XM Radio 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

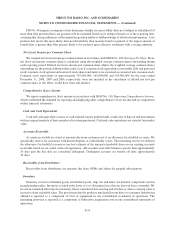

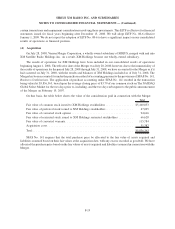

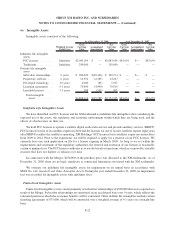

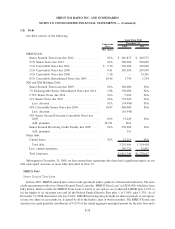

The table below summarizes the fair value of the XM Holdings assets acquired, liabilities assumed and related

deferred income taxes as of the acquisition date.

July 31, 2008

Acquired assets:

Current assets ...................................................... $ 1,078,148

Property and equipment . .............................................. 912,638

Non-amortizable intangible assets........................................ 2,250,000

Amortizable intangible assets ........................................... 474,460

Goodwill .......................................................... 6,601,046

Other assets ........................................................ 326,948

Total assets ...................................................... $11,643,240

Assumed liabilities:

Current liabilities .................................................... 789,001

Total debt ......................................................... 2,576,512

Deferred income taxes . . .............................................. 847,616

Other non-current liabilities and deferred credit on executory contracts ............ 1,593,748

Total liabilities .................................................... $ 5,806,877

Total consideration . . . .............................................. $ 5,836,363

During the third quarter of 2008, we recorded a preliminary estimate of goodwill in the amount of $6,626,504,

which was adjusted to $6,601,046 during the fourth quarter of 2008 upon finalization of the fair value of acquired

assets and assumed liabilities in the Merger. During the three months ended December 31, 2008, we recognized an

incremental $15,331 of impairment of goodwill as an adjustment to the $4,750,859 goodwill impairment loss

recognized in the third quarter of 2008, which was based on our preliminary purchase price allocations (see Note 5,

Goodwill).

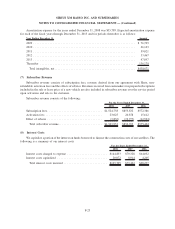

In connection with the Merger, $2,250,000 of the purchase price was allocated to certain indefinite lived

intangible assets of XM Holdings, including $2,000,000 associated with XM Holdings’ FCC license and $250,000

associated with trademarks. During the year ended December 31, 2008, no impairment loss was recorded for

intangible assets with indefinite lives.

In connection with the Merger, $474,460 of the purchase price was allocated to certain finite-lived intangible

assets of XM Holdings which are subject to straight-line amortization, except for the subscriber relationships which

are amortized on an accelerated basis. Acquired finite-lived intangible assets included $33,000 associated with a

licensing agreement with a manufacturer, $42,000 associated with a licensing agreement with XM Canada,

$380,000 associated with subscriber relationships, $16,552 associated with proprietary software, $2,000 associated

with developed technology and $908 associated with leasehold interests. During the year ended December 31, 2008,

we recorded amortization expense of $35,789.

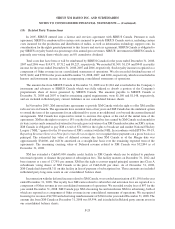

In connection with the Merger, we identified $74,473 of costs associated with reductions in staffing levels and

consolidations, which was comprised of $66,515 in severance and related benefits and $7,958 in lease and other

contract termination costs. During 2008, we paid $38,676 in severance and related benefits and the remaining

severance and related benefits are expected to be paid by the end of 2009. These costs were recognized in

accordance with the EITF No. 95-3, Recognition of Liabilities in Connection with a Purchase Business Combi-

nation, as assumed liabilities in the business combination. As of December 31, 2008, the balance of this liability was

$35,797.

F-20

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)