XM Radio 2008 Annual Report Download - page 23

Download and view the complete annual report

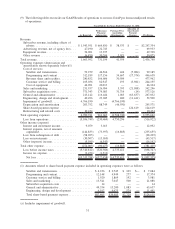

Please find page 23 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Future Liquidity and Capital Resource Requirements

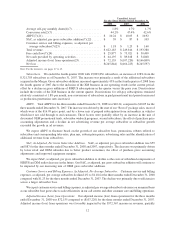

Debt Maturing in 2009 and 2010. We have approximately $537,000 of debt maturing in 2009 and 2010,

including:

• at SIRIUS, $1,744 of 83⁄4% Convertible Subordinated Notes that mature on September 29, 2009;

• at XM Holdings, approximately $227,500 of 10% Convertible Senior Notes that mature on December 1,

2009;

• at XM Holdings and XM (as co-obligors), $33,200 of 10% Senior Secured Discount Convertible Notes that

mature on December 31, 2009; and

• at XM, a $350,000 credit facility, which is fully drawn and $100,000 of which is due in 2009, $175,000 is due

by May 5, 2010 and $75,000 is due in May 2011.

As a result of the May 2010 maturities, our existing cash balances and our cash flows from operating activities

may not be sufficient to fund our projected cash needs at that time. We may not be able to access additional sources

of refinancing on similar terms or pricing as those that are currently in place, or at all, or otherwise obtain other

sources of funding. An inability to access replacement or additional sources of liquidity to fund our cash needs or to

refinance or otherwise fund the repayment of our maturing debt could adversely affect our growth, our financial

condition, or results of operations, and our ability to make payments on our debt, and could force use to seek the

protection of the bankruptcy laws. It will be more difficult to obtain additional financing if prevailing instability in

credit and financial markets continues.

Since October 1, 2008, we have entered into a series of transactions to improve our liquidity and strengthen our

balance sheet, including:

• the issuance of an aggregate of 539,611,513 shares of our common stock for $128,412 aggregate principal

amount of our 21⁄2% Convertible Notes due 2009;

• the exchange of $172,485 aggregate principal amount of outstanding 10% Convertible Senior Notes due

2009 of XM Holdings for a like principal amount of XM Holdings’ Senior PIK Secured Notes due June

2011; and

• the execution of agreements with Liberty Media Corporation and its affiliate, Liberty Radio LLC, pursuant

to which they have invested an aggregate of $350,000 in the form of loans to us, are committed to invest an

additional $180,000 in loans to us, and have received a significant equity interest in us.

See Note 19 to the consolidated financial statements included elsewhere in this Annual Report and Proxy

Statement for additional information on certain of these transactions.

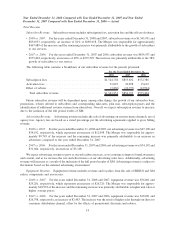

Credit Agreement with Space Systems/Loral. In July 2007, SIRIUS amended and restated its Credit

Agreement with Space Systems/Loral (the “Loral Credit Agreement”). Under the Loral Credit Agreement, Space

Systems/Loral agreed to make loans to SIRIUS in an aggregate principal amount of up to $100,000 to finance the

purchase of SIRIUS’ fifth and sixth satellites. After April 6, 2009, Loral’s commitment will be limited to 80% of

amounts due with respect to the construction of our sixth satellite. Loans made under the Loral Credit Agreement

will be secured by SIRIUS’ rights under the Satellite Purchase Agreement with Space Systems/Loral, including

SIRIUS’ rights to the new satellites. The loans are also entitled to the benefits of a subsidiary guarantee from

Satellite CD Radio, Inc., the subsidiary that holds SIRIUS’ FCC license, and any future material subsidiary that may

be formed by SIRIUS. The maturity date of the loans is the earliest to occur of (i) June 10, 2010, (ii) 90 days after our

sixth satellite becomes available for shipment, and (iii) 30 days prior to the scheduled launch of the sixth satellite.

Any loans made under the Loral Credit Agreement generally will bear interest at a variable rate equal to three-

month LIBOR plus 4.75%. The Loral Credit Agreement permits SIRIUS to prepay all or a portion of the loans

outstanding without penalty.

SIRIUS has not requested any loans under the Loral Credit Agreement with Space Systems/Loral. The Loral

Credit Agreement contains certain drawing conditions, including the requirement that SIRIUS have a market

capitalization of at least $1 billion. As a result of these borrowing conditions, we currently cannot borrow under this

21