XM Radio 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and did not elect the fair value option as of that date. The adoption had no significant impact on our consolidated

results of operations or financial position.

In November 2007, the FASB issued SFAS No. 141R, Business Combinations, which continues to require that

all business combinations be accounted for by applying the acquisition method. Under the acquisition method, the

acquirer recognizes and measures the identifiable assets acquired, the liabilities assumed, and any contingent

consideration and contractual contingencies, as a whole, at their face value as of the acquisition date. Under

SFAS No. 141R, all transaction costs are expensed as incurred. SFAS No. 141R rescinded EITF No. 93-07,

Uncertainties Related to Income Taxes in a Purchase Business Combination. Under SFAS No. 141R, all subsequent

adjustments to uncertain tax positions assumed in a business combination that previously would have impacted

goodwill are recognized in the income statement. The guidance in SFAS No. 141R is applied prospectively to

business combinations for which the acquisition date is on or after the beginning of the first annual reporting period

beginning after December 15, 2008. SFAS No. 141R does not impact the accounting for the Merger and we do not

expect its adoption to have a significant impact on our consolidated results of operations or financial position.

In December 2007, the FASB ratified EITF No. 07-1, Accounting for Collaborative Agreements, which

provides guidance on how the parties to a collaborative agreement should account for costs incurred and revenue

generated on sales to third parties, how sharing payments pursuant to a collaboration agreement should be presented

in the income statement and certain related disclosure requirements. This EITF is effective for the first annual or

interim reporting period beginning after December 15, 2008, and should be applied retrospectively to all prior

periods presented for all collaborative arrangements existing as of the effective date. We will adopt EITF No. 07-1

effective January 1, 2009. We do not expect the adoption of EITF No. 07-1 to have a significant impact on our

consolidated results of operations or financial position.

In April 2008, the FASB issued FSP No. FAS 142-3, Determination of the Useful Life of Intangible Assets. FSP

No. FAS 142-3 amends the factors that should be considered in developing renewal or extension assumptions used

to determine the useful life of a recognized intangible asset under SFAS No. 142, Goodwill and Other Intangible

Assets. This FSP is effective for financial statements issued for fiscal years beginning after December 15, 2008. We

will adopt FSP No. FAS 142-3 effective January 1, 2009. We do not expect the adoption of FSP No. FAS 142-3 to

have a significant impact on our consolidated results of operations or financial position.

In May 2008, the FASB issued FSP No. APB 14-1, Accounting for Convertible Debt Instruments That May Be

Settled in Cash upon Conversion (Including Partial Cash Settlement) which amends the accounting requirements

for convertible debt instruments that, by their stated terms, may be settled in cash (or other assets) upon conversion,

including partial cash settlement. Additional disclosures are also required for these instruments. This FSP is

effective for financial statements issued for fiscal years beginning after December 15, 2008. We will adopt FSP

No. APB 14-1 effective January 1, 2009. We do not expect the adoption of FSP No. APB 14-1 to have a significant

impact on our consolidated results of operations or financial position.

In June 2008, the FASB ratified EITF No. 07-5, Determining Whether an Instrument (or Embedded Feature) Is

Indexed to an Entity’s Own Stock, which provides guidance for determining whether an equity-linked financial

instrument (or embedded feature) issued by an entity is indexed to the entity’s stock, and therefore would qualify for

the first part of the scope exception in paragraph 11(a) of SFAS No. 133, Accounting for Derivative Instruments and

Hedging Activities. The EITF prescribes a two-step approach under which the entity would evaluate the

instrument’s contingent exercise provisions and then the instrument’s settlement provisions, for purposes of

evaluating whether the instrument (or embedded feature) is indexed to the entity’s stock. This EITF is effective for

financial statements issued for fiscal years beginning after December 15, 2008. We will adopt EITF No. 07-5

effective January 1, 2009. We do not expect the adoption of EITF No. 07-5 to have a significant impact on our

consolidated results of operations or financial position.

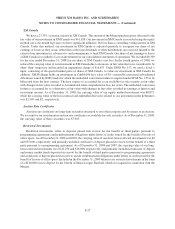

In November 2008, the FASB ratified EITF No. 08-6, Equity Method Investment Accounting Considerations,

which applies to all investments accounted for under the equity method. The EITF clarifies the accounting for

F-18

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)