XM Radio 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 ANNUAL REPORT

AND PROXY STATEMENT

TABLE OF CONTENTS

Annual Report

Letter to Stockholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Management’s Discussion and Analysis of Financial

Condition and Results of Operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of

Equity Securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Comparison of Cumulative Total Returns . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Selected Financial Data. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Quantitative and Qualitative Disclosure About Market

Risks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Reports of Independent Registered Public Accounting

Firm ................................................... F-1

Consolidated Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F-4

Notes to Consolidated Financial Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . F-9

Notice of Annual Meeting of Stockholders

and Proxy Statement

Table of contents

-

Page 1

2008 AND ANNUAL PROXY REPORT S TAT E M E N T TA B L E O F C O N T E N T S Annual Report Letter to Stockholders ...Management's Discussion and Analysis of Financial Condition and Results of Operations ...Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of ... -

Page 2

-

Page 3

... through one device. The SIRIUS and XM $12.95 per month packages remain our most popular options and, for pennies a day, continue to be a great value. Significantly, many of these new packages are offered at prices that are below our standard subscription rates. As many consumers are becoming... -

Page 4

... is in the car, home, office or while on the go, as consumer confidence returns and spending increases, we believe that SIRIUS XM is well-poised for success. Given the new reality we are operating in, when measured by subscribers, we are still one of the largest subscription media businesses in the... -

Page 5

... of the July 2008 merger with XM Holdings may not be fully realized or may take longer to realize; and the risks associated with the undertakings made to the FCC and the effects of those undertakings on the business of XM and SIRIUS in the future; • the useful life of our satellites, which have... -

Page 6

...-installed equipment in their vehicles. SIRIUS and XM radios are also offered to customers of rental car companies, including Hertz and Avis. As of December 31, 2008, we had 19,003,856 subscribers. Our subscriber totals include subscribers under our regular pricing plans; discounted pricing plans... -

Page 7

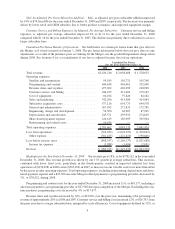

...self-pay monthly churn(1)(7) ...Conversion rate(2)(7) ...ARPU(3)(7) ...SAC, as adjusted, per gross subscriber addition(4)(7) ...Customer service and billing expenses, as adjusted, per average subscriber(5)(7) ...Total revenue...Free cash flow(6)(7) ...Net cash used in operating activities...Adjusted... -

Page 8

... Forma For the Years Ended December 31, 2008 2007 2006 Total revenue...Operating expenses: Satellite and transmission ...Programming and content...Revenue share and royalties ...Customer service and billing ...Cost of equipment ...Sales and marketing ...Subscriber acquisition costs ...General and... -

Page 9

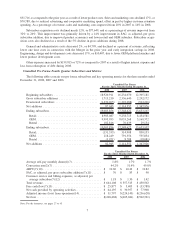

... self-pay monthly churn(1)(7) ...Conversion rate(2)(7) ...ARPU(7)(10) ...SAC, as adjusted, per gross subscriber addition(7)(11) ...Customer service and billing expenses, as adjusted, per average subscriber(7)(12) ...Total revenue ...Free cash flow(7)(13) ...Net cash provided by operating activities... -

Page 10

... For the Three Months Ended December 31, 2008 2007 2006 Total revenue ...Operating expenses: Satellite and transmission ...Programming and content ...Revenue share and royalties ...Customer service and billing ...Cost of equipment...Sales and marketing ...Subscriber acquisition costs ...General and... -

Page 11

... information in the tables that follow, includes the following non-GAAP financial measures: average monthly self-pay churn; conversion rate; average monthly revenue per subscriber, or ARPU; subscriber acquisition cost, or SAC, as adjusted, per gross subscriber addition; customer service and billing... -

Page 12

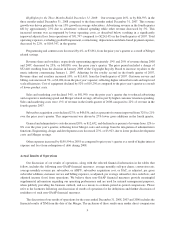

... incorporates satellite radio. The growth in OEM gross additions was offset by declines in retail gross additions. Deactivations include the results of XM from the date of the Merger. The deactivation rate for self-pay subscriptions increased slightly while the conversion rate for subscribers in... -

Page 13

...the costs of subsidized components of SIRIUS and XM radios decrease in the future. Our SAC, as adjusted, per gross subscriber addition will continue to be impacted by our increasing mix of OEM additions. Customer Service and Billing Expenses, As Adjusted, Per Average Subscriber. Customer service and... -

Page 14

...the prior year. Deactivations include the results of the XM business in the current quarter. Deactivations for self-pay subscriptions remained relatively consistent at 1.8% per month; non-conversions of subscribers in paid promotional trial periods increased as production penetration rates increased... -

Page 15

... For the Three Months Ended December 31, 2008 2007 2006 Total revenue ...Operating expenses: Satellite and transmission ...Programming and content ...Revenue share and royalties ...Customer service and billing ...Cost of equipment...Sales and marketing ...Subscriber acquisition costs ...General and... -

Page 16

...Total Revenue Subscriber Revenue. Subscriber revenue includes subscription fees, activation fees and the effects of rebates. • 2008 vs. 2007: For the years ended December 31, 2008 and 2007, subscriber revenue was $1,543,951 and $854,933, respectively, an increase of 81% or $689,018. The Merger was... -

Page 17

...Residuals are monthly fees paid based upon the number of subscribers using SIRIUS and XM radios purchased from retailers. Advertising revenue share is recorded to revenue share and royalties in the period the advertising is broadcast. • 2008 vs. 2007: For the years ended December 31, 2008 and 2007... -

Page 18

... primarily due to the Merger. XM's customer services and billing expense accounted for $59,821 during the year ended December 31, 2008. The remaining increase was primarily attributed to higher call center operating costs necessary to accommodate the increase in our subscriber base and higher total... -

Page 19

...SIRIUS or XM radio and a prepaid subscription to our service in the sale or lease price of a new vehicle; subsidies paid for chip sets and certain other components used in manufacturing radios; commissions paid to retailers and automakers as incentives to purchase, install and activate SIRIUS and XM... -

Page 20

... attributable to reduced OEM tooling and manufacturing upgrades associated with the factory installation of SIRIUS radios in additional vehicle models offset by higher employment related costs. Sharebased payment expense decreased $7,811 primarily due to the timing of third parties achieving... -

Page 21

... are stated in thousands: 2008 2007 2006 2008 vs. 2007 2007 vs. 2006 For the year ended December 31, 2008, loss on investment was $30,507 and $0, For the years ended December 31, 2006, loss on investment was $0 and $4,445, Cash flows used in operating activities ...Cash flows provided by (used in... -

Page 22

...: Net cash provided by financing activities increased $222,564 to $248,351 for the year ended December 31, 2007 from $25,787 for the year ended December 31, 2006. The increase was a result of additional proceeds, net of related costs and principal repayments, from the SIRIUS term loan entered into... -

Page 23

... consolidated financial statements included elsewhere in this Annual Report and Proxy Statement for additional information on certain of these transactions. Credit Agreement with Space Systems/Loral. In July 2007, SIRIUS amended and restated its Credit Agreement with Space Systems/Loral (the "Loral... -

Page 24

... Long-Term Stock Incentive Plan SIRIUS maintains the Sirius Satellite Radio 2003 Long-Term Stock Incentive Plan (the "2003 Plan"). Employees, consultants and members of our board of directors are eligible to receive awards under the 2003 Plan. The 2003 Plan provides for the grant of stock options... -

Page 25

... price equal to the market price of our common stock at the date of grant and expire no later than ten years from the date of grant. In connection with the Merger, the shares available for future grant under the Talent Plan were adjusted using a conversion factor of 4.6 SIRIUS shares for 1 XM share... -

Page 26

... of our board of directors, as critical to our business and understanding our results of operations. Fair Value of XM Assets Acquired and Liabilities Assumed. On July 28, 2008, our wholly owned subsidiary Vernon Merger Corporation merged (the "Merger") with and into XM Satellite Radio Holdings Inc... -

Page 27

... service period upon activation and sale to a customer. We also reimburse certain automakers for certain costs associated with the installation of certain satellite radios at the time the vehicle is manufactured. The associated payments to the automakers are included in subscriber acquisition costs... -

Page 28

... based on assumptions used for the expected life, expected stock price volatility and risk-free interest rates. We estimated the fair value of awards granted during the years ended December 31, 2008, 2007 and 2006 using the implied volatility of actively traded options on our stock. We believe that... -

Page 29

... of subscribers that receive our service and convert to self-paying after the initial promotion period. We refer to this as the "conversion rate." At the time of sale, vehicle owners generally receive between three and twelve month prepaid trial subscriptions and we receive a subscription fee from... -

Page 30

...in the fair market value of our common stock, the effect of which is unrelated to the operational conditions that give rise to variations in the components of our subscriber acquisition costs and customer service and billing expenses. Specifically, the exclusion of share-based payment expense in our... -

Page 31

...and related costs and impairment of goodwill is useful given the non-recurring nature of these transactions. We also believe the exclusion of share-based payment expense is useful given the significant variation in expense that can result from changes in the fair market value of our common stock. To... -

Page 32

... in evaluating our company compared with our GAAP Results of operations, which reflects overall financial performance. We use pro forma unadjusted results of operations to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP... -

Page 33

...,411 $ (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing ...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering, design... -

Page 34

...247,633) $ (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing ...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering... -

Page 35

...739) $ (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering, design... -

Page 36

... Forma For the Three Months Ended December 31, 2008 2007 2006 Customer service and billing expenses ...Less: share-based payment expense ...Customer service and billing expenses, as adjusted ...Daily weighted average number of subscribers ...Customer service and billing expenses, as adjusted, per... -

Page 37

... as follows: Unaudited Pro Forma For the Three Months Ended December 31, 2008 2007 2006 Net cash provided by operating activities ...Additions to property and equipment ...Merger related costs ...Restricted and other investment activity ... ...$ 64,195 ...(27,846) ...(10,472) ...- $ 30,957... -

Page 38

... in evaluating our company compared with our GAAP Results of operations, which reflects overall financial performance. We use pro forma unadjusted results of operations to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP... -

Page 39

...: Unaudited for the Three Months Ended December 31, 2008 Allocation of Purchase Price Share-based Accounting Payment As Reported Adjustments(a) Expense Pro Forma Revenue: Subscriber revenue, including effects of rebates . Advertising revenue, net of agency fees ...Equipment revenue ...Other revenue... -

Page 40

... $(405,041) $ (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing ...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering... -

Page 41

... $(502,321) $ (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing ...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering... -

Page 42

... (31,898) 8,435 $ 428,151 3,758,159 $ 114 (18) Customer service and billing expenses, as adjusted, per average subscriber is derived from total customer service and billing expenses, excluding share-based payment expense, divided by the number of months in the period, divided by the daily weighted... -

Page 43

...cash flow is calculated as follows: Unaudited Actual For the Years Ended December 31, 2008 2007 2006 Net cash used in operating activities ...Additions to property and equipment ...Merger related costs ...Restricted and other investment activity...Free cash flow ... $(152,797) (130,551) (23,519) 62... -

Page 44

... by the number of months in the period, divided by the daily weighted average number of subscribers for the period. ARPU is calculated as follows (in thousands, except for per subscriber amounts): Unaudited Actual For the Three Months Ended December 31, 2008 2007 2006 Subscriber revenue ...$ Net... -

Page 45

... Months Ended December 31, 2008 2007 2006 Customer service and billing expenses ...$ Less: share-based payment expense...Customer service and billing expenses, as adjusted ...$ 67,818 (783) 67,035 $ $ 29,288 (165) 29,123 $ $ 25,912 (167) 25,745 Daily weighted average number of subscribers... -

Page 46

... and related costs and impairment of goodwill is useful given the nonrecurring nature of these transactions. We also believe the exclusion of share-based payment expense is useful given the significant variation in expense that can result from changes in the fair market value of our common stock. To... -

Page 47

...calculated as follows: Unaudited Actual For the Three Months Ended December 31, 2008 2007 2006 Reconciliation of net loss to adjusted...operations ...Impairment of goodwill...Restructuring and related costs ...Depreciation and amortization ...Share-based payment expense ...Adjusted income (loss) from ... -

Page 48

... and Issuer Purchases of Equity Securities Our common stock is traded on the Nasdaq Global Select Market under the symbol "SIRI." The following table sets forth the high and low sales price for our common stock, as reported by Nasdaq, for the periods indicated below: High Low Year ended December... -

Page 49

... from December 31, 2003 to December 31, 2008. The graph assumes that $100 was invested on December 31, 2003 in each of our common stock, the S&P 500 and the NASDAQ Telecommunications Index and that all dividends were reinvested. $300 Sirius XM Radio Inc. S&P 500 Index NASDAQ Telecommunications Index... -

Page 50

... thereto included elsewhere in this Annual Report and Proxy Statement and "Management's Discussion and Analysis of Financial Condition and Results of Operations." 2008(1) For the Years Ended December 31, 2007 2006 2005 (In thousands, except share and per share data) 2004 Statements of Operations... -

Page 51

... material respects, the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Sirius XM Radio Inc. and subsidiaries' internal control over financial reporting as of December 31, 2008, based on criteria... -

Page 52

... also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Sirius XM Radio Inc. and subsidiaries as of December 31, 2008, and the related consolidated statements of operations, stockholders' equity (deficit... -

Page 53

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders of Sirius XM Radio Inc. (formerly Sirius Satellite Radio Inc.) and Subsidiaries: We have audited the accompanying consolidated balance sheet of Sirius XM Radio Inc. and Subsidiaries as of December 31, ... -

Page 54

...,619 (1) Amounts related to share-based payment expense included in operating expenses were as follows: Satellite and transmission ...Programming and content ...Customer service and billing ...Sales and marketing ...Subscriber acquisition costs ...General and administrative ...Engineering, design... -

Page 55

SIRIUS XM RADIO INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS As of December 31, 2008 2007 (In thousands, except share and per share data) ASSETS Current assets: Cash and cash equivalents ...Accounts receivable, net of allowance for doubtful respectively ...Receivables from distributors...... -

Page 56

SIRIUS XM RADIO INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) AND COMPREHENSIVE LOSS Series A Convertible Preferred Stock Shares Amount Total Accumulated Stockholders' Other Additional Common Stock Equity Paid-in Deferred Accumulated Comprehensive Shares Amount ... -

Page 57

... stock-based awards ...- Conversion of XM Satellite Radio Holdings outstanding warrants . . - Exercise of options, $1.45 to $3.36 per share ...- Exercise of warrants, $2.392 per share ...- Exercise of XM Satellite Radio Holdings outstanding warrants . . Exchange of 31â„2% Convertible Notes due 2008... -

Page 58

...cash ...Merger related costs ...Purchase of available-for-sale securities ...Sale of restricted and other investments ...Net cash provided by (used in) investing activities ...Cash flows from financing activities: Proceeds from exercise of warrants and stock options and from share borrow arrangement... -

Page 59

...to offer SIRIUS or XM satellite radios as factory or dealer-installed equipment in their vehicles. SIRIUS and XM radios are also offered to customers of rental car companies, including Hertz and Avis. Our subscriber totals include subscribers under our regular pricing plans; discounted pricing plans... -

Page 60

..., asset impairment, useful lives of our satellites, share-based payment expense, and valuation allowances against deferred tax assets. The financial market volatility and poor economic conditions in the U.S. have impacted and will continue to impact our business. Such conditions could have... -

Page 61

... service period, upon activation and sale to a customer. We reimburse automakers for certain costs associated with the satellite radio installed in the applicable vehicle at the time the vehicle is manufactured. The associated payments to the automakers are included in Subscriber acquisition costs... -

Page 62

... options, restricted stock and restricted stock units. The share-based payment expense recognized includes compensation cost for all stock-based awards granted to employees and members of our board of directors (i) prior to, but not vested as of January 1, 2006, based on the grant date fair value... -

Page 63

... subscription to our service in the sale or lease price of a new vehicle; subsidies paid for chip sets and certain other components used in manufacturing radios; device royalties for certain radios; commissions paid to retailers and automakers as incentives to purchase, install and activate radios... -

Page 64

...common stock equivalents (convertible debt and preferred stock, warrants, stock options and restricted stock shares and units) were exercised or converted into common stock. Common stock equivalents of approximately 787,000,000, 165,000,000 and 194,000,000 for the years ended December 31, 2008, 2007... -

Page 65

... management's assumptions about the inputs used for pricing the asset or liability. We use Level 3 inputs to fair value our investments in auction rate certificates issued by student loan trusts and the 8% convertible unsecured subordinated debentures issued by XM Canada. These investments are not... -

Page 66

... to secure two satellite launches on Proton rockets. This agreement with International Launch Services allows SIRIUS the flexibility to defer the second of these launch dates and to cancel either launch upon payment of a cancellation fee. We operate four in-orbit satellites in our XM system, two of... -

Page 67

...in the financial statements on at least an annual basis, until January 1, 2009 for calendar year end entities. In October 2008, the FASB issued FSP 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active, which provides a detailed example to illustrate key... -

Page 68

... should account for costs incurred and revenue generated on sales to third parties, how sharing payments pursuant to a collaboration agreement should be presented in the income statement and certain related disclosure requirements. This EITF is effective for the first annual or interim reporting... -

Page 69

... stock options ...Fair value of restricted stock issued to XM Holdings restricted stockholders ...Fair value of converted warrants...Acquisition costs ... ...$5,460,853 ...47,095 ...94,616 ...66,628 ...115,784 ...51,387 Total ...$5,836,363 SFAS No. 141 requires that the total purchase price... -

Page 70

... connection with the Merger, $2,250,000 of the purchase price was allocated to certain indefinite lived intangible assets of XM Holdings, including $2,000,000 associated with XM Holdings' FCC license and $250,000 associated with trademarks. During the year ended December 31, 2008, no impairment loss... -

Page 71

... at least annually or more frequently if indicators of impairment exist. The price of our common stock declined significantly from February 19, 2007, the measurement date for valuation of the Merger through December 31, 2008, indicating a potential impairment. Under SFAS No. 142, the fair value of... -

Page 72

... their use. We hold FCC licenses to operate a satellite digital audio radio service and provide ancillary services. SIRIUS' FCC license for most of its satellites expires in 2010 and the licenses for one of its new satellites expires eight years after SIRIUS certifies the satellite is operating; XM... -

Page 73

... in the sale or lease price of a new vehicle are also included in subscriber revenue over the service period upon activation and sale to the customer. Subscriber revenue consists of the following: For the Years Ended December 31, 2008 2007 2006 Subscription fees ...Activation fees ...Effect of... -

Page 74

...In January 2008, we entered into an agreement with International Launch Services to secure two additional satellite launches on Proton rockets. This agreement provides us the flexibility to defer the second of these launch dates and to cancel either launch upon payment of a cancellation fee. XM owns... -

Page 75

... 2005, XM entered into agreements to provide XM Canada with the right to offer XM satellite radio service in Canada. The agreements have an initial term of ten years and XM Canada has the unilateral option to extend the term of the agreements for an additional five years at no additional cost beyond... -

Page 76

... hold shares of our stock and have one representative each on our board of directors. GM and American Honda install XM radios and promote the XM radio service, and XM will make available use of bandwidth. Subscription revenues received from GM and American Honda for these programs are reported as... -

Page 77

... Under SFAS No. 157, we used a Level 1 input, consisting of the quoted market price of shares of XM Canada, to value our investment in XM Canada. In addition, XM Holdings holds an investment in Cdn$4,000 face value of 8% convertible unsecured subordinated debentures issued by XM Canada for which the... -

Page 78

...1.25%. As of December 31, 2008, the interest rate was 5.44%. LIBOR borrowings may be made for interest periods, at our option, of one, two, three or six months (or, if agreed by all of the lenders, nine or twelve months). The SIRIUS Term Loan amortizes in equal quarterly installments of 0.25% of the... -

Page 79

... (the "31â„4% Notes") resulting in net proceeds, after debt issuance costs, of $224,813. The 31â„4% Notes are convertible, at the option of the holder, into shares of our common stock at any time at a conversion rate of 188.6792 shares of common stock for each $1,000 principal amount, or $5.30 per... -

Page 80

... by SIRIUS or Satellite CD Radio, Inc. Interest is payable semi-annually in arrears on June 1 and December 1 of each year at a rate of 7% per annum. The Exchangeable Notes mature on December 1, 2014. The Exchangeable Notes are exchangeable at any time at the option of the holder into shares of... -

Page 81

... Interest is payable semi-annually at a rate of 10% per annum. The 10% Convertible Notes mature on December 1, 2009. The 10% Convertible Notes may be converted by the holder, at its option, into shares of our common stock at a conversion rate of 92.0 shares of our common stock per $1,000 principal... -

Page 82

... Credit Agreement, the SIRIUS Term Loan and the XM Term Loan could become immediately payable and the Loral Credit Agreement could be terminated. At December 31, 2008, we were in compliance with all such covenants. (13) Stockholders' Equity Common Stock, par value $0.001 per share At our annual... -

Page 83

... sell SIRIUS radios. In connection with this agreement, we issued RadioShack warrants to purchase up to 10,000,000 shares of our common stock. These warrants have an exercise price of $5.00 per share and vest and become exercisable if RadioShack achieves activation targets during the five-year term... -

Page 84

... warrants to purchase shares of our common stock, respectively, were issued to consultants and are included in our stock option activity. Share Lending Agreements To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements with Morgan Stanley Capital Services Inc... -

Page 85

... market price of our common stock at the date of grant and expire no later than ten years from the date of grant. In connection with the Merger, the shares available for future grant under the Talent Plan were adjusted using a conversion factor of 4.6 SIRIUS shares for each XM Holdings share. Since... -

Page 86

... to compute reported share-based payment expense to employees and members of our board of directors for the periods set forth below: For the Years Ended December 31, 2008 2007 2006 Risk-free Expected Expected Expected interest rate ...life of options - years ...stock price volatility ...dividend... -

Page 87

SIRIUS XM RADIO INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes stock option activity under our share-based payment plans for the year ended December 31, 2008 (shares in thousands): WeightedAverage Exercise Price WeightedAverage Remaining... -

Page 88

SIRIUS XM RADIO INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes the non-vested restricted stock and restricted stock unit activity under our share-based payment plans for the year ended December 31, 2008 (shares in thousands): ... -

Page 89

... to the profit sharing portion of the Sirius Plan based upon the total compensation of eligible participants. These additional contributions, referred to as profit-sharing contributions, are determined by the compensation committee of our board of directors. SIRIUS employees are only eligible... -

Page 90

...31, 2008 and 2007, respectively, is primarily a result of the deferred tax liability recorded as part of the purchase price accounting for the value assigned ...ability to utilize tax deductions. As a result of the Merger, both SIRIUS and XM had a Section 382 ownership change. The ownership change does... -

Page 91

... with International Launch Services to secure two additional satellite launches on Proton rockets. This agreement provides SIRIUS with the flexibility to defer the second launch date if it chooses, and the ability to cancel either of these launches upon payment of a cancellation fee. XM Holdings has... -

Page 92

...additional $10,000 if XM-4 continues to operate above baseline specifications during the five years beyond the satellite's fifteen year design life. Programming and Content. We have entered into various programming agreements. Under the terms of these agreements, we are obligated to provide payments... -

Page 93

... In January 2008, the Copyright Royalty Board, or CRB, of the Library of Congress issued its decision regarding the royalty rate payable by XM and SIRIUS under the statutory license covering the performance of sound recordings over their satellite digital audio radio services for the six-year period... -

Page 94

... diluted) does not necessarily agree to the net loss per share for the year due to the timing of our common stock issuances. (18) Condensed Consolidating Financial Information Sirius Asset Management, LLC and Satellite CD Radio, Inc. (collectively, the "Guarantor Subsidiaries") are our wholly owned... -

Page 95

...2008 Sirius XM Radio Inc. Sirius Asset Satellite CD Mgmt LLC Radio Non Guarantors Eliminations Consolidated Sirius XM Radio Inc. Current assets: Cash and cash equivalents ...Accounts...fees......Other long-term liabilities ... ...stock ...Capital stock ...Accumulated other comprehensive income Additional... -

Page 96

... CONSOLIDATING BALANCE SHEETS AS OF DECEMBER 31, 2007 Sirius XM Radio Inc. Consolidated Sirius Asset Satellite CD NonSirius Mgmt LLC Radio Guarantors Eliminations XM Radio Inc. Current assets: Cash and cash equivalents ...Accounts receivable, net ...Due from subsidiaries/affiliates . Inventory, net... -

Page 97

...CONSOLIDATING STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2008 Sirius XM Radio Inc. Sirius Asset Satellite CD Mgmt LLC Radio NonGuarantors Eliminations Consolidated Sirius XM Radio Inc. Revenue ...$ 1,151,906 Cost of services...Sales and marketing ...Subscriber acquisition costs ...General and... -

Page 98

... STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2007 Sirius XM Radio Inc. Consolidated Sirius Asset Satellite CD NonSirius Mgmt LLC Radio Guarantors Eliminations XM Radio Inc. Revenue ...$ 922,067 Cost of services...Sales and marketing ...Subscriber acquisition costs ...General and administrative... -

Page 99

... STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2006 Sirius XM Radio Inc. Consolidated Sirius Asset Satellite CD NonSirius Mgmt LLC Radio Guarantors Eliminations XM Radio Inc. Revenue ...$ Cost of services ...Sales and marketing ...Subscriber acquisition costs ...General and administrative... -

Page 100

... XM Satellite Radio Holdings Stockholders ...Employees and employees benefit plans ...Share borrow agreements ...Series A convertible preferred ...Share-based payment expense ...Conversion of XM Satellite vested stock awards...Conversion of XM Satellite outstanding stock awards...Exercise of options... -

Page 101

... FLOWS YEAR ENDED DECEMBER 31, 2008 Sirius XM Radio Inc. Sirius Asset Satellite CD Mgmt LLC Radio NonGuarantors Consolidated Sirius Eliminations XM Radio Inc. Net cash (used in) provided by operating activities ...Cash flows from investing activities: Additions to property and equipment ...Sales of... -

Page 102

... LLC CD Radio Non-Guarantors Eliminations Consolidated Sirius XM Radio Inc. Net cash (used in) provided by operating activities ...$(156,500) Cash flows from investing activities: Additions to property and equipment ...(64,788) Sales of property and equipment ...641 Merger related costs ...(29,444... -

Page 103

... CASH FLOWS YEAR ENDED DECEMBER 31, 2006 Sirius XM Radio Inc. Sirius Asset Satellite Mgmt LLC CD Radio Non-Guarantors Eliminations Consolidated Sirius XM Radio Inc. Net cash (used in) provided by operating activities ...$(425,390) $ 4,424 Cash flows from investing activities: Additions to property... -

Page 104

... with the Sirius Credit Agreement. In addition, we will pay a commitment fee of 2.0% per annum on the unused portion of the purchase money loan facility. The loans under the Sirius Credit Agreement are guaranteed by Satellite CD Radio, Inc. and Sirius Asset Management Company LLC, SIRIUS' wholly... -

Page 105

... of the Preferred Stock XM Credit Agreement. On February 17, 2009, XM Satellite Radio Inc. entered into a Credit Agreement (the "XM Credit Agreement") with Liberty Media Corporation, as administrative agent and collateral agent. The XM Credit Agreement provides for a $150,000 term loan. On March... -

Page 106

... Indenture On March 6, 2009, XM executed and delivered a Third Supplemental Indenture (the "XM 9.75% Notes Supplemental Indenture"), dated as of March 6, 2009, by and among XM, XM Holdings, XM Equipment Leasing LLC, XM Radio Inc. and The Bank of New York Mellon, as trustee, which supplements... -

Page 107

... July 31, 2008, among XM Escrow LLC and The Bank of New York Mellon, as trustee, relating to the 13% Senior Notes due 2014 (the "XM 13% Notes"), the maturity of the XM 13% Notes changes from August 1, 2014 to August 1, 2013 when certain conditions have been satisfied. Following the execution of the... -

Page 108

SIRIUS XM RADIO INC. AND SUBSIDIARIES Schedule II - Schedule of Valuation and Qualifying Accounts Description Balance January 1, Write-offs/ Payments/ Charged to Expenses Other (In thousands) Balance December 31, 2006 Allowance for doubtful accounts...purchase price in connection with the Merger F-58 -

Page 109

... 30, 2010 from December 31, 2009. 4. Approve the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan. 5. Ratify the appointment of KPMG LLP as our independent registered public accountants for 2009. 6. Transact any other business, including consideration of one stockholder proposal, that may... -

Page 110

-

Page 111

... and who will pay the costs of the solicitation? ...When, and how, do I submit a proposal for next year's annual meeting of stockholders? ...STOCK OWNERSHIP ...Who are the principal owners of SIRIUS XM's stock? ...How much stock do the directors and executive officers of SIRIUS XM own? ...Section 16... -

Page 112

... INCORPORATION TO EFFECT A REVERSE STOCK SPLIT AND TO REDUCE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK ...ITEM 4 - APPROVAL OF THE SIRIUS XM RADIO INC. 2009 LONG-TERM STOCK INCENTIVE PLAN ...ITEM 5 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS ...ITEM 6 - STOCKHOLDER PROPOSAL... -

Page 113

.... A copy of our Annual Report on Form 10-K for the year ended December 31, 2008, as filed with the Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written request to Sirius XM Radio Inc., Attention: Corporate Secretary, 1221 Avenue of... -

Page 114

..., in person or by proxy, and entitled to vote at the annual meeting is required to ratify the appointment of KPMG LLP as our independent registered public accountants, to approve the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan and to act upon any other matter that may properly come... -

Page 115

... New York City time. What constitutes a quorum? The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of our common stock, our Series A Convertible Preferred Stock and our Series B-1 Preferred Stock entitled to vote at the annual... -

Page 116

... and annual report to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies for this year or future years should be directed to: Sirius XM Radio Inc., Attention: Corporate Secretary, 1221 Avenue of the Americas, 36th Floor, New York, New York 10020... -

Page 117

... of business on March 9, 2010. Notices of intention to present proposals at next year's annual meeting should be addressed to Patrick L. Donnelly, Executive Vice President, General Counsel and Secretary, Sirius XM Radio Inc., 1221 Avenue of the Americas, 36th Floor, New York, New York 10020. STOCK... -

Page 118

... much stock do the directors and executive officers of SIRIUS XM own? The following table shows the number of shares of common stock beneficially owned by each of our directors, our Chief Executive Officer, our Chief Financial Officer and the four other most highly compensated executive officers as... -

Page 119

...Vice President and Chief Accounting Officer, in connection with the sale of certain common stock to pay federal and state taxes associated with the vesting of restricted stock in December 2008. Shareholder Rights Plan On April 28, 2009, our board of directors adopted a rights plan to protect against... -

Page 120

... are the responsibilities of the board of directors? The business and affairs of our company are managed by or under the direction of our board of directors. Our board reviews and ratifies senior management selection and compensation, monitors overall corporate performance and ensures the integrity... -

Page 121

..., including stockholders, for possible Common Stock Directors. Such suggestions, together with appropriate biographical information, should be submitted to our Corporate Secretary, Sirius XM Radio Inc., 1221 Avenue of the Americas, 36th Floor, New York, New York 10020. Candidates who are suggested... -

Page 122

...each of whom is an employee of Liberty Media Corporation. With respect to Joan L. Amble, the board evaluated ordinary course transactions during the last three fiscal years between us and the American Express Company, for which she serves as an executive officer, and found that the amount paid by us... -

Page 123

... XM radios become subscribers to XM's service. XM must also share with GM a percentage of the subscription revenue attributable to GM vehicles with installed XM radios. As part of the agreement, GM provides certain call-center related services directly to XM subscribers who are also GM customers... -

Page 124

... in connection with the Sirius Credit Agreement. In addition, we pay a commitment fee of 2% per annum on the unused portion of the purchase money loan facility. The loans under the Sirius Credit Agreement are guaranteed by Satellite CD Radio, Inc. and Sirius Asset Management Company LLC, our wholly... -

Page 125

... Agreement, XM may borrow $150 million of term loans on December 1, 2009. The proceeds of these loans will be used to repay a portion of the 10% Convertible Notes due 2009 of our wholly-owned subsidiary, and the parent of XM, XM Satellite Radio Holdings Inc. ("XM Holdings") on the stated maturity... -

Page 126

... by employees of concerns regarding questionable accounting or auditing matters. These procedures are available upon request. Does SIRIUS XM have corporate governance guidelines and a code of ethics? Our board of directors has adopted Corporate Governance Guidelines which set forth a flexible... -

Page 127

... of our board of directors. The following report concerns the Audit Committee's activities regarding oversight of our financial reporting and auditing process. The Audit Committee is comprised solely of independent directors, as defined in the Marketplace Rules of the NASDAQ Global Select Market and... -

Page 128

... that our board of directors include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2008. Audit Committee JOAN L. AMBLE, CHAIRWOMAN EDDY W. HARTENSTEIN JAMES P. HOLDEN JAMES F. MOONEY Principal Accountant Fees and Services The... -

Page 129

... executives for increased responsibilities brought about by the merger and changing economic conditions. However, our Compensation Committee has not yet awarded any annual bonuses with respect to the year ended December 31, 2008. Changes in economic conditions in 2009 may cause us to make additional... -

Page 130

... proportion of pay that is "at risk" - namely, the annual bonus and the value of stock options and restricted stock units. This "at risk" compensation is used to motivate executives to achieve goals and objectives that support our business plan and align with the short- and long-term interests of... -

Page 131

..., reporting structure, internal pay relationship, complexity and importance of roles and responsibilities, leadership and growth potential. In determining compensation element levels, including the annual grants of restricted stock units and stock options, for each named executive officer (other... -

Page 132

... price increases. Restricted stock units have value on the date of grant. Restricted stock units are affected by all stock price changes, so the value to named executive officers is affected by both increases and decreases in our stock price. Our long-term incentive program calls for stock options... -

Page 133

Ms. Altman became an executive officer in September 2008, following our merger with XM, and did not receive a long-term incentive award from us during 2008. As a result of the decline in the price of our common stock, none of our executive officers hold any stock options that are "in-the-money." The... -

Page 134

... Chief Executive Officer In November 2004, our board of directors negotiated, and we entered into, a five-year employment agreement with Mel Karmazin to serve as our Chief Executive Officer. The material terms of Mr. Karmazin's employment agreement are described below under "Potential Payments Upon... -

Page 135

... as of December 31, 2008 for services rendered to us during the past three fiscal years. These six officers are referred to herein as the named executive officers. Change in Pension Value and Nonqualified Deferred Non-Equity All Other Stock Option Incentive Plan Compensation Earnings Compensation... -

Page 136

...fiscal year 2008 to the named executive officers. Information for Ms. Altman is included for the period after September 26, 2008. All Other Stock Awards: Number of Shares of Stock or Units (#)(1) All Other Option Awards: Number of Securities Underlying Options (#)(2) Exercise or Base Price of Option... -

Page 137

..., 2008 of all unexercised options and unvested restricted stock and restricted stock units awarded to each of the named executive officers. Option Awards Stock Awards Equity Incentive Plan Awards: Equity Incentive Market or Plan Awards: Payout Value Number of of Unearned Unearned Market Value Shares... -

Page 138

... closing price of our common stock of $0.12 on December 31, 2008. Option Exercises and Stock Vested in 2008 The following table provides information with respect to option exercises and restricted stock and restricted stock units that vested during 2008. Option Awards Number of Shares Acquired Value... -

Page 139

... as our Chief Executive Officer. We pay Mr. Karmazin an annual salary of $1,250,000, and annual bonuses in an amount determined each year by the Compensation Committee of our board of directors. Pursuant to our agreement with Mr. Karmazin, his stock options and shares of restricted stock will vest... -

Page 140

... into a three year employment agreement with Dara F. Altman to serve as our Executive Vice President and Chief Administrative Officer. We pay Ms. Altman an annual salary of $446,332, and annual bonuses in an amount determined each year by the Compensation Committee of our board of directors. If Ms... -

Page 141

... has agreed to serve as our Executive Vice President and Chief Financial Officer through July 2011. We pay Mr. Frear an annual salary of $750,000, and annual bonuses in an amount determined each year by the Compensation Committee of our board of directors. If Mr. Frear's employment is terminated... -

Page 142

... options. The accelerated vesting of restricted stock and restricted stock units is valued at the closing price times the number of shares of restricted stock and restricted stock units. (2) Assumes that medical and dental benefits would be continued under COBRA for up to 18 months at current rates... -

Page 143

... member of our board of directors receives a cash annual retainer and equity compensation payable in the following manner: • $50,000 in cash; and • $70,000 in the form of options to purchase our common stock which are granted the business day following each year's annual meeting of stockholders... -

Page 144

.... From December 2006 until the closing of the merger with XM in July 2008, Ms. Amble served as a director of XM Satellite Radio Holdings Inc. Ms. Amble has served as Executive Vice President and Corporate Comptroller for American Express Company since December 2003. Prior to joining American Express... -

Page 145

...business. From December 2004 to December 2007, Mr. Mooney was the chairman of the board of directors of RCN Corporation, a provider of bundled telephone, cable and high speed internet services. From April 2001 to September 2002, Mr. Mooney was the Executive Vice President and Chief Operating Officer... -

Page 146

... May 1997 until the closing of the merger with XM in July 2008, Mr. Parsons served as Chairman of the Board of Directors of XM Satellite Radio Holdings Inc. and previously served as its Chief Executive Officer. He serves on the board of Canadian Satellite Radio Holdings Inc. and Devas Multimedia Pvt... -

Page 147

... of companies or assets and sales of stock or securities convertible into or exercisable for common stock. We believe that this will provide us with additional flexibility to meet business and financing needs as they arise. Our board of directors will determine whether, when and on what terms the... -

Page 148

... December 18, 2008. A vote FOR this Item 3 will constitute approval of the Reverse Stock Split Amendment providing for the combination of any whole number of shares of common stock between and including ten and fifty into one share of common stock and will grant our board of directors the authority... -

Page 149

... the reverse stock split is to increase the per share trading value of our common stock. Our board of directors intends to effect the proposed reverse stock split only if it believes that a decrease in the number of shares outstanding is likely to improve the trading price for our common stock, and... -

Page 150

... the additional shares would provide us with additional flexibility to meet business and financing needs as they arise; • based upon the reverse stock split ratio selected by our board of directors, proportionate adjustments will be made to the per share exercise price and/or the number of shares... -

Page 151

... if it believes that a decrease in the number of shares is likely to improve the trading price of our common stock and if the implementation of the reverse stock split is determined by the board of directors to be in the best interests of the company and its stockholders. Effective Time The proposed... -

Page 152

... the common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares or cash payment in... -

Page 153

... completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Stockholders will then receive a New Certificate(s) representing the number of whole shares of common stock which they... -

Page 154

.... For purposes of this section, the term "U.S. holder" means a beneficial owner of our common stock that for U.S. federal income tax purposes is: • a citizen or resident of the United States; • a corporation, or other entity treated as a corporation for U.S. federal income tax purposes, created... -

Page 155

... by our board of directors and to reduce the number of authorized shares as set forth in Item 3 above. Item 4 - Approval of the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan Our board of directors has adopted the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan (referred to... -

Page 156

... to purchase shares of our common stock at a price not less than fair market value at the date of grant, and may be ISOs, nonqualified stock options, or combinations of the two. Stock options granted under the Plan will be subject to such terms and conditions, including exercise price and conditions... -

Page 157

... before interest, taxes, depreciation and amortization, number of subscribers, growth of subscribers, operating expenses, capital expenses, subscriber acquisition costs, share price, enterprise value, equity market capitalization or sales or market share. To the extent required under Section 162... -

Page 158

... SARs will equal the excess, if any, of the fair market value of the shares subject to such options or SARs over the aggregate exercise price or grant price of such options or SARs. Change of Control Unless otherwise provided in an award agreement, if there is a change of control of us (as defined... -

Page 159

... upon the occurrence of a vesting event a number of shares with a fair market value equal to such withholding liability. Termination No grant will be made under the Plan more than 10 years after the date on which the Plan is first approved by our board of directors, but all grants made on or prior... -

Page 160

... will have taxable ordinary income on the date of transfer of the shares equal to the excess of the fair market value of such shares (determined without regard to the Restrictions) over the purchase price, if any, of such restricted stock. If a Section 83(b) election has not been made, any dividends... -

Page 161

... of the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan. Item 5 - Ratification of Independent Registered Public Accountants The board of directors has selected KPMG LLP ("KPMG") as our independent registered public accountants for 2009. As such, KPMG will audit and report on our financial... -

Page 162

...the board of directors to adopt a policy that Sirius XM Satellite Radio stockholders be given the opportunity at each annual meeting of stockholders to vote on an advisory resolution, to be proposed by Sirius XM Satellite Radio's management, to ratify the compensation of the named executive officers... -

Page 163

... executive compensation at Sirius XM Satellite Radio by establishing an annual referendum process. The results of such a vote would, we think, provide Sirius XM Satellite Radio with useful information about whether stockholders view the company's senior executive compensation, as reported each year... -

Page 164

... an e-mail to [email protected] or by writing to any director in c/o Patrick L. Donnelly, Executive Vice President, General Counsel and Secretary, Sirius XM Radio Inc., 1221 Avenue of the Americas, New York, New York 10020. The board of directors exercises great care in determining... -

Page 165

...the annual meeting, the persons named in the accompanying proxy will vote the shares represented by it in accordance with the recommendation of our board of directors. By Order of the Board of Directors, Patrick L. Donnelly Executive Vice President, General Counsel and Secretary New York, New York... -

Page 166

(This page intentionally left blank) -

Page 167

... OF SIRIUS XM RADIO INC. The undersigned officer of Sirius XM Radio Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the "Corporation"), DOES HEREBY CERTIFY as follows: FIRST: The name of the Corporation is Sirius XM Radio Inc... -

Page 168

IN WITNESS WHEREOF, the undersigned has signed this Certificate of Amendment as of this day of , 2009. Sirius XM Radio Inc. By: Name: Title: A-2 -

Page 169

...,000,000] [500,000,000] [400,000,000] shares of common stock, par value $0.001 per share ("Common Stock"). (1) The total number of shares of all classes of stock authorized will be: 1,350,000,000 if the reverse stock split ratio determined by the board of directors is between one-for-ten and one-for... -

Page 170

... fractional shares of New Common Stock as set forth above), provided, however, that each holder of record of a certificate that represented shares of Old Common Stock shall receive, upon surrender of such certificate, a new certificate representing the number of whole shares of New Common Stock into... -

Page 171

IN WITNESS WHEREOF, the undersigned has signed this Certificate of Amendment as of this day of , 20 . Sirius XM Radio Inc. By: Name: Title: B-3 -

Page 172

(This page intentionally left blank) -

Page 173

... LONG-TERM STOCK INCENTIVE PLAN SECTION 1. Purpose. The purposes of this Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan are to promote the interests of Sirius XM Radio Inc. and its stockholders by (i) attracting and retaining employees and directors of, and consultants to, the Company and... -

Page 174

...Restated Sirius Satellite Radio 2003 LongTerm Stock Incentive Plan, the XM Satellite Radio Holdings Inc. 2007 Stock Incentive Plan, and the XM Satellite Radio Holdings Inc. Talent Option Plan. "Fair Market Value" shall mean (i) with respect to any property other than Shares, the fair market value of... -

Page 175

... liability company, jointstock company, trust, unincorporated organization, government or political subdivision. "Plan" shall mean this Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan. "Restricted Stock" shall mean any Share granted under Section 8 of the Plan. "Restricted Stock Unit" shall... -

Page 176

...executive officers or directors of the Company subject to Section 16 of the Exchange Act or Covered Employees (within the meaning of Section 162(m) of the Code). SECTION 4. Shares Available for Awards. (a) Shares Available. (i) Subject to adjustment as provided in Section 4(b), the aggregate number... -

Page 177

.... SECTION 6. Stock Options. (a) Grant. Subject to the terms of the Plan, the Committee shall have sole authority to determine the Participants to whom Options shall be granted, the number of Shares to be covered by each Option, the exercise price thereof and the conditions and limitations... -

Page 178

... time each Option is granted, which exercise price shall be set forth in the applicable Award Agreement and which shall not be less than the Fair Market Value per Share on the date of grant. (c) Exercise. Each Option shall be exercisable at such times and subject to such terms and conditions as the... -

Page 179

... to the Company, and the other terms and conditions of such Awards. (b) Transfer Restrictions. Shares of Restricted Stock and Restricted Stock Units may not be sold, assigned, transferred, pledged or otherwise encumbered, except, in the case of Restricted Stock, as provided in the Plan or the... -

Page 180

terms and conditions of any such Other Stock-Based Award, including the price, if any, at which securities may be purchased pursuant to any Other Stock-Based Award granted under this Plan. (b) Dividend Equivalents. In the sole discretion of the Committee, an Award (other than Options or Stock ... -

Page 181

... increase the number of securities which may be issued under the Plan, (iii) would materially modify the requirements for participation in the Plan or (iv) must otherwise be approved by the stockholders of the Company in order to comply with applicable law or the rules of the Nasdaq Stock Market... -

Page 182

..., to the extent outstanding Awards granted under this Plan are either assumed, converted or replaced by the resulting entity in the event of a Change of Control, if a Participant's employment or service is terminated without Cause by the Company or an Affiliate or a Participant terminates his or... -

Page 183

... six months) with a Fair Market Value equal to such withholding liability or by having the Company withhold from the number of Shares otherwise issuable pursuant to the exercise of the option a number of Shares with a Fair Market Value equal to such withholding liability. (e) Award Agreements. Each... -

Page 184

...of Code) payable under this Plan and grants hereunder to any anticipation, alienation, sale, transfer, assignment, pledge, ...Company shall not pay such amount on the otherwise scheduled payment date but shall instead pay it, with interest, on the earlier of the first business day of the seventh month... -

Page 185

...from any or all of such taxes or penalties. SECTION 16. Term of the Plan. (a) Effective Date. The Plan shall be effective as of the date of its approval by the Board (the "Effective Date"), subject to approval of the Plan by the stockholders of the Company. No grants will be made under the Existing... -

Page 186

..., LLC Executive Offices Sirius XM Radio Inc. 1221 Avenue of the Americas 36th Floor New York, New York 10020 212.584.5100 www.siriusxm.com Preferred Stock Directors Gregory B. Maffei Director President and CEO Liberty Media Corporation John C. Malone Director Chairman of the Board Liberty Media... -

Page 187

...-680-6685 (international callers) 800-231-5469 (hearing impaired TDD phone) www.bnymellon.com/shareowner/isd Sirius XM common stock is listed on The NASDAQ Global Select Market under the symbol "SIRI". Independent Registered Public Accounting Firm KPMG LLP 345 Park Avenue New York, New York 10154 -

Page 188