XM Radio 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FIN No. 48 requires a company to first determine whether it is more-likely-than-not (defined as a likelihood of

more than fifty percent) that a tax position will be sustained based on its technical merits as of the reporting date,

assuming that taxing authorities will examine the position and have full knowledge of all relevant information. A tax

position that meets this more-likely-than-not threshold is then measured and recognized at the largest amount of

benefit that is greater than fifty percent likely to be realized upon effective settlement with a taxing authority.

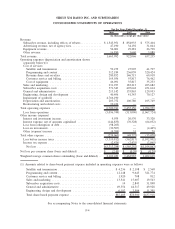

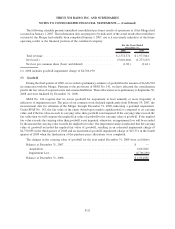

Net (Loss) Income per Common Share

We compute net (loss) income per common share in accordance with SFAS No. 128, Earnings Per Share. Basic

net (loss) income per common share is calculated using the weighted average common shares outstanding during

each reporting period. Diluted net (loss) income per common share adjusts the weighted average common shares

outstanding for the potential dilution that could occur if common stock equivalents (convertible debt and preferred

stock, warrants, stock options and restricted stock shares and units) were exercised or converted into common stock.

Common stock equivalents of approximately 787,000,000, 165,000,000 and 194,000,000 for the years ended

December 31, 2008, 2007 and 2006, respectively, were not included in the calculation of diluted net loss per

common share as the effect would have been anti-dilutive.

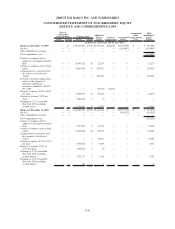

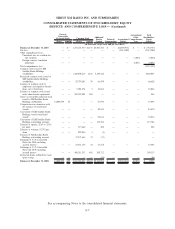

Comprehensive (Loss) Income

We report comprehensive (loss) income in accordance with SFAS No. 130, Reporting Comprehensive Income,

which established the standard for reporting and displaying other comprehensive (loss) income and its components

within financial statements.

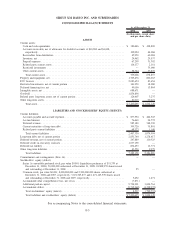

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, money market funds, certificates of deposit and investments

with an original maturity of three months or less when purchased. Cash and cash equivalents are stated at fair market

value.

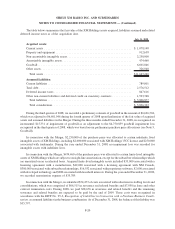

Accounts Receivable

Accounts receivable are stated at amounts due from customers net of an allowance for doubtful accounts. We

specifically reserve for customers with known disputes or collectability issues. The remaining reserve recorded in

the allowance for doubtful accounts is our best estimate of the amount of probable losses in our existing accounts

receivable based on our actual write-off experience. All accounts receivable balances greater than approximately

30 days past the due date are considered delinquent. Delinquent accounts are written off after approximately

30 days.

Receivables from Distributors

Receivables from distributors are amounts due from OEMs and others for prepaid subscriptions.

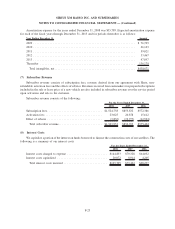

Inventory

Inventory consists of finished goods, refurbished goods, chip sets and other raw material components used in

manufacturing radios. Inventory is stated at the lower of cost, determined on a first-in, first-out basis, or market. We

record an estimated allowance for inventory that is considered slow moving and obsolete or whose carrying value is

in excess of net realizable value. The provision related to products purchased for our direct to consumer distribution

channel is reported as a component of Cost of equipment in our consolidated statements of operations. The

remaining provision is reported as a component of Subscriber acquisition costs in our consolidated statements of

operations.

F-14

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)