XM Radio 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

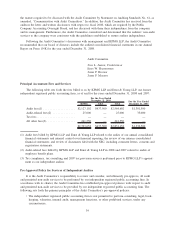

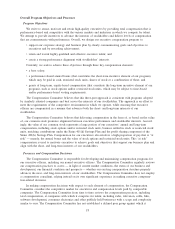

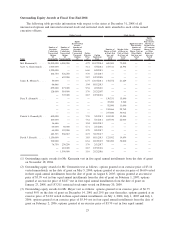

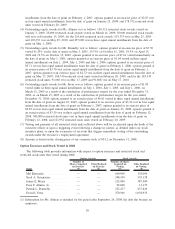

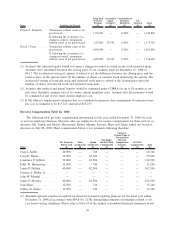

Value of Stock Awards and Option Awards v. FAS 123R Expense (supplemental table)

Market Value as of

12/31/08

2008 Expense as per

SFAS No. 123R

Market Value as of

12/31/08

Expense as per

SFAS No. 123R

Value of Stock Awards Value of Option Awards

Mel Karmazin ........ 72,000 2,832,000 — 24,118,312

James E. Meyer ....... 21,429 272,125 — 1,473,309

Scott A. Greenstein .... 18,398 233,853 — 1,903,228

Dara F. Altman ....... 86,112 198,473 — —

Patrick L. Donnelly .... 34,544 405,135 — 888,476

David J. Frear ........ 50,634 701,985 — 2,027,195

Based on a closing stock price of $0.12 on December 31, 2008. The closing price of our common stock

on April 28, 2009 was $0.39.

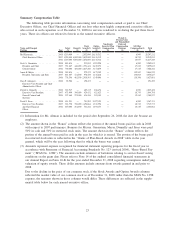

(4) Represents matching and profit sharing contributions by us under our 401(k) savings plan. The profit shar-

ing contribution was $0 in 2008 for each of Messrs. Karmazin, Greenstein, Meyer, Donnelly and Frear.

The matching contributions were paid in the form of shares of our common stock. All other compensation

for Mr. Meyer also includes amounts reimbursed for temporary living and travel expenses. In 2008,

Mr. Meyer was paid $55,000 for rent, $28,571 for travel, $3,905 for utilities, and $58,591 for reimburse-

ment of taxes associated with these expenditures in accordance with his employment agreement. Travel-

related expenses include airfare, taxi/car services, and other incidental travel-related costs which are reim-

bursed based on receipts.

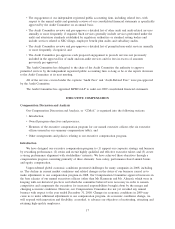

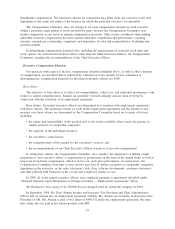

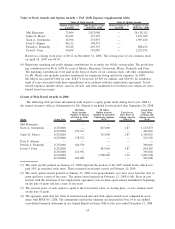

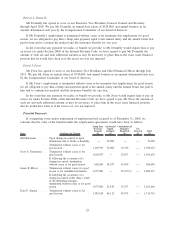

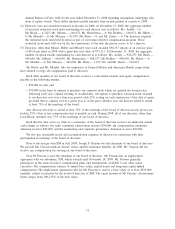

Grants of Plan-Based Awards in 2008

The following table provides information with respect to equity grants made during fiscal year 2008 to

the named executive officers. Information for Ms. Altman is included for the period after September 26, 2008.

Name Grant Date

All Other

Stock Awards:

Number of Shares

of Stock or Units

(#)(1)

All Other

Option Awards:

Number of Securities

Underlying Options

(#)(2)

Exercise or

Base Price of

Option Awards

($/Sh)(3)

Grant Date

Fair Value

of Stock and

Option Awards

($)(4)

Mel Karmazin ........ — — — — —

Scott A. Greenstein .... 1/23/2008 — 607,000 2.87 1,123,873

1/23/2008 153,311 — — 440,003

James E. Meyer ....... 1/23/2008 — 707,000 2.87 1,309,025

1/23/2008 178,572 — — 512,502

Dara F. Altman ....... — — — — —

Patrick L. Donnelly .... 1/23/2008 104,530 — — 300,001

David J. Frear ........ 1/23/2008 — 483,000 2.87 894,285

1/23/2008 121,952 — — 350,002

2/12/2008 — 1,500,000 3.10 3,002,748

2/12/2008 300,000 — — 942,000

(1) The stock awards granted on January 23, 2008 represent the portion of the 2007 annual bonus which was

paid 50% in restricted stock units. These restricted stock units vested on February 20, 2009.

(2) The stock option awards granted on January 23, 2008 vests proportionally over four years from the date of

grant and have a term of ten years. The option award granted on February 12, 2008 to Mr. Frear in con-

nection with the extension of his employment agreement vests in three equal annual installments beginning

on the date of grant and has a term of ten years.

(3) The exercise price of each option is equal to the fair market value, or closing price, of our common stock

on the date of grant.

(4) The aggregate grant date fair value of restricted stock unit and stock option awards were computed in accor-

dance with SFAS No. 123R. The assumptions used in the valuation are discussed in Note 14 to our audited

consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2008.

24