

The rights, preferences and privileges of the preferred stock are set forth in a Certificate of Designations filed

with the Secretary of State of the State of Delaware. The holders of the preferred stock are entitled to appoint a

proportionate number of our board of directors based on their ownership levels from time to time. The Certificate of

Designations also provides that so long as the Purchaser beneficially owns at least half of its initial equity

investment, we need the consent of the Purchaser for certain actions, including:

• the grant or issuance of our equity securities;

• any merger or sale of all or substantially all of our assets;

• any acquisition or disposition of assets other than in the ordinary course of business above certain thresholds;

• the incurrence of debt in amounts greater than a stated threshold;

• engaging in a business different than the business currently conducted by us; and

• amending our certificate of incorporation or by-laws in a manner that materially adversely affects the holders

of the preferred stock.

The preferred stock, with respect to dividend rights, ranks on a parity with our common stock, and with respect

to rights on liquidation, winding-up and dissolution, rank senior to our common stock. Dividends on the preferred

stock are payable, on a non-cumulative basis, as and if declared on our common stock, in cash, on an as-converted

basis.

Phase Two: XM Credit Agreement; Amendment and Restatement of Existing XM Bank Facilities; and Issu-

ance of the Preferred Stock

XM Credit Agreement. On February 17, 2009, XM Satellite Radio Inc. entered into a Credit Agreement (the

“XM Credit Agreement”) with Liberty Media Corporation, as administrative agent and collateral agent. The XM

Credit Agreement provides for a $150,000 term loan.

On March 6, 2009, XM amended and restated the XM Credit Agreement (the “Second-Lien Credit Agree-

ment”) with Liberty Media Corporation, and simultaneously closed the facility. Pursuant to the Second-Lien Credit

Agreement, XM may borrow $150,000 aggregate principal amount of term loans on December 1, 2009. The

proceeds of the loans will be used to repay a portion of the 10% Convertible Notes due 2009 of XM Holdings on the

stated maturity date thereof. The Second-Lien Credit Agreement matures on March 1, 2011, and bears interest at

15% per annum. XM will pay a commitment fee of 2.0% per annum on the undrawn portion of the Second-Lien

Credit Agreement until the date of disbursement of the loans or the termination of the commitments.

F-55

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)