XM Radio 2008 Annual Report Download - page 60

Download and view the complete annual report

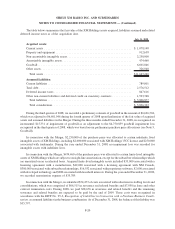

Please find page 60 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equivalents on hand, marketable securities, available borrowings from Liberty Media, and expected cash flows from

operations in 2009 will be sufficient to satisfy our financial obligations through January 2010. Our financial

projections are based on assumptions, which we believe are reasonable, but contain uncertainties as noted above.

Unless otherwise indicated,

• “we,” “us,” “our,” the “company,” “the companies” and similar terms refer to Sirius XM Radio Inc. and its

consolidated subsidiaries;

• “SIRIUS” refers to Sirius XM Radio Inc. and its consolidated subsidiaries, excluding XM Satellite Radio

Holdings Inc. and its consolidated subsidiaries;

• “XM Holdings” refers to XM Satellite Radio Holdings Inc. and its consolidated subsidiaries, including XM

Satellite Radio Inc.; and

• “XM” refers to XM Satellite Radio Inc. and its consolidated subsidiaries.

(2) Principles of Consolidation and Basis of Presentation

Principles of Consolidation

The accompanying consolidated financial statements of Sirius XM Radio Inc. and subsidiaries have been

prepared in accordance with U.S. generally accepted accounting principles. We consolidate variable interest

entities, as defined by Financial Accounting Standards Board (“FASB”) Interpretation (“FIN”) No. 46(R),

Consolidation of Variable Interest Entities, An Interpretation of ARB No. 51, in which we are the primary

beneficiary. All intercompany transactions have been eliminated in consolidation.

Basis of Presentation

In presenting consolidated financial statements, management makes estimates and assumptions that affect the

amounts reported and related disclosures. Additionally, estimates were used when recording the fair values of assets

acquired and liabilities assumed in the Merger. Estimates, by their nature, are based on judgment and available

information. Actual results could differ from those estimates.

The results of XM Holdings’ operations have been included in the accompanying consolidated financial

statements of Sirius XM Radio Inc. from the date of the Merger. Although the effective date of the Merger was

July 28, 2008, due to the immateriality of the results of operations for the period between July 28 and July 31, 2008,

we have accounted for the Merger as if it had occurred on July 31, 2008 with the results and balances of XM

Holdings included as of July 31, 2008.

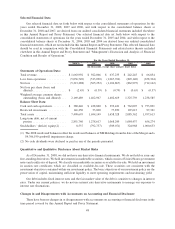

(3) Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles

requires management to make estimates and assumptions that affect the amounts reported and related disclosures.

Significant estimates inherent in the preparation of the accompanying consolidated financial statements

include fair valuations of XM Holdings’ assets and liabilities, revenue recognition, asset impairment, useful lives of

our satellites, share-based payment expense, and valuation allowances against deferred tax assets. The financial

market volatility and poor economic conditions in the U.S. have impacted and will continue to impact our business.

Such conditions could have a material impact to our significant accounting estimates.

F-10

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)