XM Radio 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

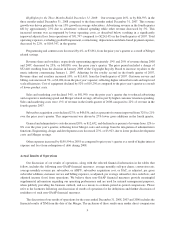

$31,716, as compared to the prior year as a result of lower product costs. Sales and marketing costs declined 17%, or

$70,788, due to reduced advertising and cooperative marketing spend, offset in part by higher customer retention

spending. As a percentage of revenue, sales and marketing costs improved from 20% in 2007 to 14% in 2008.

Subscriber acquisition costs declined nearly 12%, or $77,649, and as a percentage of revenue improved from

32% to 24%. This improvement was primarily driven by a 14% improvement in SAC, as adjusted, per gross

subscriber addition, due to improved product economics and lower retail and OEM subsidies. Subscriber acqui-

sition costs also declined as a result of the 5% decline in gross additions during 2008.

General and administrative costs decreased 2%, or $4,799, and declined as a percent of revenue, reflecting

lower one time costs in connection with the Merger in the prior year and early integration savings in 2008.

Engineering, design and development costs decreased 17%, or $10,407, due to fewer OEM platform launches and

lower product development costs.

Other expenses increased by $159,815 or 72% as compared to 2007 as a result of higher interest expense and

loss from redemption of debt during 2008.

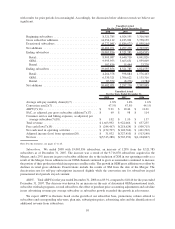

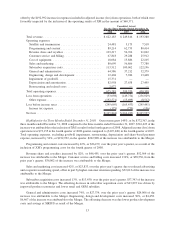

Unaudited Pro Forma Fourth Quarter Subscribers and Metrics:

The following tables contain our pro forma subscribers and key operating metrics for the three months ended

December 31, 2008, 2007 and 2006:

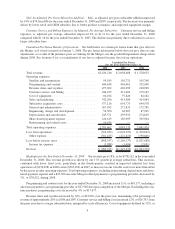

2008 2007 2006

Unaudited Pro Forma

For the Three Months Ended December 31,

Beginning subscribers ........................... 18,920,911 16,234,070 12,305,181

Gross subscriber additions ........................ 1,713,210 2,336,640 2,292,172

Deactivated subscribers .......................... (1,630,265) (1,222,088) (944,246)

Net additions .................................. 82,945 1,114,552 1,347,926

Ending subscribers .............................. 19,003,856 17,348,622 13,653,107

Retail...................................... 8,905,087 9,238,715 8,454,581

OEM...................................... 9,995,953 8,033,268 5,169,372

Rental ..................................... 102,816 76,639 29,154

Ending subscribers .............................. 19,003,856 17,348,622 13,653,107

Retail...................................... (131,333) 314,908 830,153

OEM...................................... 218,249 791,356 535,854

Rental ..................................... (3,971) 8,288 (18,081)

Net additions .................................. 82,945 1,114,552 1,347,926

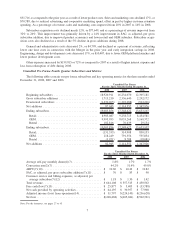

2008 2007 2006

Unaudited Pro Forma

For the Three Months Ended December 31,

Average self-pay monthly churn(1)(7) .................. 1.8% 1.7% 1.7%

Conversion rate(2)(7) .............................. 44.2% 51.4% 49.8%

ARPU(7)(10) .................................... $ 10.60 $ 10.42 $ 10.82

SAC, as adjusted, per gross subscriber addition(7)(11) ...... $ 70 $ 83 $ 90

Customer service and billing expenses, as adjusted, per

average subscriber(7)(12) ......................... $ 1.18 $ 1.30 $ 1.42

Total revenue .................................... $644,108 $ 557,515 $ 450,502

Free cash flow(7)(13) .............................. $ 25,877 $ 5,405 $ (33,788)

Net cash provided by operating activities................ $ 64,195 $ 30,957 $ 77,908

Adjusted income (loss) from operations(14).............. $ 31,797 $(224,143) $(236,628)

Net loss . ....................................... $(248,468) $(405,041) $(502,321)

Note: For the footnotes, see pages 27 to 45

7