XM Radio 2008 Annual Report Download - page 46

Download and view the complete annual report

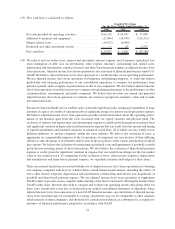

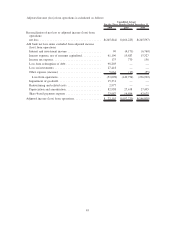

Please find page 46 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.performance of other communications, entertainment and media companies. We believe that investors use

current and projected adjusted income (loss) from operations to estimate our current or prospective enterprise

value and to make investment decisions.

Because we fund and build-out our satellite radio system through the periodic raising and expenditure of large

amounts of capital, our results of operations reflect significant charges for interest and depreciation expense.

We believe adjusted income (loss) from operations provides useful information about the operating perfor-

mance of our business apart from the costs associated with our capital structure and physical plant. The

exclusion of interest and depreciation expense is useful given fluctuations in interest rates and significant

variation in depreciation and amortization expense that can result from the amount and timing of capital

expenditures and potential variations in estimated useful lives, all of which can vary widely across different

industries or among companies within the same industry. We believe the exclusion of taxes is appropriate for

comparability purposes as the tax positions of companies can vary because of their differing abilities to take

advantage of tax benefits and because of the tax policies of the various jurisdictions in which they operate. We

believe the exclusion of restructuring and related costs and impairment of goodwill is useful given the non-

recurring nature of these transactions. We also believe the exclusion of share-based payment expense is useful

given the significant variation in expense that can result from changes in the fair market value of our common

stock. To compensate for the exclusion of taxes, other income (expense), depreciation and amortization and

share-based payment expense, we separately measure and budget for these items.

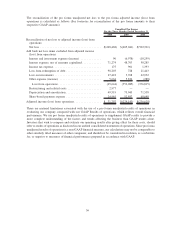

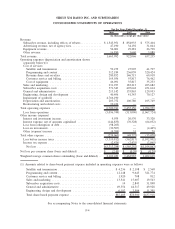

There are material limitations associated with the use of adjusted income (loss) from operations in evaluating

our company compared with net loss, which reflects overall financial performance, including the effects of

taxes, other income (expense), depreciation and share-based payment expense. We use adjusted income (loss)

from operations to supplement GAAP results to provide a more complete understanding of the factors and

trends affecting the business than GAAP results alone. Investors that wish to compare and evaluate our

operating results after giving effect for these costs, should refer to net loss as disclosed in our audited

consolidated statements of operations. Since adjusted income (loss) from operations is a non-GAAP financial

measure, our calculation of adjusted income (loss) from operations may be susceptible to varying calculations;

may not be comparable to other similarly titled measures of other companies; and should not be considered in

isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with

GAAP.

44